To sign up to receive the latest Canadian Energy Centre research to your inbox email: research@canadianenergycentre.ca

Download the PDF here

Download the charts here

Introduction

Since introducing a carbon tax in 2008, the Province of British Columbia (BC) has attracted significant attention from policymakers due to its large natural resource sector. Energy products account for 38 percent of all provincial exports, with coal and natural gas accounting for 31.5 percent of those exports.

The carbon tax is a policy instrument governments have implemented with the aim of curbing greenhouse gas emissions (GHGs). However, businesses and others have raised concern about the impact of the carbon tax on industry costs and competitiveness. The carbon tax makes producers pay for their emissions. The problem arises when there is no uniform carbon policy across international markets.

The carbon tax affects nearly all taxpayers in BC regardless of who bears the initial cost. As such, businesses in the province need to know about the carbon tax and its impact. This CEC Fact Sheet looks at the potential impact of a federally mandated $170 per tonne carbon tax in 2030 on various industries in the province.1

Our analysis provides a general overview of the potential impact of the carbon tax on production costs for particular sectors because each business organization is unique. Businesses need to complete their own analyses specific to their own business models and based on their suppliers, competitors, customers, and markets. Studies conducted with different methodologies and assumptions will calculate different estimates of the impact of the carbon tax on business.

Carbon tax legislation and business costs

As part of the 2016 Pan-Canadian Framework on Clean Growth and Climate Change, the Government of Canada passed the Greenhouse Gas Pollution Pricing Act (GGPPA) in December 2018. The GGPPA imposes a carbon pricing system on provinces and territories that either have not implemented their own carbon pricing system or have implemented a system that does not meet the minimum requirements set by the federal government.

Federal and provincial governments both have the constitutional authority to regulate climate change policy, which affects how policy has been developed in BC.2 Under the GGPPA, the federal carbon tax began at $20/tonne in 2019 and escalated by $10/tonne per year to $50/tonne in 2022. In December 2020, the federal government released an updated plan with a $15/tonne per year increase in the carbon price to reach $95/tonne in 2025 and $170/tonne in 2030.

According to Environment and Climate Change Canada (undated), the GGPPA consists of two parts: a regulatory charge on fuels such as gasoline and natural gas (known as the fuel charge) and a performance-based baseline and credit system for large industrial emitters that meet prescribed criteria set out in the GGPPA and its regulations, known as the Output-Based Pricing System (OBPS).

BC’s provincial carbon tax was initially set at $10 per tonne in 2008, but by 2023 the rate had increased to $65 per tonne. BC uses the provincial carbon tax (for fuel emissions) and, starting in April 2024, will switch to the BC output-based pricing system (B.C. OBPS) for industrial emissions.

In line with the federal government’s nationwide carbon tax, BC must meet the federally mandated carbon tax and move towards $170 per tonne by 2030.

The carbon tax gives rise to both direct and indirect business costs. Energy-intensive industries will incur more of the former, and other industries more of the latter. Direct

impacts are the cost that the carbon tax will impose on carbon-emitting sectors and the cost of fuel or energy used directly in production. Indirect costs are the carbon tax-induced costs the business will incur through input or production processes subject to the carbon tax in the prior production stage.

Industries such as food services and restaurants or retail stores that are not subject to the tax directly may still experience significant cost increases if the sector relies on inputs that use energy-intensive production processes.

Estimated impact of the carbon tax on industry production costs in BC

The production of goods and services in any sector necessitates business input costs, including capital, goods, services, energy, and wages and salaries. Industries that have a high usage of petroleum products will generally experience a slightly higher cost increase due to their higher usage.

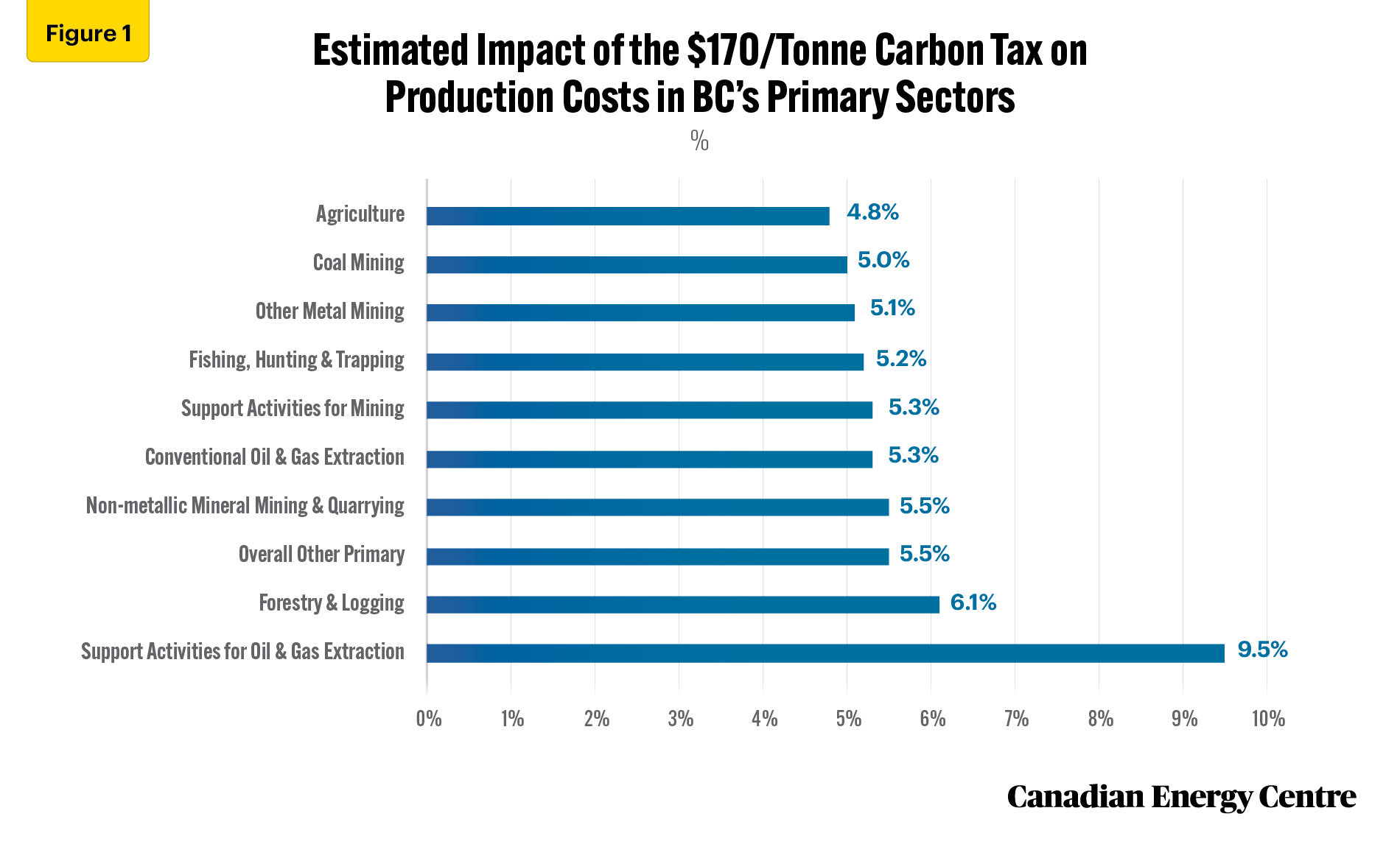

The forestry and logging industry in the province will see its cost increase by 6.1 percent on average. The most significant increase in production costs will be incurred by support activities for oil and gas extraction, which witnesses a cost increase of 9.5 percent. The fishing, hunting and trapping industry will see its costs increase by 5.2 percent.

Non-metallic mineral mining and quarrying, which relies on fuels such as gasoline, diesel, and fuel oils to produce goods, will experience a 5.5 percent increase in its production inputs from the $170 per tonne carbon tax (see Figure 1).

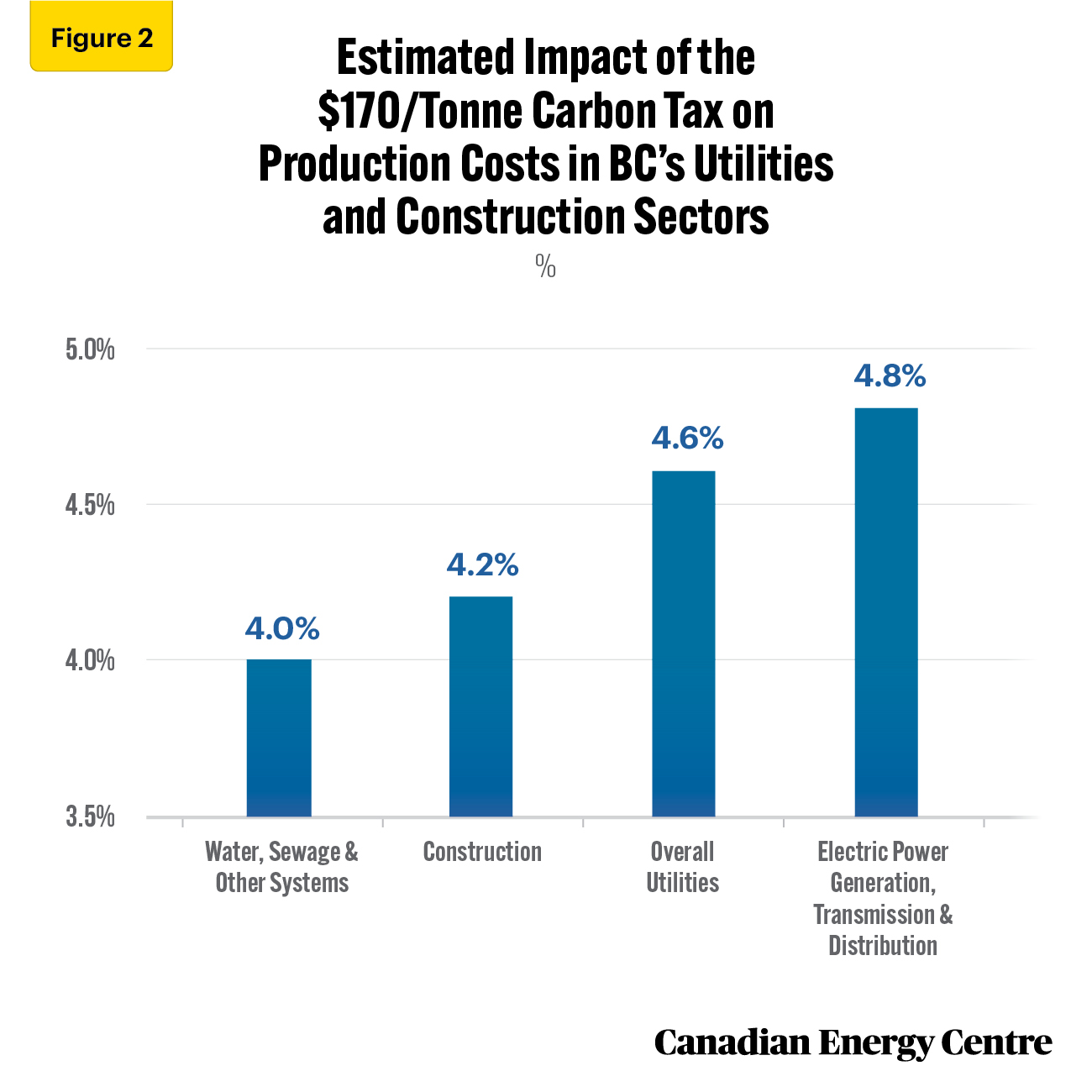

For the utilities sector, on average, production costs will increase by about 4.6 percent. BC’s electric power generation, transmission, and distribution sector will see a cost increase of almost 4.8 percent due to the carbon tax. Construction sector costs will increase by 4.2 percent (see Figure 2).

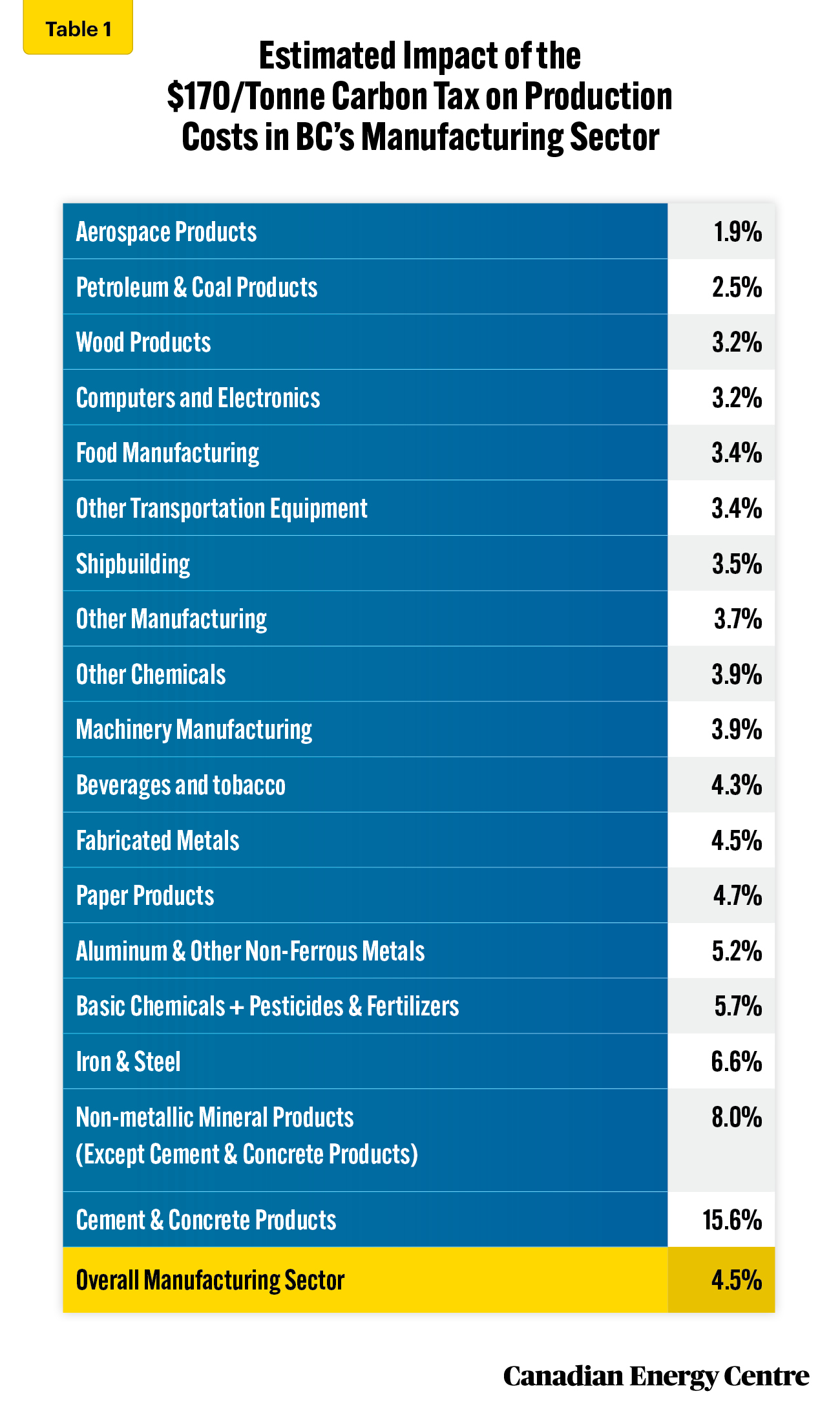

In the manufacturing sector, the cement and concrete products sub-sector will see the highest cost increase of all industries from the carbon tax at 15.6 percent. This increase is predominantly due to the industry’s high use of energy inputs, including coke and coal, which account for 6.9 percent of total inputs.

Other energy-intensive industries, such as aluminum manufacturing, and chemicals, pesticides, and fertilizers, will see their costs increase by between 5 percent and 7 percent. The paper products industry will witness a cost increase of 4.7 percent. Food manufacturing costs will increase by 3.4 percent under the $170/tonne carbon tax (see Table 1).

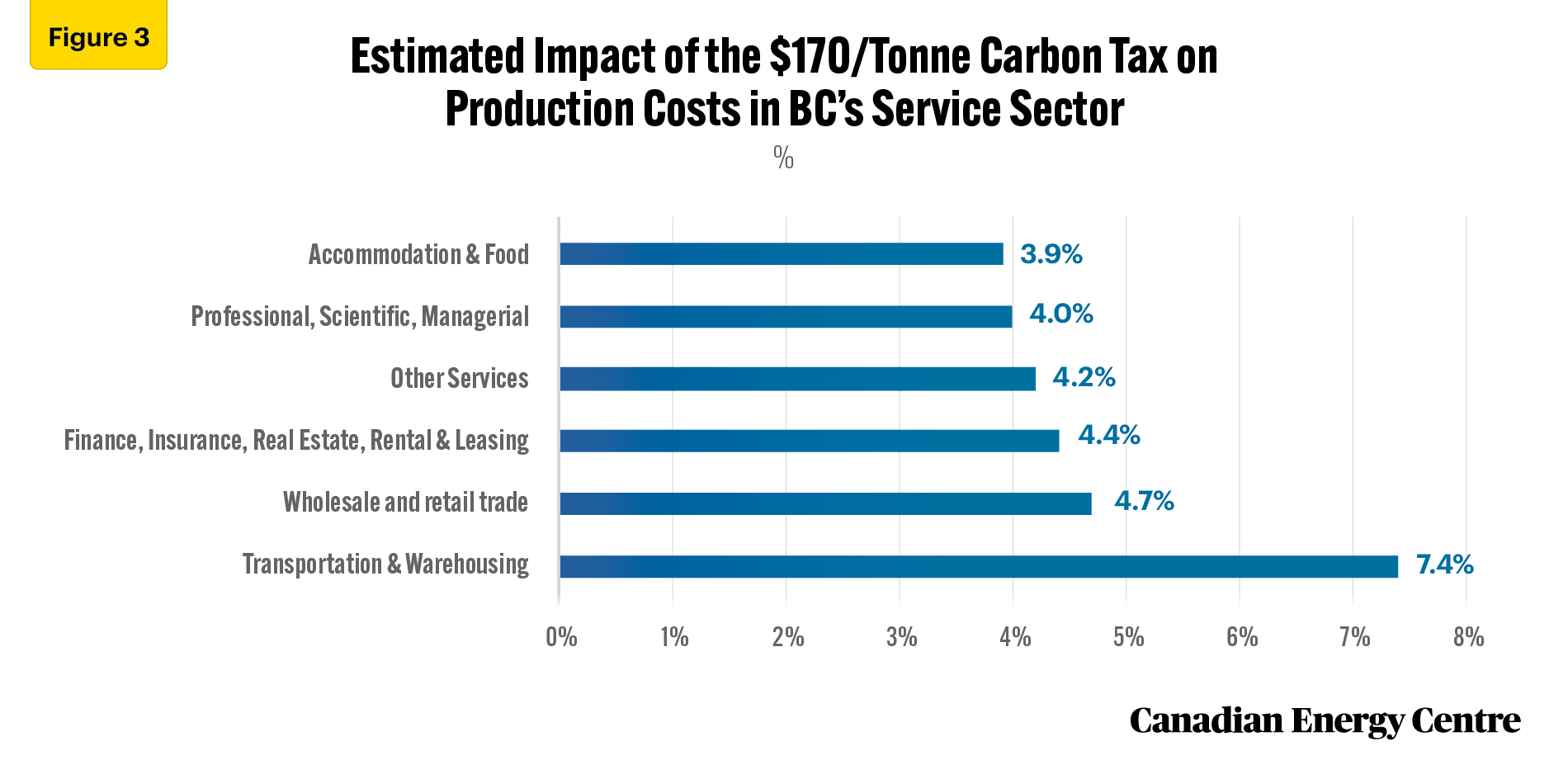

In BC’s service sector, the transportation and warehousing sub-sector, which relies heavily on refined petroleum products, will see the highest cost increases from the $170 per tonne carbon tax, at 7.4 percent. The accommodation and food services industry will see costs rise by 3.9 percent and the wholesale and retail trade industry will see its cost increase by 4.7 percent (see Figure 3).

Conclusion

This Fact Sheet has analyzed the impact of the carbon tax across various industries in British Columbia. It shows that introducing the $170 per tonne carbon tax will increase business costs for the province’s key industries.

The design of BC’s output-based pricing system is intended to mitigate this impact by targeting energy-intensive and trade-exposed (EITE) industries and setting individual facility or industry emission limits for them.

Each business must determine how the carbon tax will apply to its specific business environment and its impact on stakeholders, employees, customers, and owners. Nevertheless, there is no doubt that key industries in British Columbia will face additional costs associated with the $170 per tonne carbon tax and those charges will affect industry cost competitiveness.

- In this Fact Sheet, we use customized data from Stokes Economics to examine the impact of the carbon tax on industry production costs. The CEC retained Stokes Economics to estimate the additional costs industries will incur from the carbon tax. The estimated impact on industry costs from carbon taxes presented in this analysis focuses solely on pricing fuel emissions subject to the provincial carbon tax.

- Federal and provincial governments in Canada share jurisdiction on environmental regulations in accordance with Canada’s Constitution Act, 1867, which did not assign jurisdiction over the environment to either the provincial or federal governments.

Appendix

About the estimates: Impact of the carbon tax on production costs

Stokes Economics provided macroeconomic cost projections of the impact of the carbon tax on various industries. Stokes Economics uses a provincial macroeconomic modelling system known as “PROVMODS” to estimate the impacts of the carbon tax on industry costs. The estimated impact on industry costs from carbon taxes presented in this analysis focuses solely on pricing fuel emissions subject to provincial and federal carbon taxes either directly through a fuel charge or indirectly through a cap-and-trade system.

To quantify the impact of carbon pricing, the model uses a “base case” forecast that includes the carbon price beginning at $50 per tonne in 2022 and escalating to $170 per tonne by 2030. Next, the model creates an alternate scenario where the carbon tax is immediately repealed in 2023 and remains cancelled in all future years. The two scenarios are compared for industry costs and other economic impacts. As various aspects of the carbon pricing system must be accounted for, the selected model is multi-faceted in its features and capabilities.

Limitations

This analysis focuses solely on the cost implications associated with the fuel charge component of the carbon tax. With the implementation of BC OBPS in 2024, large industrial emitters subject to the output-based pricing system (OBPS) may incur additional costs if their facility doesn’t meet emission standards set under that program. These potential costs are not included in the results presented in this analysis. Also, the analysis doesn’t include the impact of clean fuel standards.

The model relies on relative aggregate industry data that masks heterogeneity across firms in the industry. The model assumes that the carbon tax is an input cost and not a fixed cost in production, and that the average cost is equal to the marginal cost, reflecting the long-run absence of economies or diseconomies of scale. The estimates do not consider input substitution among factors of production (energy, land, labour, and capital). Moreover, the study does not consider how the revenue from the carbon tax will be recycled to various industries through cuts in other taxes or taxes on input production. This analysis does not assume changes in production technology or fuel switching in industrial production processes due to the carbon fuel charge. The model ignores different manufacturing processes used in various industries. Different manufacturing processes can lead to a different industry fuel mix and energy use.

Notes

This CEC Fact Sheet was compiled by Ven Venkatachalam and Lennie Kaplan at the Canadian Energy Centre: www.canadianenergycentre.ca. The authors and the Canadian Energy Centre would like to thank and acknowledge the assistance of Stokes Economics and one anonymous reviewer in reviewing the data and research for this Fact Sheet.

References (All links live as of August 11, 2023)

British Columbia (2023), Exports, Issue 23-05 (May) <https://tinyurl.com/5dv32yjh>; British Columbia (Undated), British Columbia’s Carbon Tax <https://tinyurl.com/5xbsdz9u>; Environment and Climate Change Canada (Undated), Carbon Pollution Pricing Systems across Canada <https://tinyurl.com/25xmew2n>.

Creative Commons Copyright

Research and data from the Canadian Energy Centre (CEC) is available for public usage under creative commons copyright terms with attribution to the CEC. Attribution and specific restrictions on usage including non-commercial use only and no changes to material should follow guidelines enunciated by Creative Commons here: Attribution-NonCommercial-NoDerivs CC BY-NC-ND.