To sign up to receive the latest Canadian Energy Centre research to your inbox email research@canadianenergycentre.ca

Overview

Canada’s oil and gas industry has a positive impact on many sectors of the Canadian economy, not only in Alberta but across the country. In this CEC Fact Sheet (which can be downloaded here as a pdf), we examine the direct and indirect impact that the oil and gas sector has had on the Ontario economy.¹ Given that the largest proportion of oil and gas activity in Canada occurs in Alberta, we also profile the impact of purchases from Alberta on specific Ontario sectors.

Impact of the oil and gas sector on Ontario

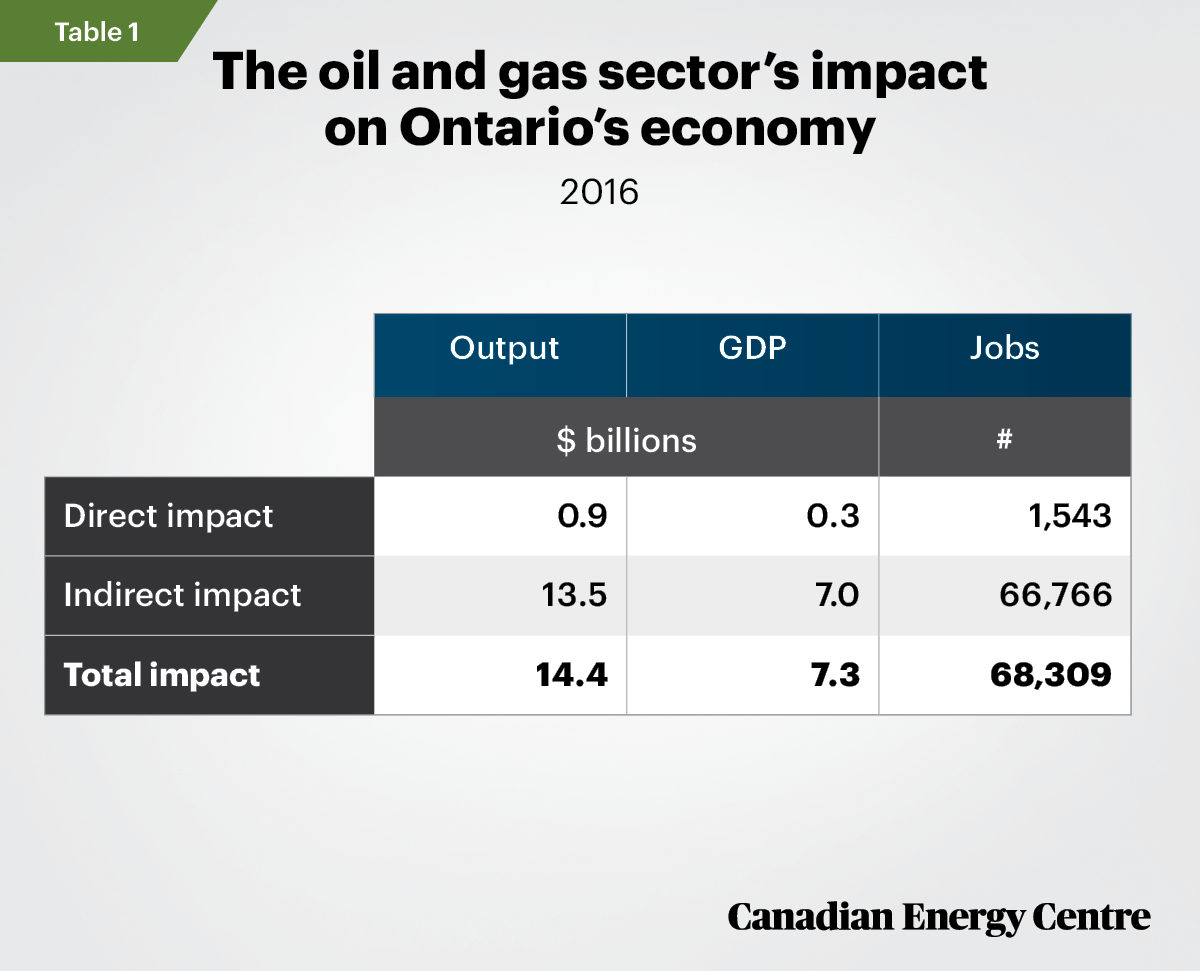

Using customized data from Statistics Canada² (see Table 1), in 2016 the oil and gas sector:

- Was responsible for adding $7.3 billion in nominal GDP to the Ontario economy;

- Generated $14.4 billion in outputs, consisting primarily of the value of goods and services produced by sectors in the Ontario economy;

- Supported over 68,000 jobs, directly and indirectly, in Ontario’s economy; and

- Paid $2.1 billion in wages and salaries to workers in Ontario³

1. The direct impact is measured in terms of GDP, output, and jobs within the oil and gas sector. The indirect impact is measured in terms of GDP, output, and jobs through the supply chain of the oil and gas sector, including other key sectors of the Ontario economy. See the end this Fact Sheet for entities included in the definition of the oil and gas sector. 2. For a discussion of Statistics Canada’s use of Input/Output models and also equilibrium models, see the addendum in Fact Sheet #17. 3. The latest available year for this figure is 2016.

Source: Derived from Statistics Canada, Supply and Use Tables, Custom Tabulation.

Quantifying the contribution of the oil and gas sector to Ontario’s economy

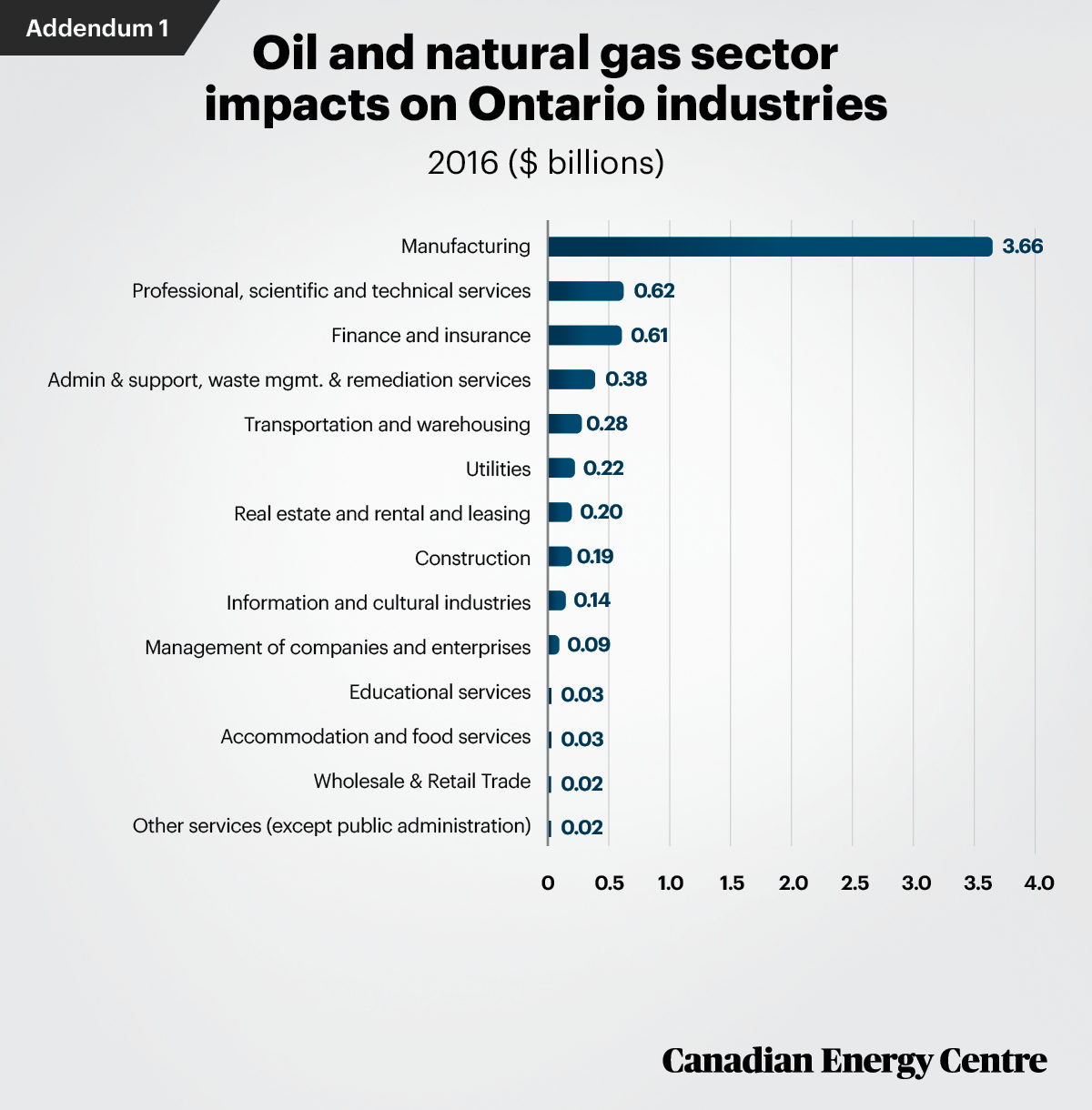

To examine the impact of the oil and gas sector on Ontario’s economy in more detail, consider that in 2016 (the most recent year of data available for this breakdown), the oil and gas sector purchased $6.5 billion worth of goods and services from other industries in Ontario (see Addendum 1). That $6.5 billion included:

- Over $3.6 billion from the manufacturing sector;

- $620 million from the professional, scientific and technical services sector;

- $610 million from the finance and insurance sector; and

- $280 million from the transportation and warehousing sector.

Alberta: Ontario’s second-biggest destination for interprovincial trade

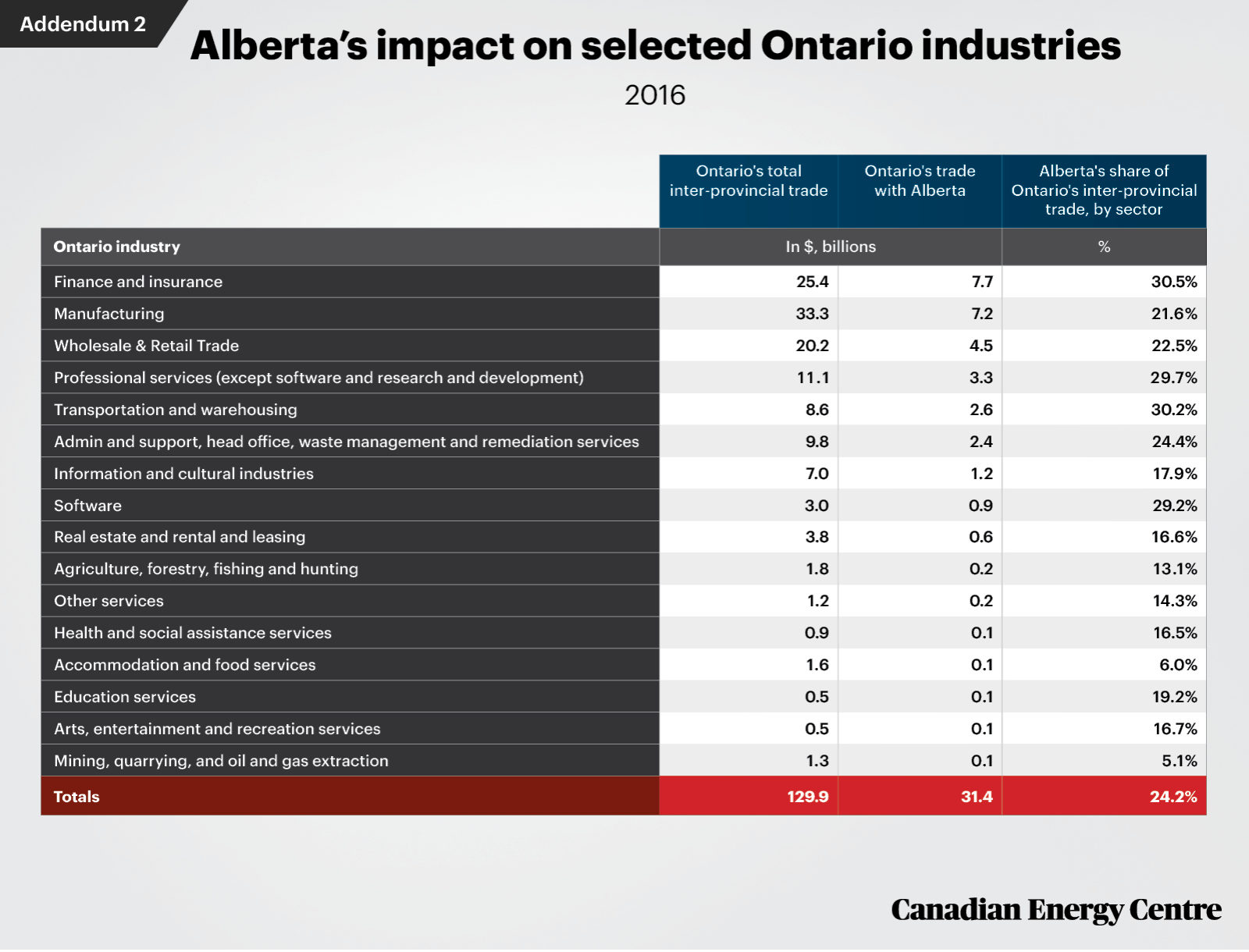

Alberta is second only to Quebec as a critical market for Ontario’s interprovincial exports (see Table 2 and Addendum 2). Ontario’s trade with Alberta was worth $31.4 billion in 2016, or 24.2 per cent of all Ontario interprovincial trade, second only to Quebec at $42.5 billion or 32.7 per cent.

Source: Statistics Canada, Table 12-10-0088-01.

Analyzing Alberta’s purchasing impact on Ontario manufacturers: $7.2 billion or almost 22% of Ontario’s exports to all provinces

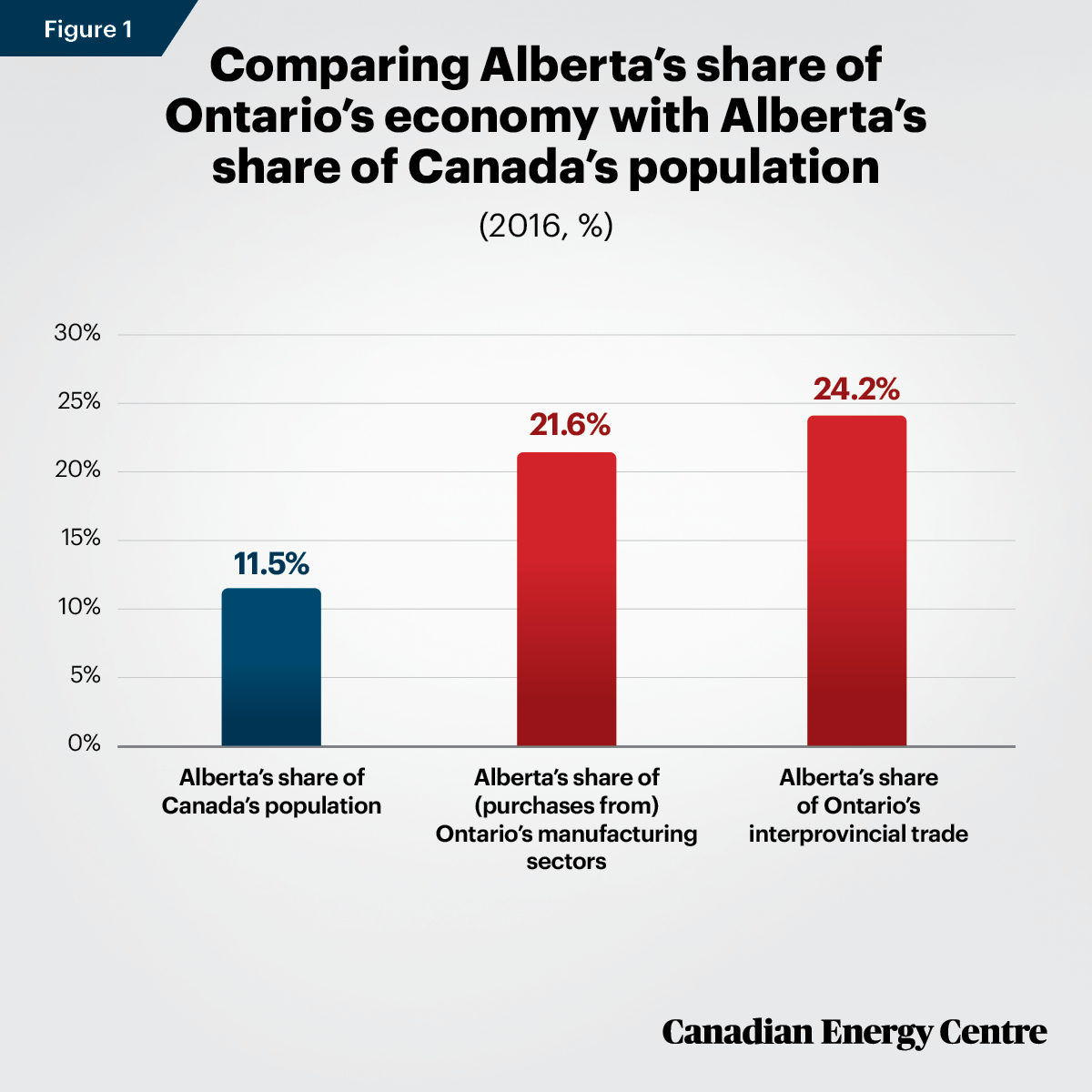

In 2016, purchases from Ontario’s manufacturing sector by Alberta businesses (21.6 per cent of total Ontario manufacturing exports), were significantly higher than Alberta’s proportion of Canada’s population at 11.5 per cent (see Figure 1).

In dollar terms, Albertans made substantial purchases from Ontario in 2016, from $22 million in computers and electronics to over $2 billion in food and non-alcoholic beverages. As a proportion of Ontario’s manufacturing sub-sectors, Alberta purchases ranged from 6 per cent (wood, pulp and paper) to 30 per cent for furniture, and also 30 per cent for refined petroleum products. Across all Ontario sectors an average of 21.6 per cent of purchases were made by Alberta-based consumers, businesses and governments.

Alberta’s share of Ontario’s interprovincial trade: $31.4 billion or 24%

In 2016, Alberta’s share of Ontario’s interprovincial trade (beyond just manufacturing) was worth $31.4 billion or 24 per cent of all exports from Ontario that year (see figure 1). The impact of Alberta’s purchases ranged from $68 million in the mining, quarrying and oil and gas extraction sector in Ontario (5.1 per cent of that sector) to nearly $7.4 billion in finance and insurance (over 30 per cent of that sector).

Sources: Statistics Canada, Table 12-10-0088-01; 2016 Census.

2012-2016 totals: $161 billion

Ontario has benefited from the growth in Alberta’s oil and gas sector and the purchase of goods and services from Ontario by Alberta-based residents, businesses and governments. Between 2012 and 2016 inclusive, Alberta imported $161 billion worth of goods and services from Ontario. Among others, this includes:

- $38.6 billion from the finance and insurance industry;

- More than $35 billion from the manufacturing sector;⁴

- $14 billion from the professional service sector; and

- $3 billion from the software industry.

The top 10 Ontario sectors sold $101 billion worth of goods and services into Alberta between 2012 and 2016 inclusive (see Figure 2).

4. Includes food and non-alcoholic beverages; alcoholic beverages and tobacco products; textile products, clothing, and products of leather and similar materials; wood products; wood pulp, paper and paper products and paper stock; printed products and services; refined petroleum products (except petrochemicals); chemical products; plastic and rubber products; nonmetal mineral products; primary metal products; fabricated metal c products; industrial machinery; computers and electronic products; electrical equipment, appliances and components; transportation equipment; motor vehicle parts; furniture and related products; other manufactured products.

Source: Authors’ calculations from Statistic Canada Supply and Use Tables (various years).

*Except software and research and development.

Alberta is Ontario’s third largest export market after the United States and Quebec

Ontario’s interprovincial trade with Alberta was worth $31.4 billion in 2016. That was behind only the United States (over $206 billion) and Quebec ($42.5 billion) and ahead of international markets such as the United Kingdom ($14 billion), Mexico ($3.6 billion) and China ($3.2 billion), among others (see Table 3)

Source: Government of Canada, trade data online and authors’ calculation derived from Supply and Use Tables, Statistics Canada catalogue 15-602-X.

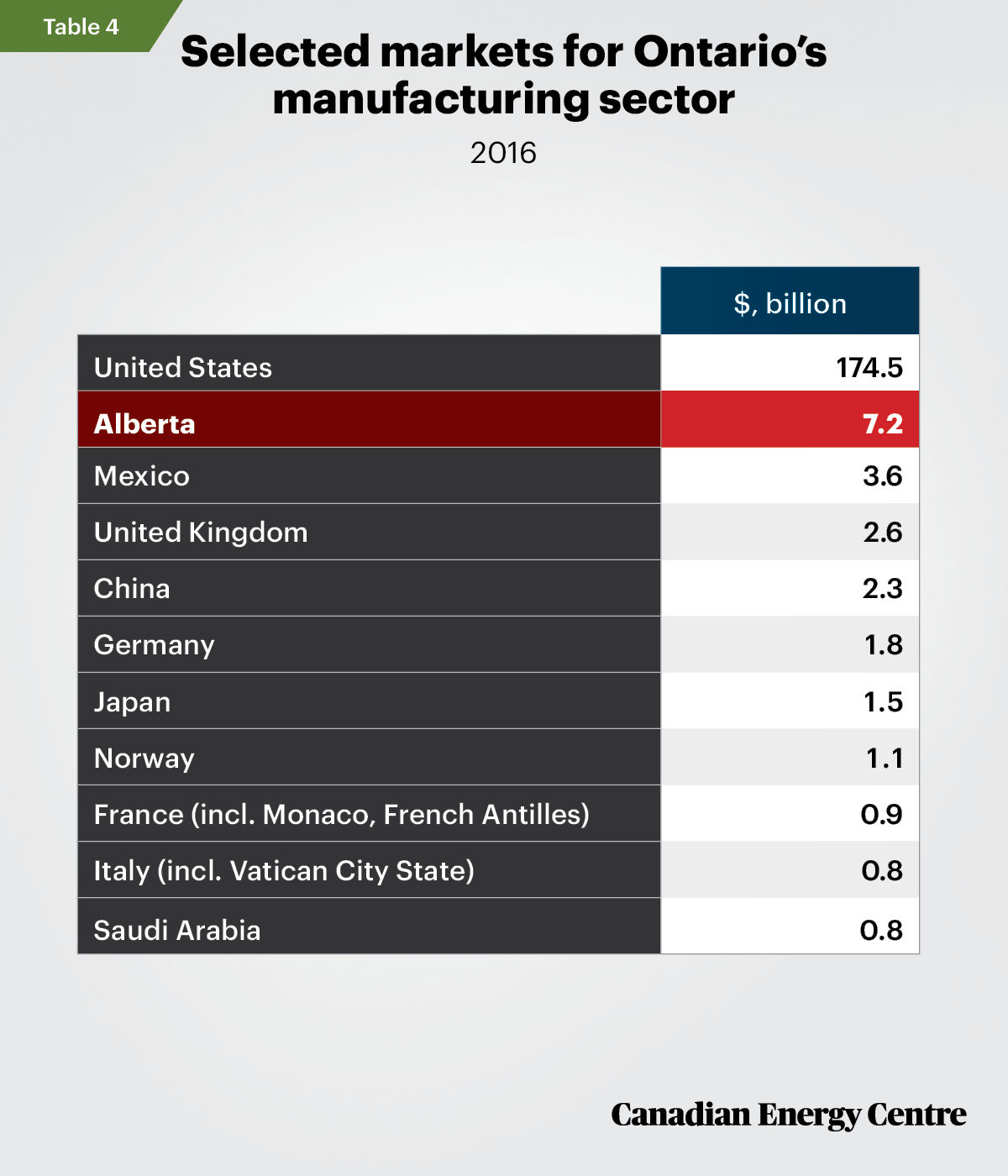

Alberta and Ontario’s manufactured goods

In 2016, Ontario’s manufacturing sector exported nearly $7.2 billion of goods and services to Alberta, about 22 per cent of the industry’s total value of interprovincial trade (see Table 4 and Addendum 2). That was significantly less than the United States (over $174 billion) but ahead of international destinations for Ontario’s manufactured exports including Mexico ($3.6 billion), the United Kingdom ($2.5 billion), China ($2.3 billion) and Germany ($1.7 billion), among others.

Source: Government of Canada, trade data online and authors’ calculation derived from Supply and Use Tables, Statistics Canada catalogue 15-602-X.

The takeaway

The oil and gas sector in Canada has a significant impact on Ontario’s export sectors, directly and indirectly, as does the purchase of goods and services by citizens, businesses and governments in the province where the oil and gas sector is concentrated, i.e., by those in Alberta.

Addendums

Source: Authors’ calculation from Statistic Canada Catalogue No. 15-F0002-X.

Sources (Links live as of September 29, 2020)

Statistics Canada (2019a). Supply and Use Tables, 2016, 15-602-X-2016. <https://bit.ly/3mJdGiB>; Statistics Canada (2019b). Supply and Use Tables, Custom Tabulation; Statistics Canada (2020). Population and Dwelling Count Highlight Tables, 2016 Census. <https://bit.ly/36v2WP8>; The American Petroleum Institute (July 2017). Impact of the Natural Gas and Oil Industry on the US Economy in 2015. <https://bit.ly/2EKrJTT>; Government of Canada, Trade Data Online(July 2020).<https://bit.ly/2EMswnj>.

Notes

This CEC Fact Sheet was compiled by Ven Venkatachalam and Mark Milke at the Canadian Energy Centre (www.canadianenergycentre.ca). The authors and the Canadian Energy Centre would like to thank and acknowledge the assistance of Philip Cross in reviewing the data and research for this Fact Sheet. Image credits: Sunset over Toronto skyline by Brady Baker from Getty Images.

The oil and gas sector is defined as the sum of oil and gas extraction and oil and gas investment. Oil and gas extraction is defined by NAICS subsector 211. It comprises establishments primarily engaged in operating oil and gas field properties. Such activities may include exploration for crude petroleum and natural gas; drilling, completing and equipping wells, and all other activities in the preparation of oil and gas up to the point of shipment from the producing property. This subsector includes the production of oil, the mining and extraction of oil from oil shale and oil sands, and the production of gas and hydrocarbon liquids, through gasification. Oil and gas investment include capital expenditures on construction, machinery and equipment and exploration by the oil and gas extraction industry. We use the American Petroleum Institute (API) definition of the oil and gas sector to quantify the good and services purchased by the sector and the wages paid by the sector. API definition of the oil and natural gas sector includes conventional oil and gas extraction; non-conventional oil extraction; support activities for oil and gas extraction; natural gas distribution, oil and gas engineering construction; petroleum refineries; petroleum and coal product manufacturing (except petroleum refineries); petroleum product wholesaler-distributors; gasoline stations; crude oil and other pipeline transportation; pipeline transportation of natural gas.

Creative Commons Copyright

Research and data from the Canadian Energy Centre (CEC) is available for public usage under creative commons copyright terms with attribution to the CEC. Attribution and specific restrictions on usage including non-commercial use only and no changes to material should follow guidelines enunciated by Creative Commons here: Attribution-NonCommercial-NoDerivs CC BY-NC-ND.