A new analysis by the Canadian Energy Centre has found the vast majority of oil and gas firms in Canada are small businesses (fewer than 100 employees), and Canada’s oil and gas industry has a higher proportion of small and medium-sized enterprises than the United States, Norway and the European Union.

The Fact Sheet, “Big oil” is mainly “small oil” in Canada examined the prevalence of small business enterprises (based on employee counts) in the oil and gas sector in Canada, the United States and Europe.

Highlights from the Fact Sheet include:

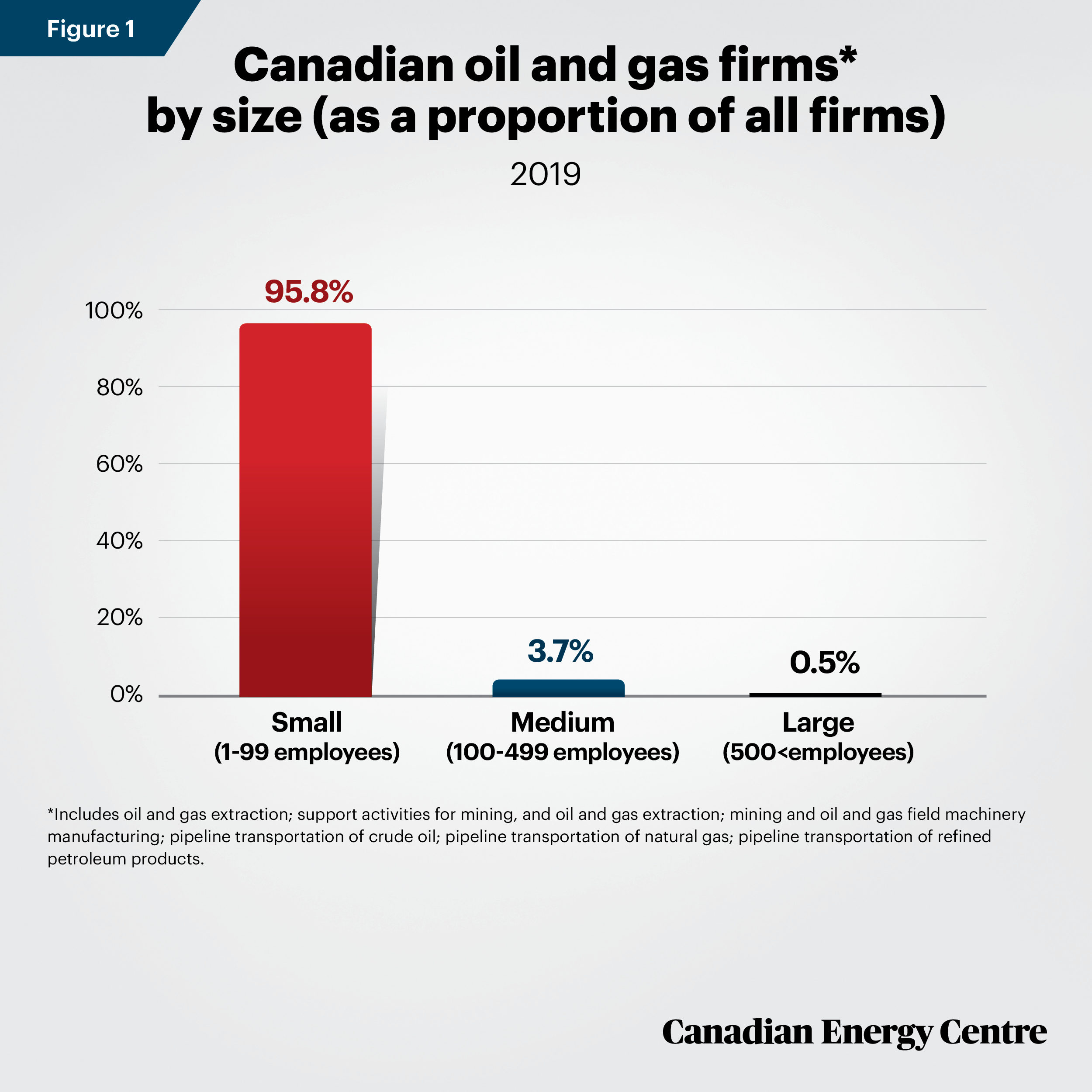

- In Canada, 95.8 per cent of the companies in the oil and gas sector are small businesses, while 3.7 per cent are medium-sized (100-499 employees), and 0.5 per cent are large enterprises (500+ employees).

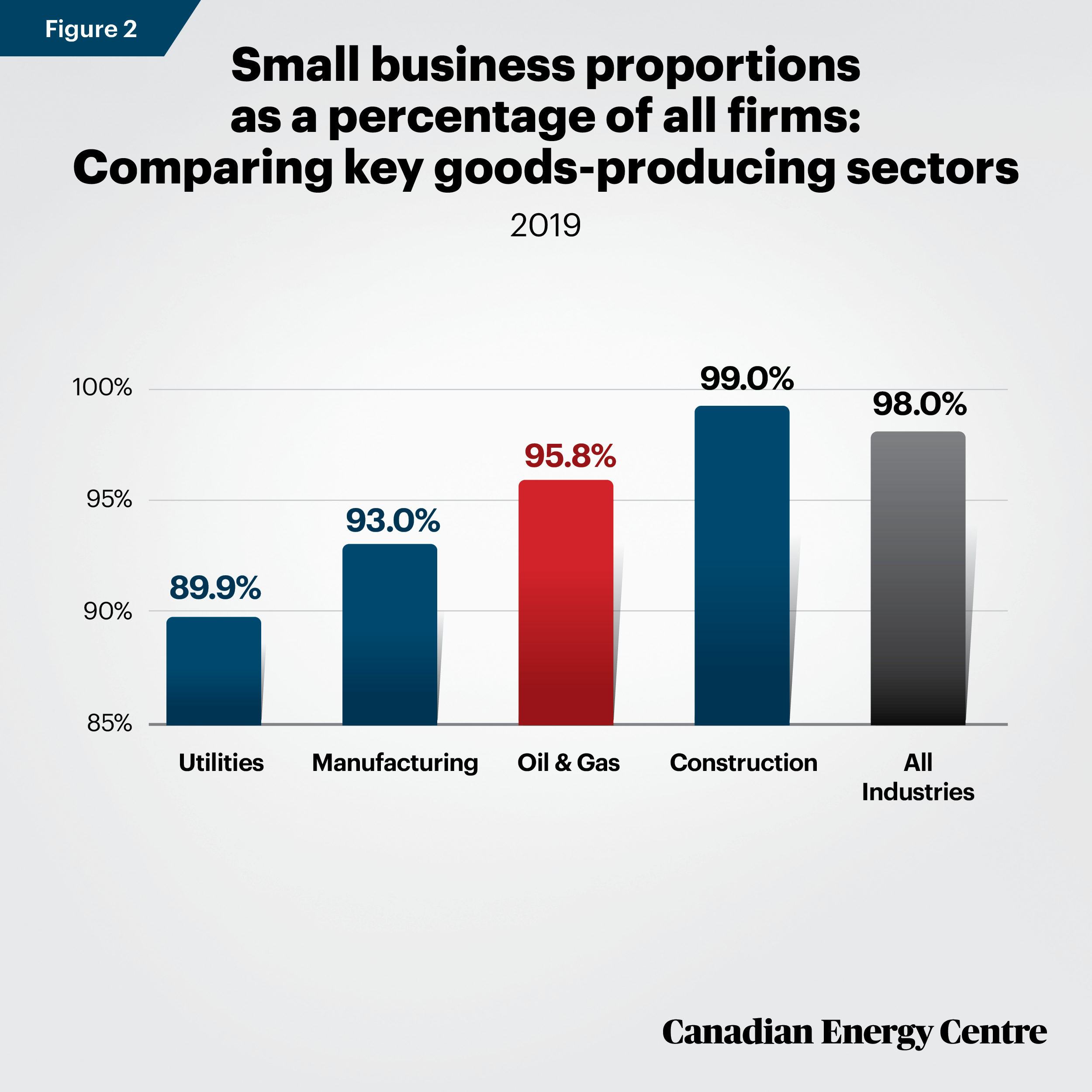

- Canada’s energy sector has a higher proportion of small businesses than other major goods-producing sectors, with the exception of construction. 95.8 per cent of all oil and gas firms have employee counts between 1 and 99 compared with 93 per cent in manufacturing, 89.9 per cent in utilities, and 99 per cent in the construction sector. Small businesses make up 98 per cent of all industries in Canada.

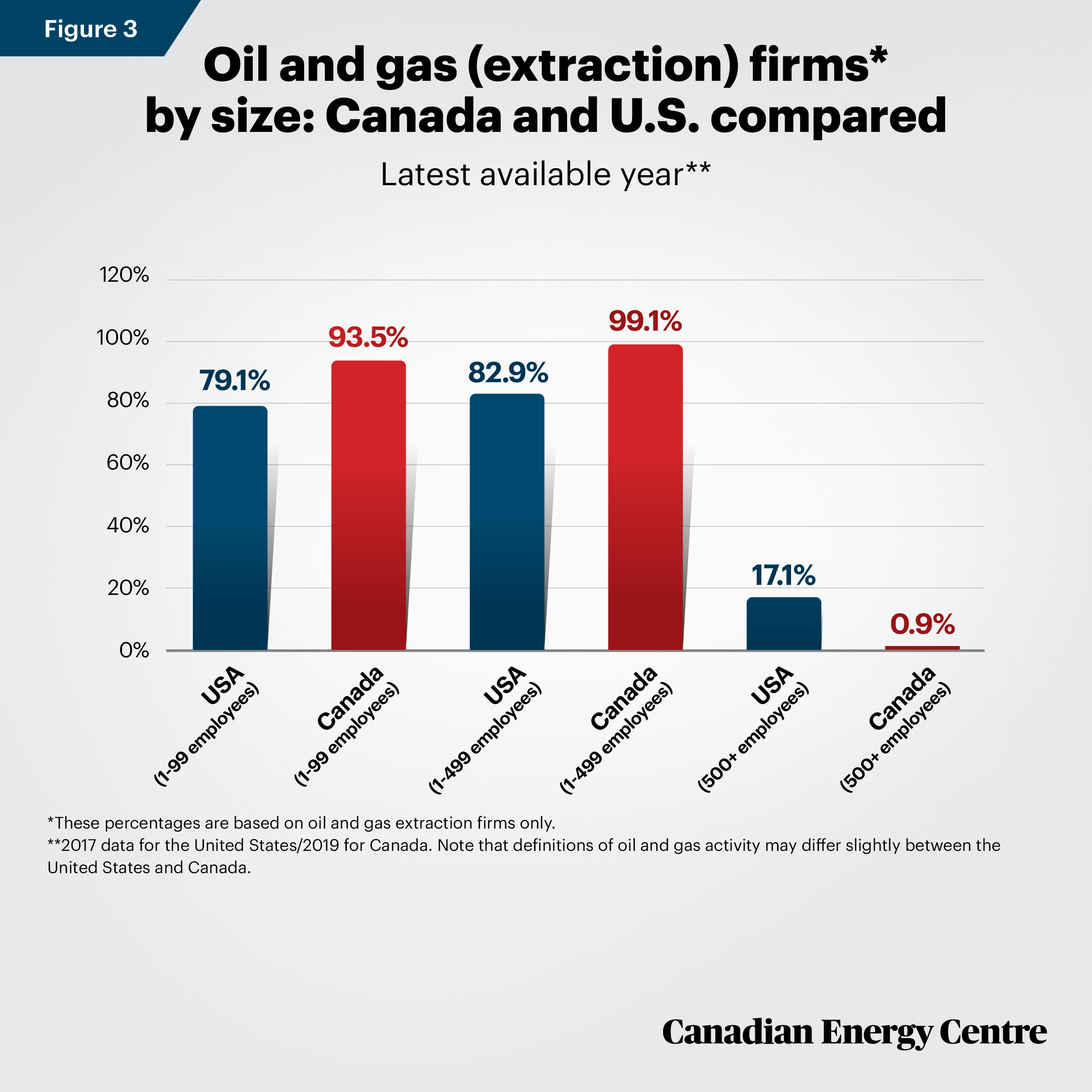

- Narrowing the comparison to just oil and gas extraction companies, 93.5 per cent of Canada’s oil and gas extraction sector is comprised of small businesses, compared to the United States at 79.1 per cent.

- In comparisons to Norway and the European Union, the analysis also finds that Canada’s oil and gas extraction sector has a higher proportion of small and medium size businesses than either Norway or the EU.

“Big oil” is mainly “small oil and gas”

This Fact Sheet (which can be downloaded here as a pdf) examines the prevalence of small business enterprises (based on employee counts) in the oil and gas sector in Canada, the United States and Europe.

The spur for this Fact Sheet is the notion that oil and gas in Canada is mainly “big” corporate business. While economies of scale can be of central importance for large oil and gas projects, for producers and suppliers, there are advantages to any firm at any size (small and nimble versus large and integrated, for example). Nonetheless, the vast majority of oil and gas firms are small businesses. When Canada’s oil and gas sector is healthy, the small businesses therein are de facto able to flourish. Conversely, if the oil and gas sector falters as is occurring now, so too do small businesses and their employees.

This Fact Sheet profiles oil and gas companies by firm size (small, medium, large); it then compares the share of small business by industry; then by country (Canada and the U.S. and then Norway and the European Union).

Two different types of oil and gas firms are profiled in this Fact Sheet given available data by jursidictions.

• The in-Canada oil and gas comparison to other sectors includes: oil and gas extraction; support activities for mining, and oil and gas extraction; mining and oil and gas field machinery manufacturing; pipeline transportation of crude oil; pipeline transportation of natural gas; pipeline transportation of refined petroleum products.

• The Canada-U.S. and Canada-Europe comparisons are drawn from a smaller subset of oil and gas activity — oil and gas extraction only — which allows for international comparisons.

Oil and gas comparisons by firm size

For the purposes of our analysis, small businesses are defined by Statistics Canada as those with between 1 and 99 paid employees. Medium-size enterprises are those with 100 to 499 employees while large enterprises have 500 or more employee. For oil and gas firms:

- 95.8 per cent are small. i.e., companies with between one and 99 employees;

- 3.7 per cent are medium-size companies, with between 100 and 499 employees;

- 0.5 per cent are large companies with 500 or more employees.

Source: Authors’ calculation based on Statistics Canada Table 33-10-0222-01.

Industry comparisons in Canada

In Canada, the energy sector has a higher proportion of small businesses than other major sectors, with the exception of construction (see Figure 2). In energy, 95.8 per cent of all firms have employee counts between 1 and 99 compared with 89.9 per cent in utilities, 93 per cent in manufacturing, and 99 per cent in the construction sector. The all-industry average is 98 per cent.¹

Source: Authors’ calculation based on Statistics Canada Table 33-10-0222-01

Canada-U.S. comparisons on oil and gas firms and size by employee count

Canada and the United States define small businesses differently, with an employee count of 1-99 in Canada and 1-499 employees in the United States. In addition, the following Canada-U.S. (and subsequent Canada-Europe) comparisons are drawn from a smaller subset of oil and gas activity — oil and gas extraction only — which allows for international comparisons.²

For a more standardized comparison between the two countries, Figure 3 shows both the 1-99 employee comparison and the 1-499 comparison. Using Canadian definitions of firm size:

- Small business comparisons: 79.1 per cent of all oil and gas firms in the United States have employee counts between 1 and 99 employees compared with 93.5 per cent in Canada.

- Small and medium-size business comparisons: Adding in medium-size employee counts (defined in Canada as 100 to 499 employees), we find that 82.9 per cent of all oil and gas firms in the United States have employee counts between 1 and 499 employees compared with 99.1 per cent in Canada.

- “Big oil and gas”: Corporations with 500-plus employees in the United States thus represent 17.1 per cent of all oil and gas firms while in Canada the figure for “big oil and gas” is just 0.9 per cent of all firms.

Sources: Derived from Statistics Canada Table 33-10-0222-01 and U.S. Small Business Administration.

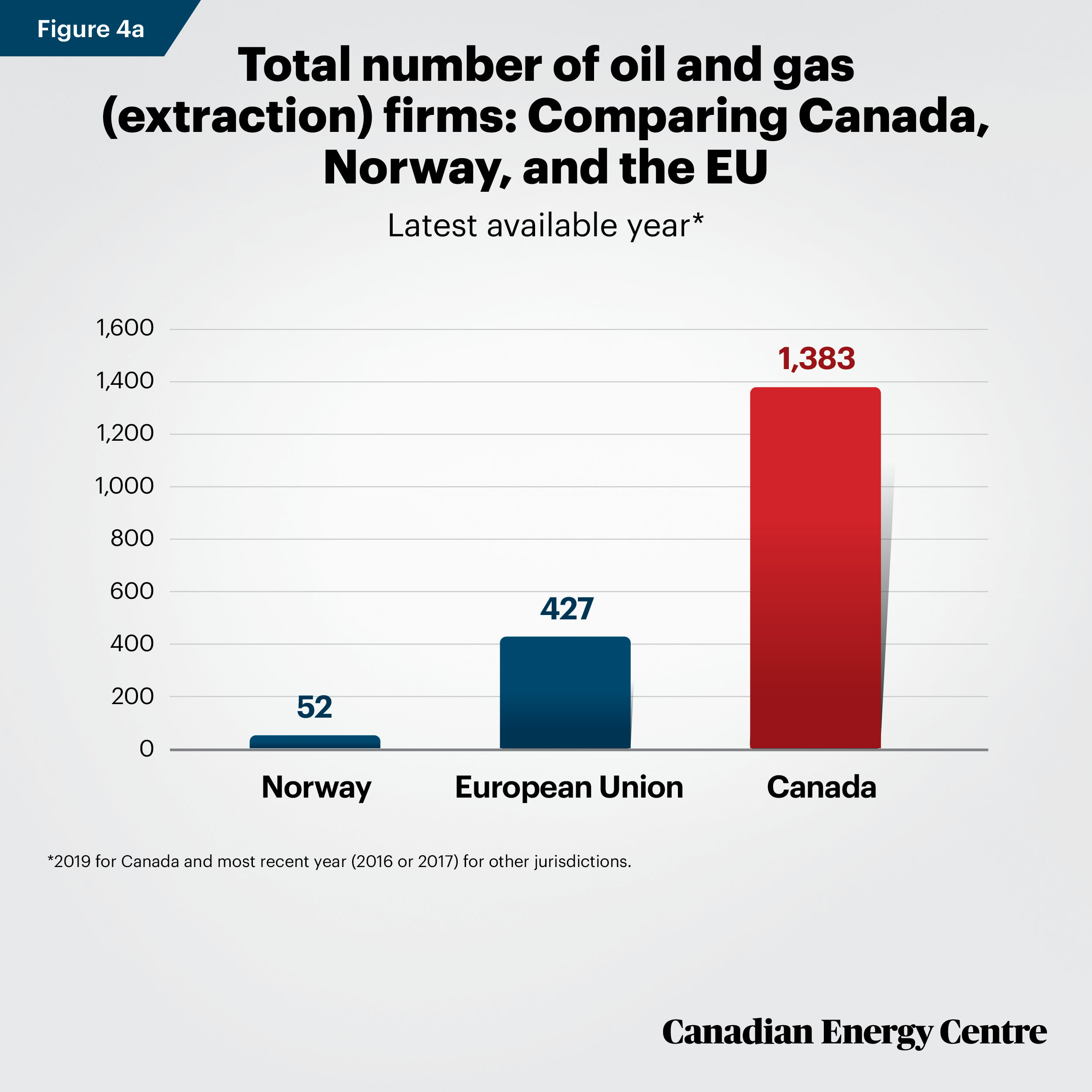

Canada-Europe comparisons: Total firms involved in oil and gas extraction

The final set of comparisons contrast Canada with Norway (another major oil producer) and the European Union (of which Norway is not a member)³. The first comparison (Figure 4a) makes obvious the importance of the oil and gas sector to Canada given the sheer numbers of oil and gas firms.⁴

- Far and away, Canada has the largest number of oil and gas extraction firms—small, medium, and large—at 1,383 in total.

- In contrast, Norway has just 52 oil and gas extraction firms⁵ with the European Union at just 427 firms in total involved in oil and natural gas activity.

Source: Eurostat and Statistics Canada *2019 for Canada and most recent year (2016 or 2017) for other jurisdictions

Canada compared with Europe and Norway on smaller companies

Unlike Canada-U.S. comparisons data limitations do not allow for exact 1-99 or 1-499 employee count comparisons on firm sizes between Canada and Norway and the European Union.

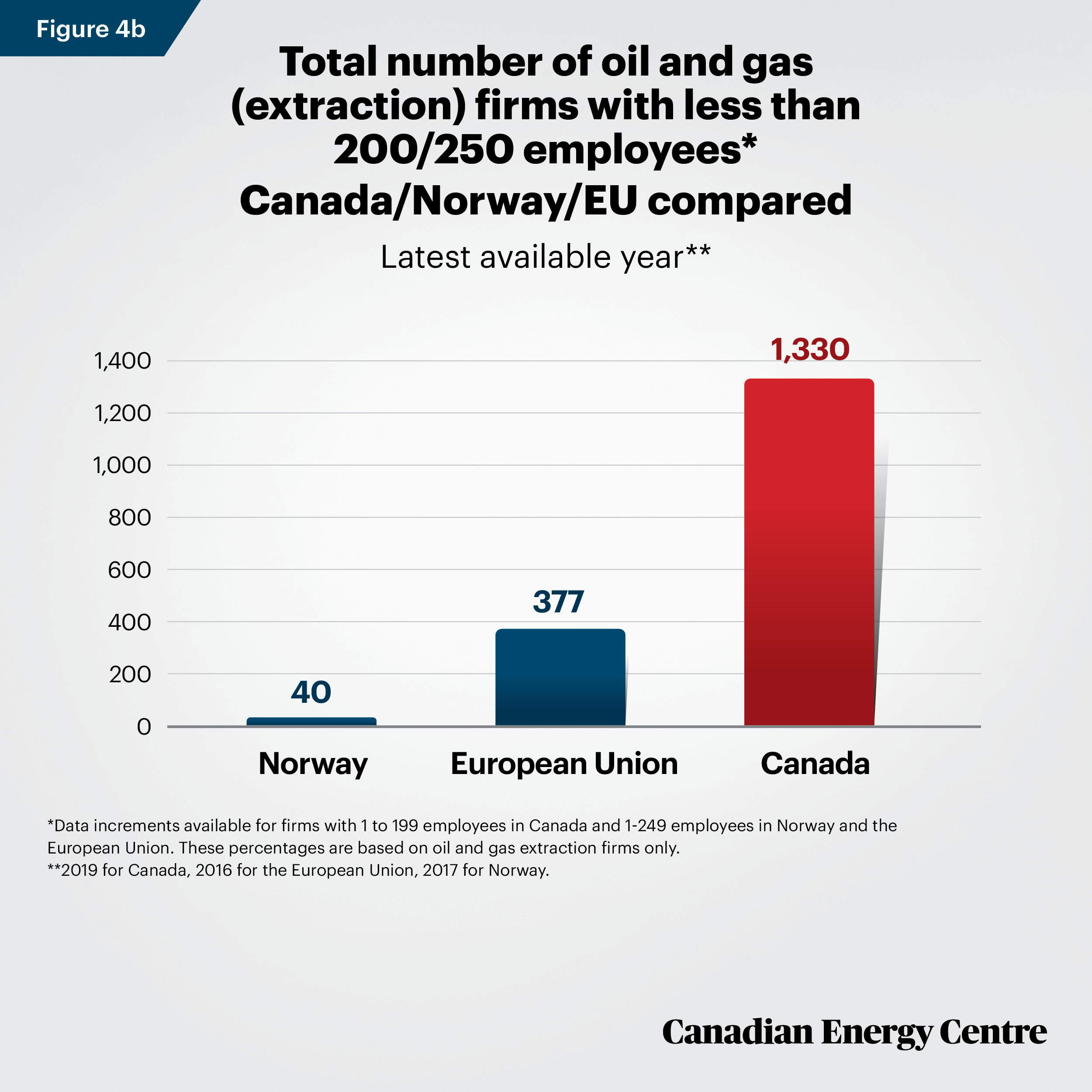

However, we can compare Canada (1-199 employees, i.e., below 200) with Norway and Europe (1-249 employees, i.e., below 250). Figure 4b breaks down the proportion of oil and gas extraction firms by size for each jurisdiction.

- Norway has just 40 oil and gas extraction firms with fewer than 250 employees;

- The European Union has 377 firms that employ fewer than 250 employees;

- Canada has 1,330 oil and gas extraction firms with fewer than 200 employees. In other words, even with a more limited comparison available for Canada, the absolute number of oil and gas companies in Canada with smaller workforces is about three times that of Norway and the European Union combined (1,330 firms versus 417 oil and gas enterprises in Norway and the EU combined).

Source: Eurostat and Statistics Canada.

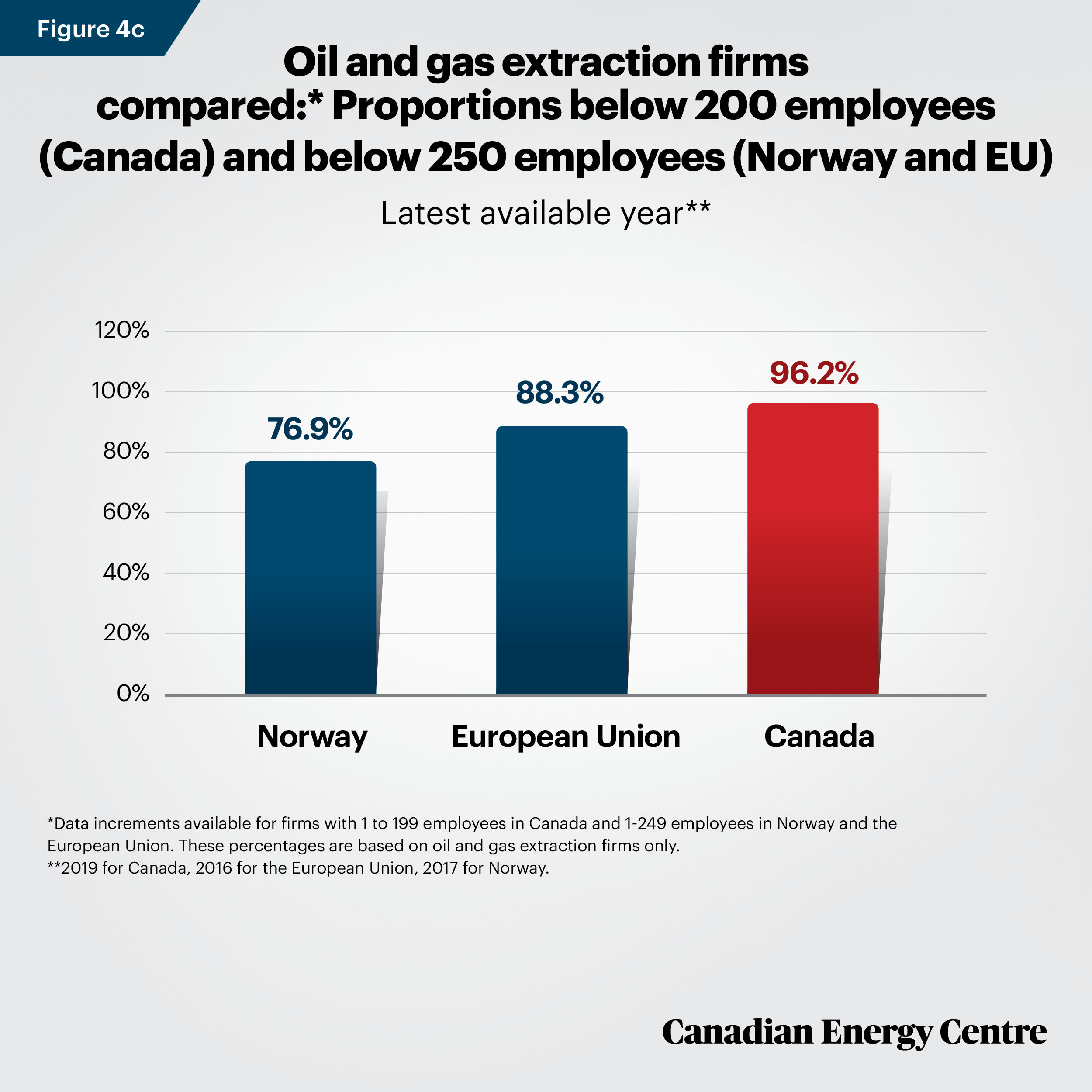

“Big oil” is a more accurate description in Europe, not Canada

This slightly modified comparison shows that smaller businesses constitute just 76.9 per cent of all oil and gas extraction firms in Norway, 88.3 per cent of all firms in the European Union, and 96.2 per cent of all and gas extraction firms in Canada (see Figure 4c). Canada’s oil and gas extraction sector is thus overwhelmingly composed of small and medium-size businesses relative to Norway and the European Union.

Source: Eurostat and Statistics Canada.

The takeaway

Most oil and gas firms in Canada are small or medium-size businesses whether measured domestically and compared with other sectors, or in comparison to the United States, Norway and in the European Union.

End Notes

1. The 98% average for all industries is high in large measure because of the sheer size of the construction sector. In 2019, there were 149,912 firms in that sector compared with 51,653 in manufacturing, 8,040 in oil and gas, and 1,447 in utilities. 2. Thus, the difference in measurements of the proportion of smaller business proportions for Canada, i.e., 95.8% of all oil and gas firms when the larger cohort is measured (beyond just oil and gas extraction) and 93.5% when only oil and gas extraction is measured. 3. As of January 2020, the United Kingdom is not a member of the European Union. However, at the time this data was compiled by the European statistical agency, Eurostat, the United Kingdom was an EU member and thus its numbers are contained within the EU data. 4. As per previous notes, the Canada-U.S. and Canada-Europe comparisons are drawn from a smaller subset of oil and gas activity—oil and gas extraction only—which allows for international comparisons. Thus, the difference in measurements of the proportion of smaller business proportions for Canada, i.e., 95.8% of all oil and gas firms when the larger cohort is measured (beyond just oil and gas extraction) and the 93.5% figure when only oil and gas extraction is measured. 5. Large firms dominate Norway’s oil and gas sector given all of its oil and gas results from offshore drilling, which is complicated and expensive.

Notes:

This CEC Fact Sheet was compiled by Ven Venkatachalam, Lennie Kaplan and Mark Milke at the Canadian Energy Centre: www.canadianenergycentre.ca. The authors and the Canadian Energy Centre would like to thank and acknowledge the assistance of Philip Cross in reviewing the data and research for this Fact Sheet. Image credits: “Oil Rig in Alberta in Fall” by ImagineGolf on Getty Images, “Canadian Flag” by Andre Furtado on Pexels.com

Sources: (All links live as of July 16, 2020)

Canada (2019). Key Small Business Statistics <https://bit.ly/2Aoj7Q9>; European Union (undated). European Union—About Member Countries. <https://bit.ly/3eu9Nsw>; Eurostat (undated) <https://bit.ly/2DGOLtN>; Statistics Canada (2019). Table 33-10-0222-01 Canadian Business Counts, with employees. <https://bit.ly/3dJbn9Y>; Statistics Canada (2019). Table 14-10-0068-01, Employment by establishment size. <https://bit.ly/2CzAa2O>; Statistics Canada (undated), population estimates, quarterly, <https://bit.ly/3jggaDo>; U.S. Small Business Administration (2019) 2019 Small Business Profile; <https://bit.ly/2Z0jL0z>; United States Census (2020). 2017 SUSB Annual Data Tables by Establishment Industry. <https://bit.ly/2B4MXd9>.

Creative Commons Copyright

Research and data from the Canadian Energy Centre (CEC) is available for public usage under creative commons copyright terms with attribution to the CEC. Attribution and specific restrictions on usage including non-commercial use only and no changes to material should follow guidelines enunciated by Creative Commons here: Attribution-NonCommercial-NoDerivs CC BY-NC-ND.