To sign up to receive the latest Canadian Energy Centre research to your inbox email: research@canadianenergycentre.ca

Download the PDF here

Download the charts here

Executive Summary

The carbon tax is a significant instrument for curbing greenhouse gas emissions (GHGs). However, there have been concerns expressed regarding the impact of the carbon tax on industry costs and competitiveness. The carbon tax makes producers pay for their emissions. The problem arises when there is no uniform carbon policy across international markets.

Differences between countries in the approach to lowering carbon emissions will impose higher costs on industries, possibly leading to “carbon leakages” or seeing industries relocate to lower-cost regions, such as the United States.

This study analyzes the impact of the carbon tax on key industries across the Atlantic provinces. The analysis shows that the $170 per tonne carbon tax by 2030 will increase business costs for industries in Atlantic Canada. Companies in the region could see their profits fall. Businesses will also find it difficult to pass on the cost increases associated with the carbon tax to customers.

In Atlantic Canada, goods-producing industries such as mining, utilities, and the manufacturing sector, which generally have higher energy input requirements, will witness the highest impacts from the carbon tax.

In Newfoundland and Labrador, oil and gas extraction sector support activities are the most energy-intensive industry, with energy exceeding 18 per cent as an input. The heavy usage of natural gas in the province results in the industry experiencing a 24 per cent cost increase from the $170 per tonne per tonne carbon tax.

In Prince Edward Island, the agriculture sector will witness cost increases from inter-industry demand and supply linkages as other industries’ costs are pushed onto the agriculture sector. As a result, the industry will see its production costs increase by over 4 per cent. Production costs for the manufacturing sector will increase by more than 2 per cent.

In Nova Scotia, the electric power generation industry will see the highest cost increases in the country due to its reliance on coal as an electric power generating input. The cost to produce electric power will increase by 109 per cent due to the carbon tax. The possibility of Nova Scotia transitioning from coal-based electric power generation to other alternative sources, such as natural gas, would reduce the impacts of the rising carbon tax. The manufacturing sector in Nova Scotia is heavily trade exposed. Non-metallic mineral product manufacturing (excluding cement and concrete) use refined petroleum products (RPPs) as a significant input, resulting in a 9 per cent cost increase due to the $170 per tonne carbon tax.

In New Brunswick, the utilities sector will see the highest production cost increase at 42.1 per cent. For the other primary sectors, which include industries such as forestry and logging, production costs will increase by more than 5 per cent.

Introduction

The idea and implementation of carbon taxes is receiving increasing attention from industries, consumers, and policymakers across Canada.

In 2018, Canada’s federal government implemented a nationwide carbon tax as one of its tools to reduce carbon emissions. The carbon tax will affect nearly all Canadian taxpayers regardless of who will bear the costs initially. As such, businesses nationwide need to be informed and participate in conversations about the impact of the carbon tax.

As the debate continues among policymakers in Canada about the costs and benefits of the carbon tax, this study looks at the potential impact of a $170 per tonne carbon tax on various industries in the Atlantic provinces.¹ The analysis provides a general overview of the potential impact of the carbon tax on production costs for a particular sector; because each business organization is unique, businesses need to complete their own analyses, specific to their business models and based on their suppliers, competitors, customers, and markets. Studies conducted with different methodologies and assumptions will calculate different estimates of the impact of the carbon tax on business.

The authors are undertaking this carbon tax impact study because such information will be helpful for all industry stakeholders when they are assessing the effects of a carbon tax. Many organizations and authors have studied the impact of the carbon tax on households (Ammar et al., 2022) and businesses (McKitrick and Aliakbari, 2021). The current study contributes to the discourse by calculating the impact of the carbon tax on industry.

The rest of the paper is organized as follows. Section 2 provides a brief overview of carbon tax legislation in Canada and the Atlantic provinces. Section 3 examines the impact of the carbon tax on business costs. Section 4 provides information on the sectoral share of GDP for various industries and on carbon emissions in the Atlantic region. Section 5 examines the impact of the carbon tax on various industries in the Atlantic provinces. The paper concludes by summarizing the implications of the carbon tax on the competitiveness of several different sectors.

1. In this Canadian Energy Centre (CEC) Research Brief, we use the data provided by Stokes Economics to examine the impact of the carbon tax on industry production costs. The CEC retained Stokes Economics to estimate the additional costs industries will incur from the carbon tax. The estimated impact on industry costs from carbon taxes presented in this analysis focuses solely on pricing fuel emissions subject to provincial and federal carbon taxes either directly through a fuel charge or indirectly through a cap-and-trade system.

Carbon Tax Legislation

As part of the 2016 Pan-Canadian Framework on Clean Growth and Climate Change, the Government of Canada passed the Greenhouse Gas Pollution Pricing Act (GGPPA) in December 2018. The GGPPA imposes a carbon pricing system on provinces and territories that either have not implemented their own carbon pricing system or have implemented a system that does not meet the minimum requirements set by the federal government.

According to the government of Canada (n.d.), the GGPPA consists of two parts: a regulatory charge on fuels such as gasoline and natural gas (known as the fuel charges) and a performance-based baseline and credit system for large industrial emitters that meet prescribed criteria set out in the GGPPA and its regulations (known as the Output-Based Pricing System (OBPS).

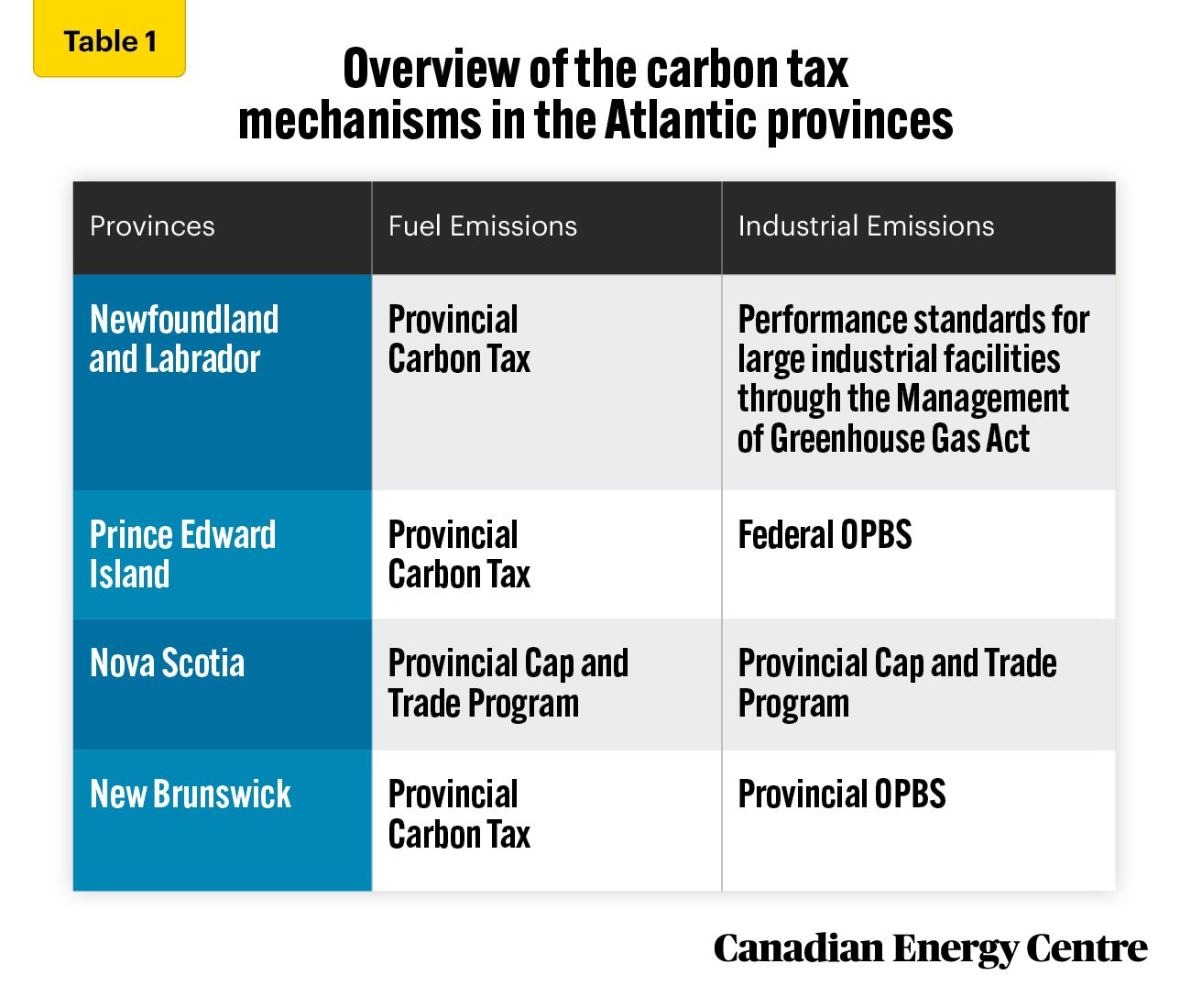

Federal and provincial governments have the constitutional authority to regulate climate policy, which affects how such policy has been developed in the Atlantic provinces.² Provincial governments in the Atlantic region have used different policy instruments to regulate greenhouse gas (GHG) emissions, including cap-and-trade emission trading regimes and the carbon tax (see Table 1).

Under the GGPPA, the federal carbon tax began at $20/tonne in 2019 and escalated by $10 a year to $50/tonne in 2022. In December 2020, the federal government released an updated plan that called for a $15/tonne per year increase in the carbon price, reaching $95/tonne in 2025 and $170/tonne in 2030.

2. Federal and provincial governments in Canada share jurisdiction on environmental regulations in accordance with the Canadian Constitution Act, 1867, which did not assign jurisdiction over the environment to either the provincial or federal governments. Hence, environmental laws are diffused and can be addressed under federal or provincial legislative power depending upon the nature and scope of the issue. Federal initiatives on the environment can be regulated through parliamentary powers using various laws. Provincial environmental legislation is supported under the power granted to the provinces to regulate land and business through provincial property and civil rights laws and provincial power over municipal government (Becklumb, 2019).

Source: Canada (n.d.)

Carbon Taxes and Business Costs

The main way in which the federal government’s carbon tax will influence the national economy is through increased energy costs for businesses. The carbon tax makes gasoline and natural gas more expensive–and electricity generation when a firm relies on it.

Industry cost impacts from a direct fuel charge are primarily determined by the amount and type of fuel a company’s production process uses. As such, it is essential to understand the energy mix that an industrial production process uses in order to accurately interpret the cost impacts. The carbon tax, which is a tax on the factors of production, will raise the intermediate input cost and increase the production cost or business cost of almost everything we use or buy.³ Intermediate input costs play an essential role in business, affecting the final price at which goods and services will be sold to customers and, thus, a business’s profitability.

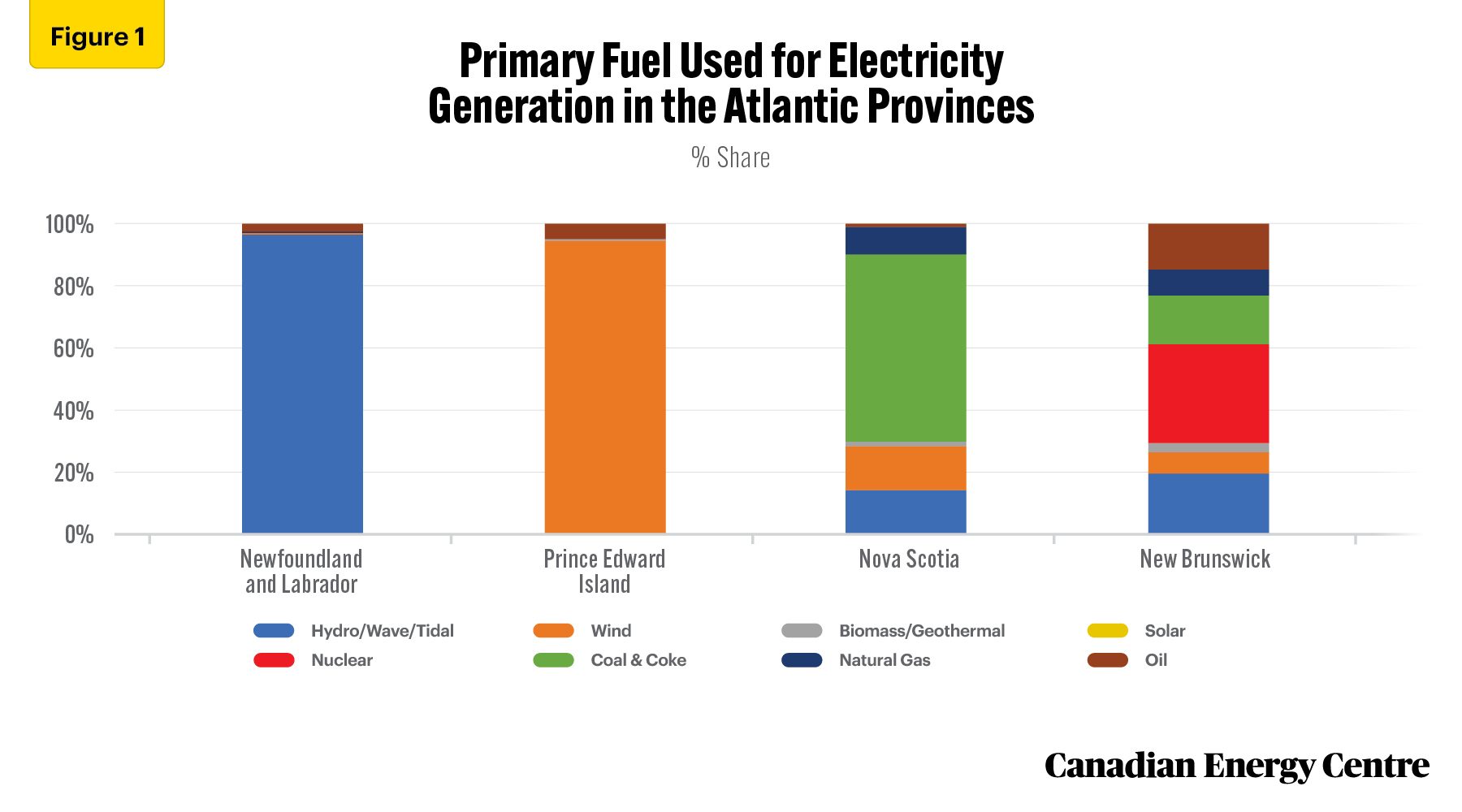

Electricity use is an essential consideration in calculating the cost of industrial production as its cost impact will vary based on how electricity is generated in a particular region. The Atlantic provinces use renewable natural gas and coal-powered electricity (see Figure 1) for most of their energy needs.

The distinction among the provinces is evident when comparing the cost impact across industries. Provinces such as Nova Scotia that use a higher share of coal, natural gas, or refined petroleum products to generate electricity will experience a relatively higher cost impact. In comparison, Newfoundland and Labrador will have lower input costs as that province generates more electric power created by renewable sources such as hydroelectric facilities.

3. The four primary business input costs in producing goods and services are goods, services, energy, and wages and salaries. These input costs are called intermediate product costs. Intermediate products include goods and services other than fixed assets that are used as inputs into the production process. Intermediate products are a variable input in the production function and include both purchased goods and service inputs, including energy expenditures.

Source: Canada Energy Regulator (n.d.)

The carbon tax will give rise to direct and indirect business costs. Energy-intensive industries will incur more of the former, and other industries more of the latter. Direct impacts are the cost that the carbon tax will impose on carbon-emitting sectors and the cost of fuel or energy used directly in production.

Indirect costs are the carbon tax-induced cost the business will incur through input or production processes subject to the carbon tax in the prior production stage. Industries such as food services or restaurants, financial services, or retail stores that are not subject to the tax directly may still experience significant cost increases if the sector relies on inputs that use energy-intensive production processes.

Carbon taxes have two effects on industries. First, the carbon tax is applied to refineries, utility companies, and other intermediaries that supply electricity, fuel, and other energy that industries use. The tax then translates into higher fuel prices, which increases input costs. Second, there is an output effect, which measures the long-run reduction in industrial output caused by increased output prices due to the carbon tax.

The carbon tax will also affect the profitability⁴ of companies if they choose not to pass increased production costs on to consumers. A carbon tax also affects industries that are trade exposed.⁵

The carbon tax effect is more pronounced in industries that export most of their products. Industries that rely on exports face a unique challenge: the prices of the goods they produce are set in the global marketplace.

Without the ability to pass some portion of the increased cost of production on to buyers, trade-exposed industries must pay that portion of the cost themselves, which will affect the company’s profitability.

4. The term “profit” here refers to the gross operating surplus and gross mixed income. It refers to the income of corporations, governments, households and non-profit institutions serving households accruing to the capital factor of production from producing goods and services. 5. Trade exposed industries may or may not have the capacity to transfer the carbon cost imposed on the firm to its customers. Only the company knows its capacity to transfer its costs to the customer. “Trade exposure” is a theoretical concept; the higher a sector’s trade exposure the more difficult it will be for the company to transfer its costs to customers, including the cost of carbon. The trade exposure ratio is: (Exports + Imports) / (Domestic production + Imports)

Atlantic Canada’s Economy and Sources of Energy-Related Emissions

The first step in analyzing the impact of the carbon tax is to examine the economies of each province in Atlantic Canada and calculate its share of gross domestic product (GDP) and its sources of greenhouse gas emissions (GHGs).

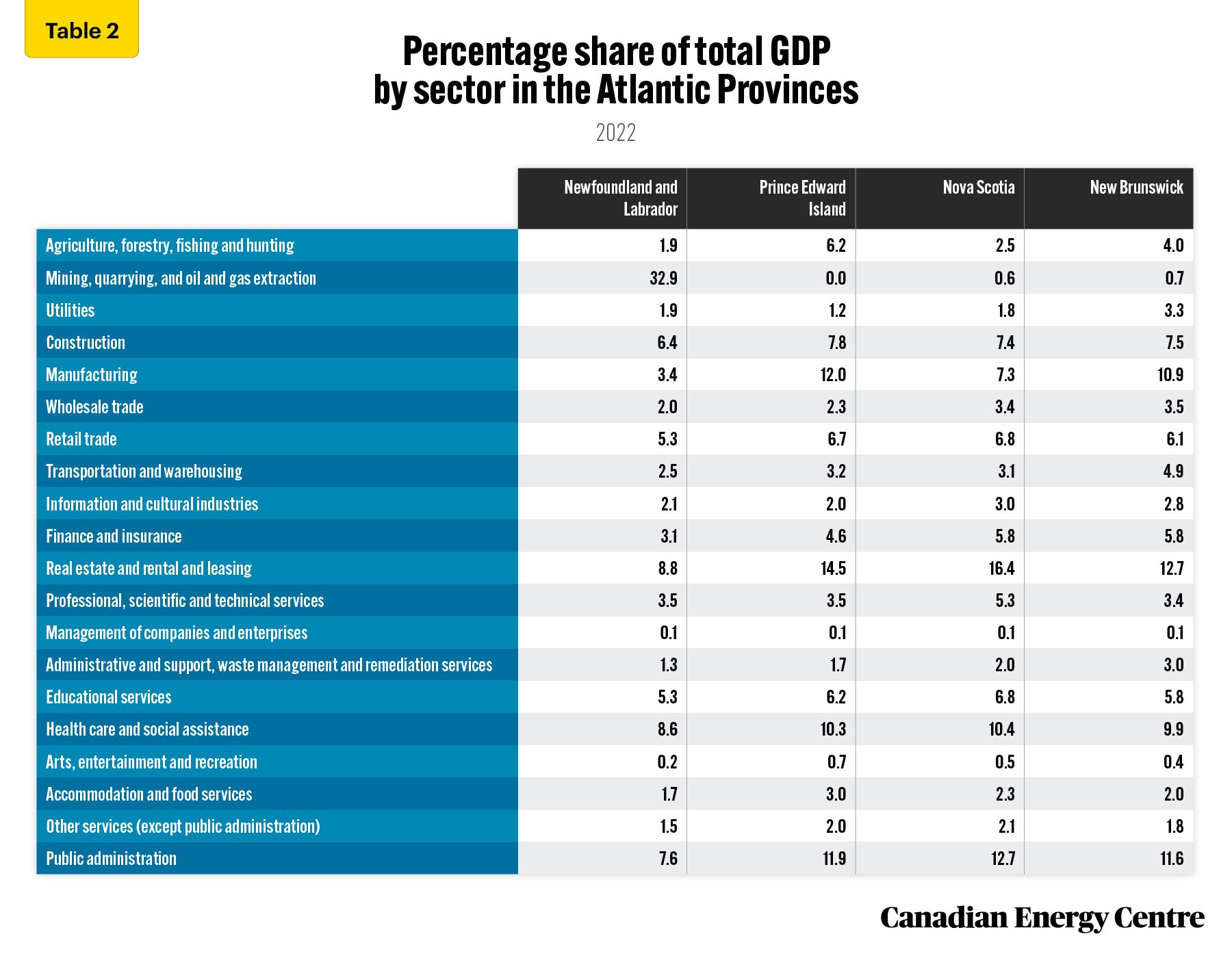

Table 2 shows the sectoral GDP share across the four provinces in Atlantic Canada. There are some similarities among sectors in the provinces, namely, finance, insurance, information, and professional services. Notably, the oil and gas sector represent 32.9 per cent of GDP in Newfoundland and Labrador, the highest among the Atlantic provinces.

Manufacturing comprises 12.0 per cent of GDP in Prince Edward Island (PEI), 10.9 per cent in New Brunswick (NB), 7.3 per cent in Nova Scotia (NS) and 3.4 per cent in Newfoundland and Labrador (NL).

The agriculture sector’s share of GDP ranges from 1.9 per cent in NL to 6.2 per cent in PEI. The construction sector’s share ranges from 6.4 to 7.8 per cent across the Atlantic provinces.

Source: Statistics Canada, Table 36-10-0400-01

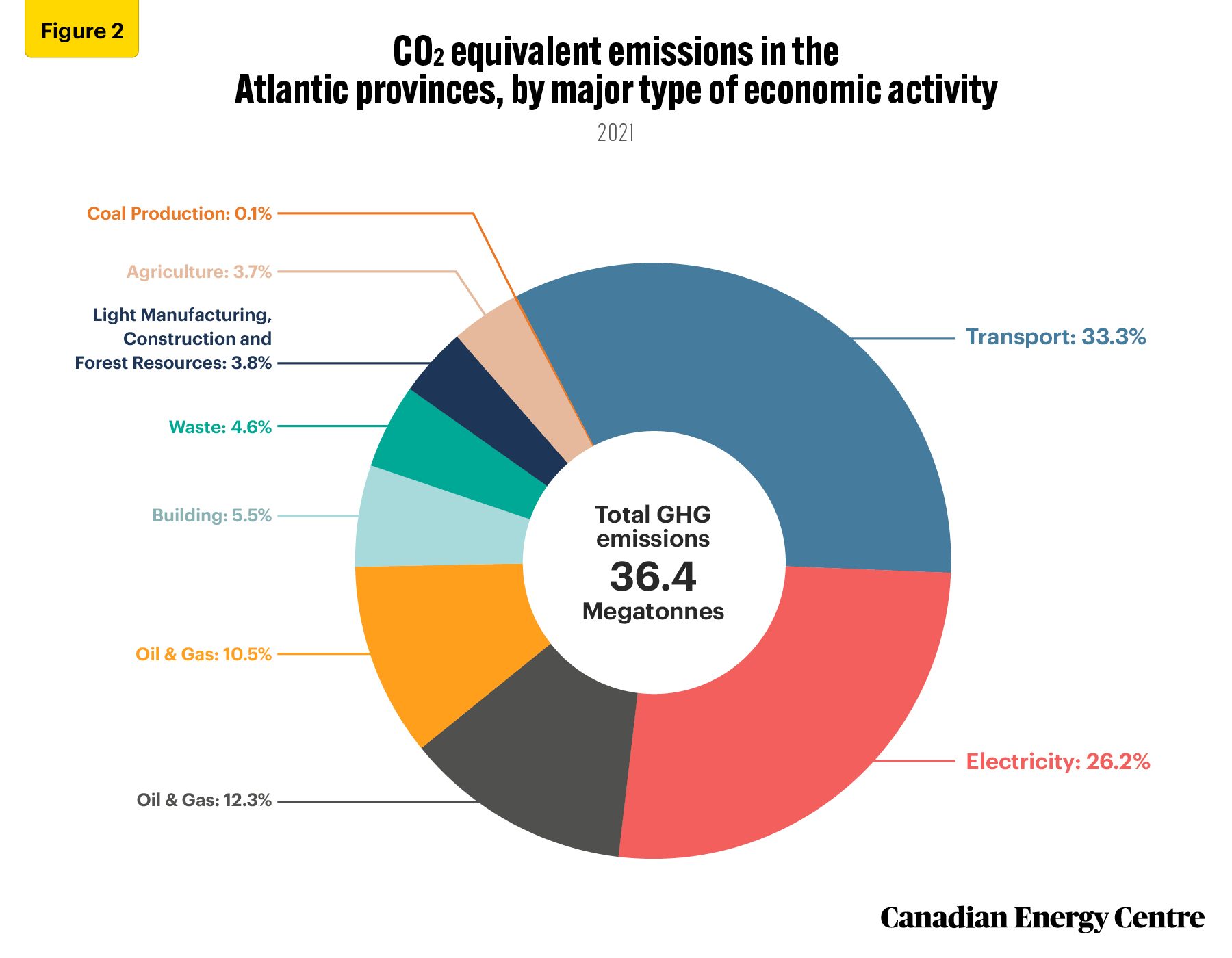

The total GHG emissions in the Atlantic provinces was 36.4 megatonnes (MT) of carbon dioxide equivalent (CO2e) in 2021, less than 6 per cent of Canada’s 670.4 MT of CO2e GHG emissions that year.

Greenhouse gas emissions in the Atlantic provinces are primarily concentrated in a few types of economic activities, as Figure 2 shows. The transportation sector accounts for 33.3 per cent of all GHG emissions, while electric power generation accounts for 26.2 per cent. Industrial activity, including oil and gas and manufacturing, accounts for 21.6 per cent. The agriculture sector accounts for less than 4 per cent of GHG emissions in the Atlantic provinces.

Source: Environment and Climate Change Canada (2023)

Estimated Impact of the Carbon Tax on Industry Production Costs

Newfoundland and Labrador

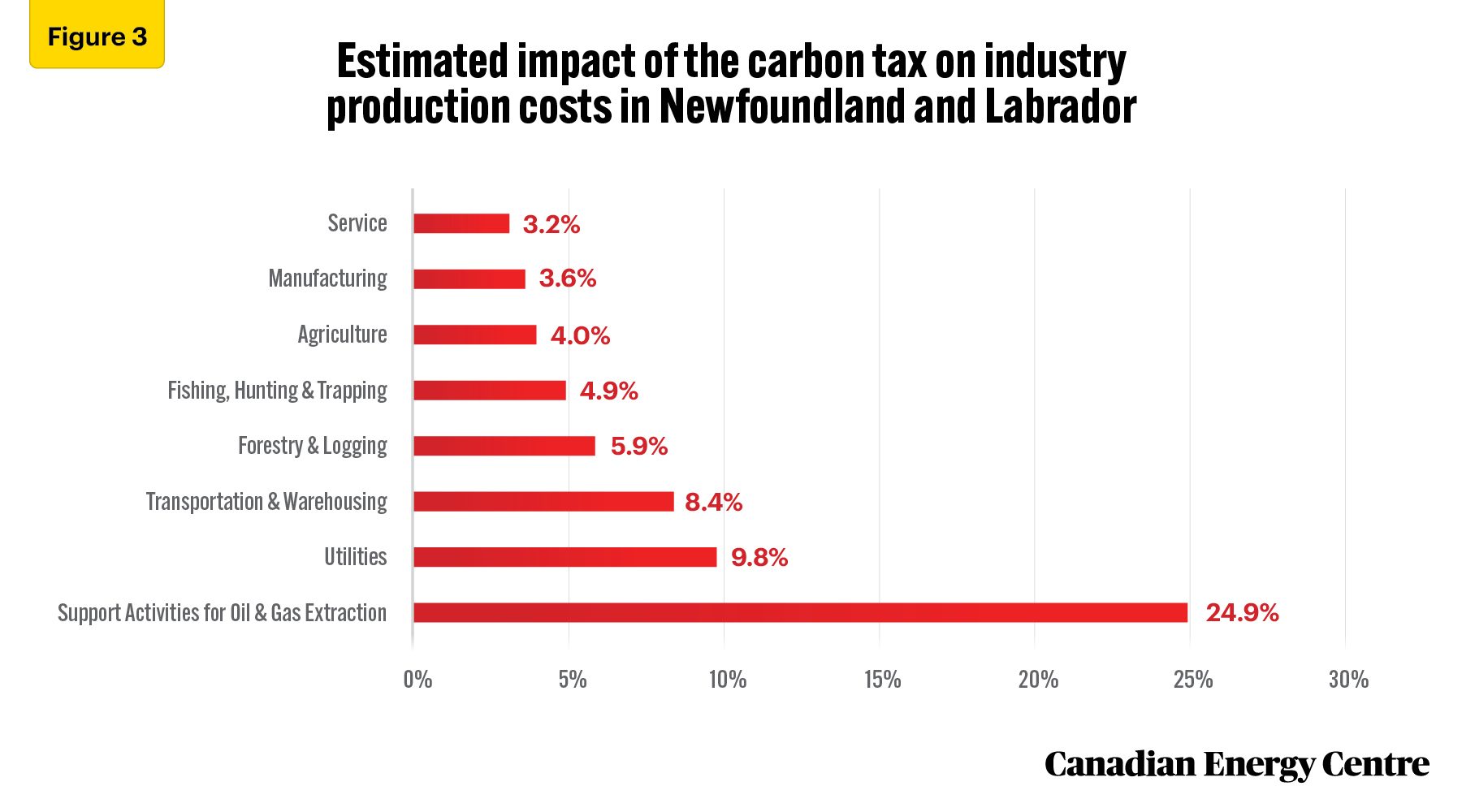

In Newfoundland and Labrador, on average, the support activities for the oil and gas extraction sector will see the highest cost increase following the imposition of the carbon tax. Support activities for oil and gas extraction are the most energy-intensive of the primary industries, with energy exceeding 18 per cent as an input. That industry’s heavy use of natural gas liquids (NGLs) will result in the industry experiencing a 24.9 per cent cost increase from the carbon tax (see Figure 3).

On average, production costs will increase by more than 9 per cent in the utilities industry. The forestry industry will see its cost increase by more than 5 per cent. Agriculture and manufacturing industries will see a more than 3 per cent production cost increase.

Source: Derived from custom data provided by Stokes Economics

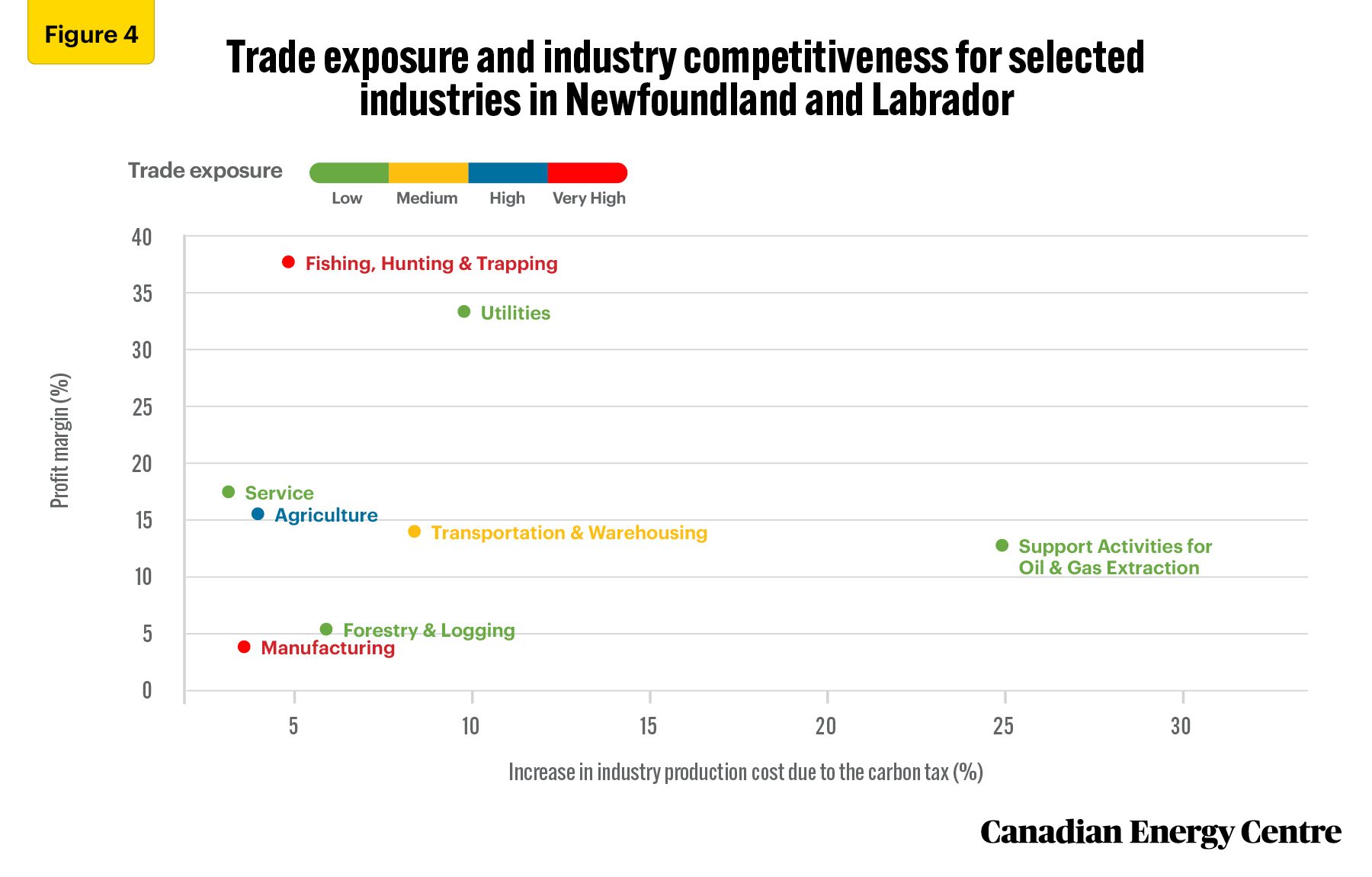

The carbon tax will also affect the profitability of industries in Newfoundland and Labrador, as Figure 4 illustrates. Figure 4 combines the carbon tax impact on production costs, industry profits, and trade exposure to identify industries that may face the most competitive cost pressures due to the implementation of the carbon tax.

The carbon tax will significantly impact industries, such as manufacturing in Newfoundland and Labrador, with very high trade exposure and low-profit margins. The rise in business costs due to carbon tax significantly affectsindustries with lower profit margins.⁶ Industries such as forestry and manufacturing, with low-profit margins, will incur significant impacts from the carbon tax. Profit margins must be high enough compared to similar businesses to attract investors. If profit margins are not high enough; companies will exit the sector.

6. Profit margin is the industry’s profit (gross operating surplus and gross mixed income) ratio to gross output (total production). Gross output measures sales or revenue from production for most industries. However, it is measured as sales or revenue less the cost of goods sold for margin industries like retail and wholesale trade. For example, if an industry has a profit margin of 5 per cent, this means that for every $100 the product is sold for, the industry makes five dollars of profit.

Source: Derived from custom data provided by Stokes Economics

Prince Edward Island

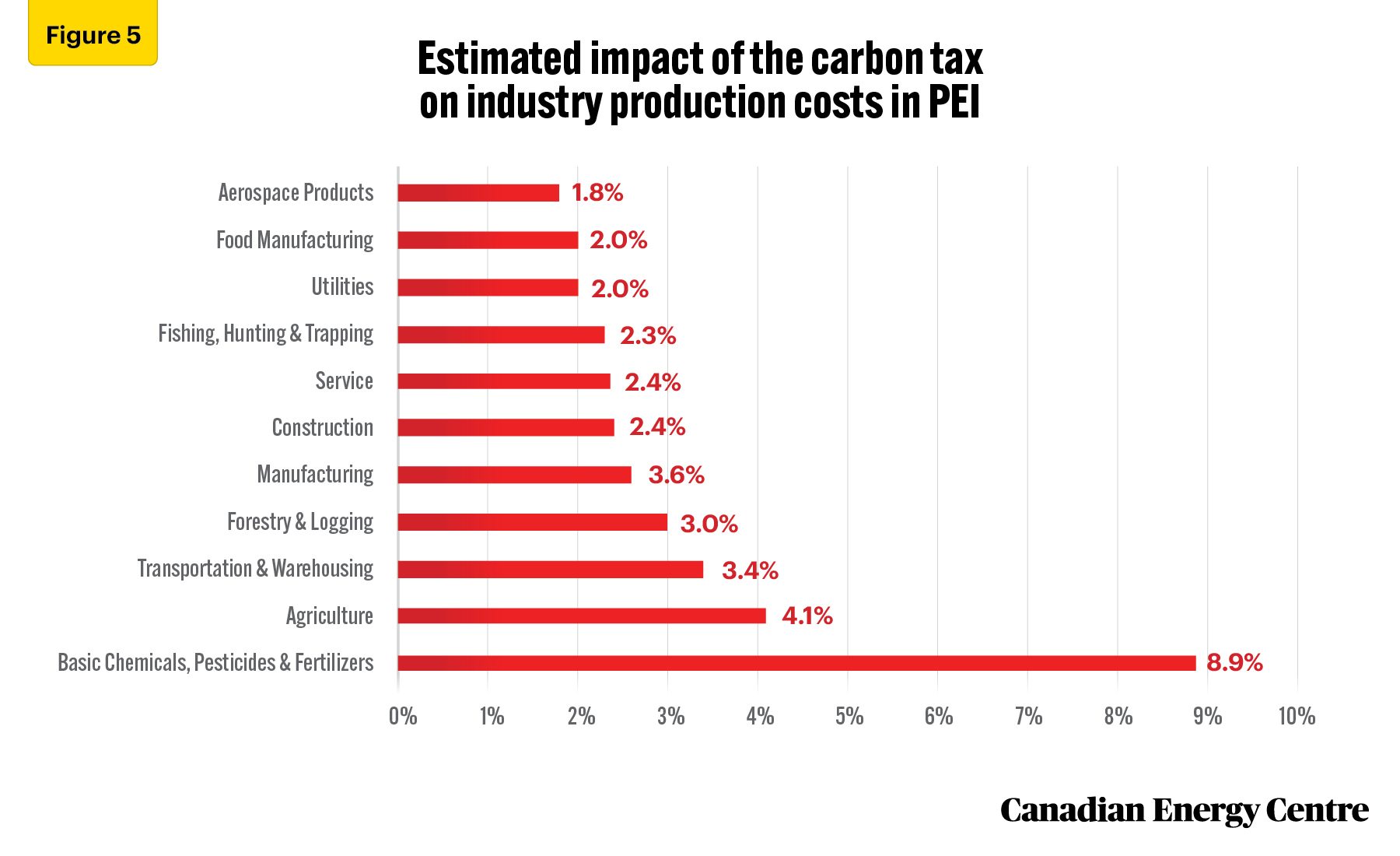

In PEI, agriculture has an energy input share of 7 per cent of production and relies on diesel, biodiesel, and gasoline for its energy inputs. Fuels used in farming activities are mainly exempt from the carbon tax, so the cost increase for the sector arises from inter-industry demand and supply linkages as other industries’ costs are pushed onto the agriculture sector. As a result, the industry will see its production cost increase by over 4 per cent (see Figure 5).

Production costs for manufacturing will increase by more than 3 per cent. Food manufacturing and basic chemicals will see slightly higher cost increases of 2 per cent and 9 per cent, resulting from higher energy input shares and more carbon-intensive inputs.

Source: Derived from custom data provided by Stokes Economics

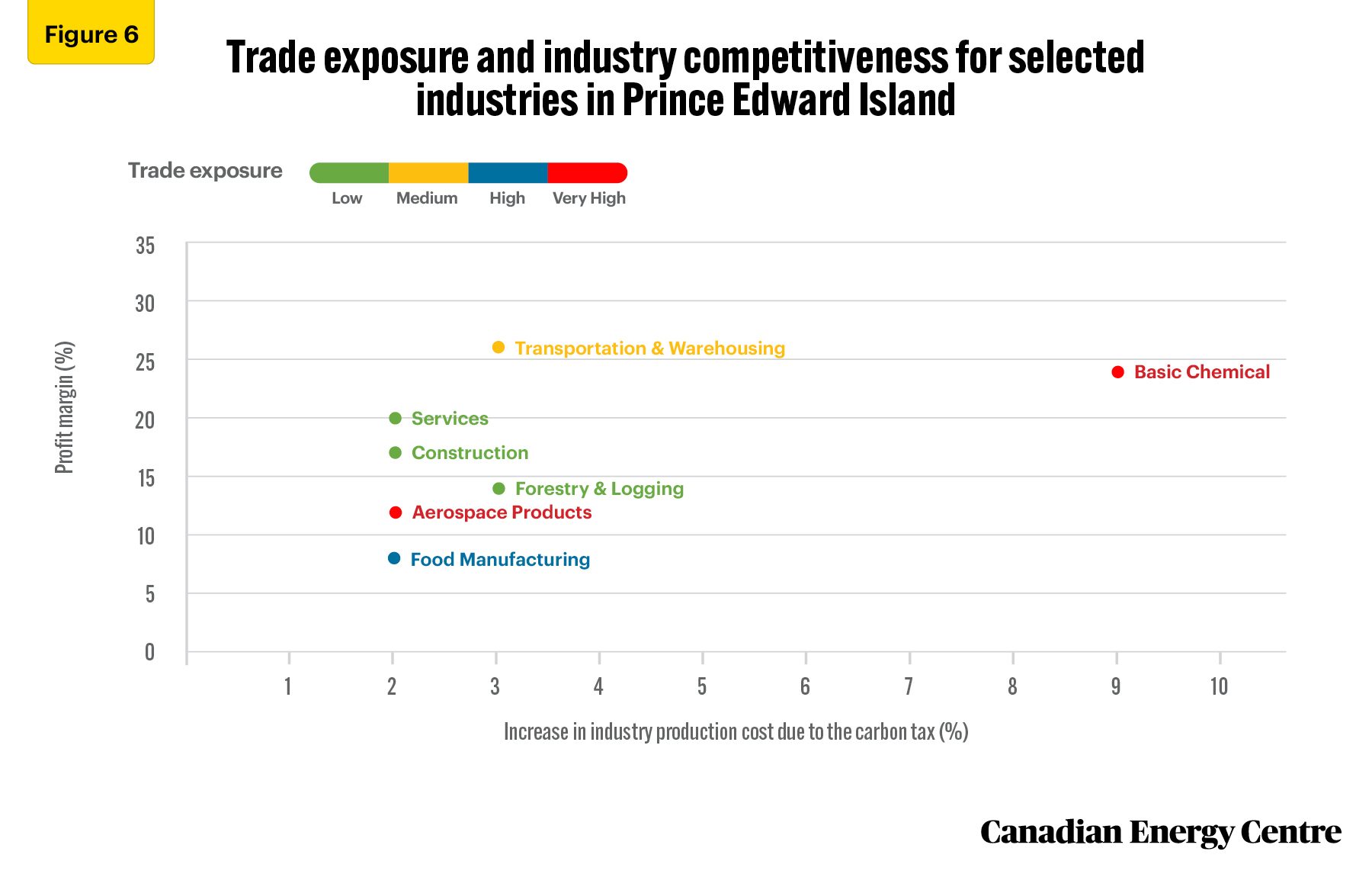

Industries in PEI that are trade-exposed will face competitive pressures. Food manufacturing (40 per cent of manufacturing GDP), other chemicals (17 per cent of manufacturing GDP), and aerospace parts (14 per cent of manufacturing GDP) are the province’s most significant manufacturing industries and have significant trade exposure (see Figure 6).

As Figure 6 shows, the impact of the carbon tax will be more obvious in sectors such as food manufacturing and aerospace, industries with low-profit margins.

Source: Derived from custom data provided by Stokes Economics

Nova Scotia

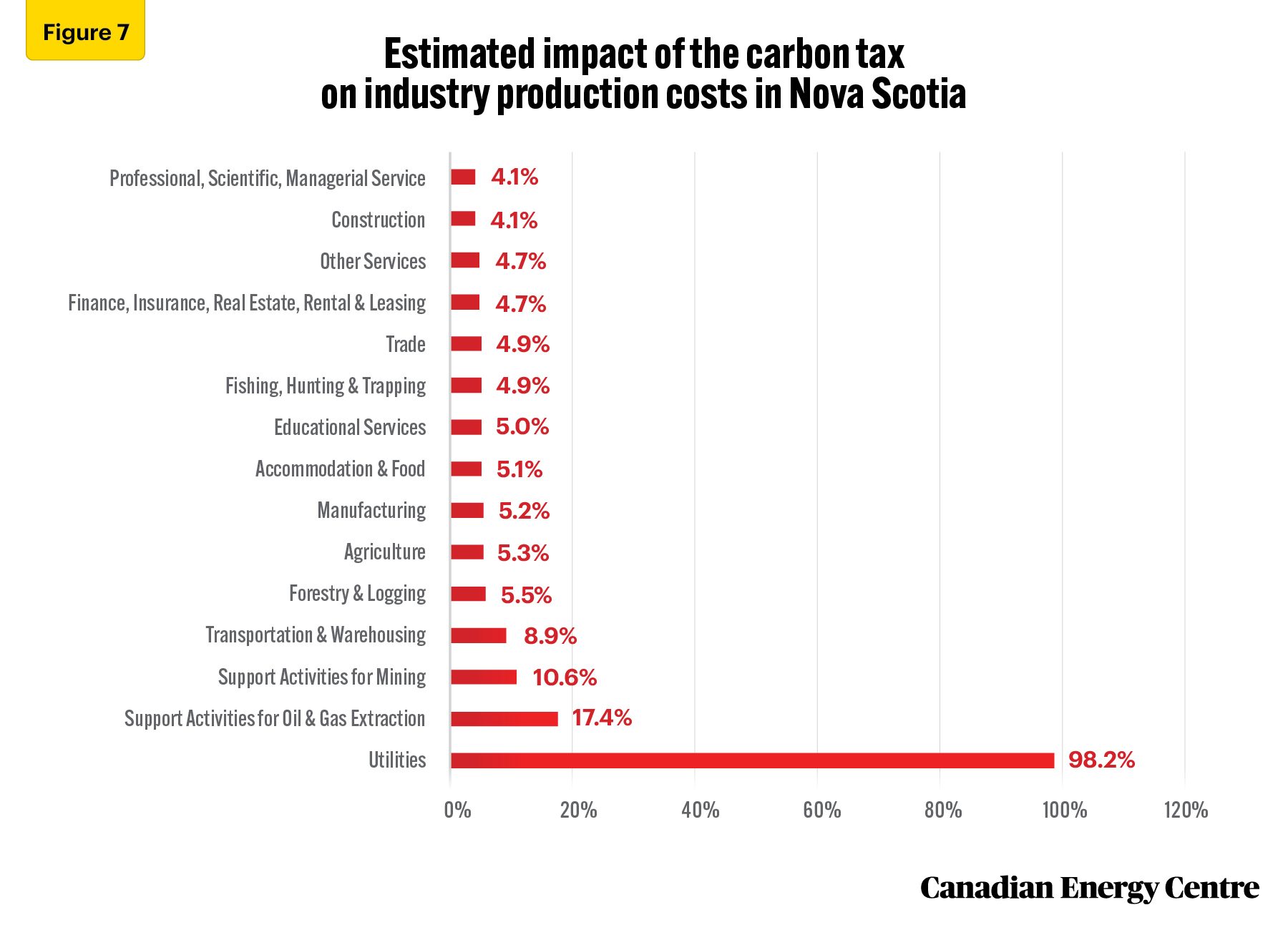

In Nova Scotia, the utilities sector (electric power generation) will see the highest cost increases in the country from the $170 per tonne carbon tax due to its reliance on coal as an input for generating electric power.

The production costs in the utilities sector will increase by more than 90 per cent. Other industries will see significant cost increases, including oil and gas and mining support activities. This latter sector relies on refined petroleum products, which will lead to double-digit percentage increases in production costs. The transportation sector will bear a cost increase of more almost 9 per cent (see Figure 7).

Source: Derived from custom data provided by Stokes Economics

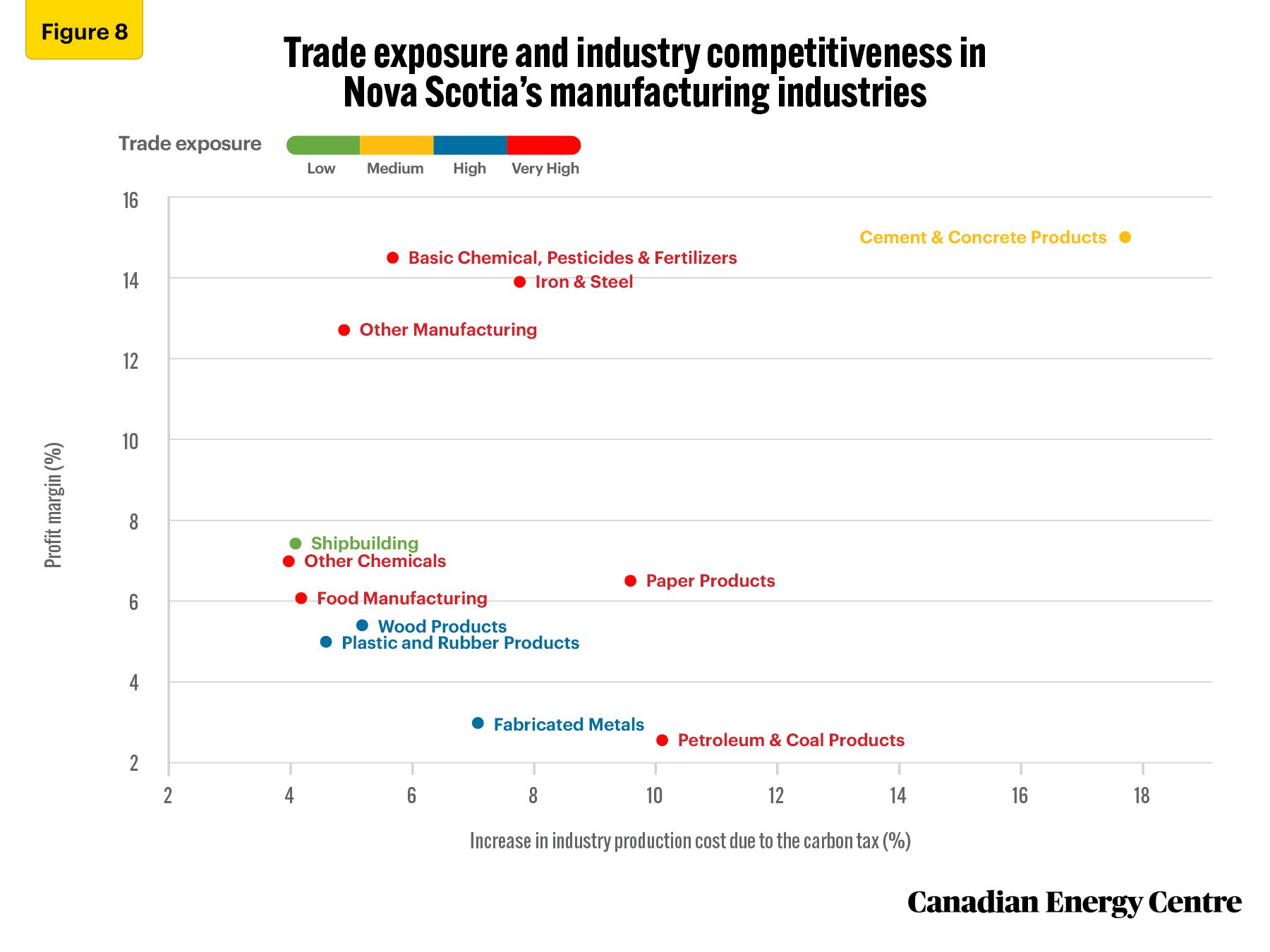

The manufacturing sector in Nova Scotia is heavily trade-exposed (see Figure 8). Non-metallic mineral product manufacturing (excluding cement and concrete) uses refined petroleum products as a significant input, resulting in a 9 per cent cost increase due to the $170 per tonne carbon tax. Paper manufacturing is another energy-intensive industry and will see a similar cost rise. However, this increase is due to the amount of electricity the industry uses. The rising cost of generating electricity, discussed above, will feed into other industries.

While cement and concrete product manufacturing is not the most energy-intensive industry in the province, it relies on other energy inputs, including the direct use of coal products. While these products account for only two per cent of inputs, their high carbon content makes the industry very sensitive to the escalating carbon tax, resulting in a 17.7 per cent increase by 2030. The more significant manufacturing industries in the province, such as plastic and rubber products, aerospace, and shipbuilding, are less energy intensive, bringing down the cost increase for the manufacturing industry to 5 per cent.

As Figure 8 shows, the increase in business costs due to carbon tax will significantly impact industries with low-profit margins. Companies in fabricated metal, rubber products and food manufacturing will have the most significant impact from the carbon tax due to their low-profit margins and high trade exposure.

Source: Derived from custom data provided by Stokes Economics

New Brunswick

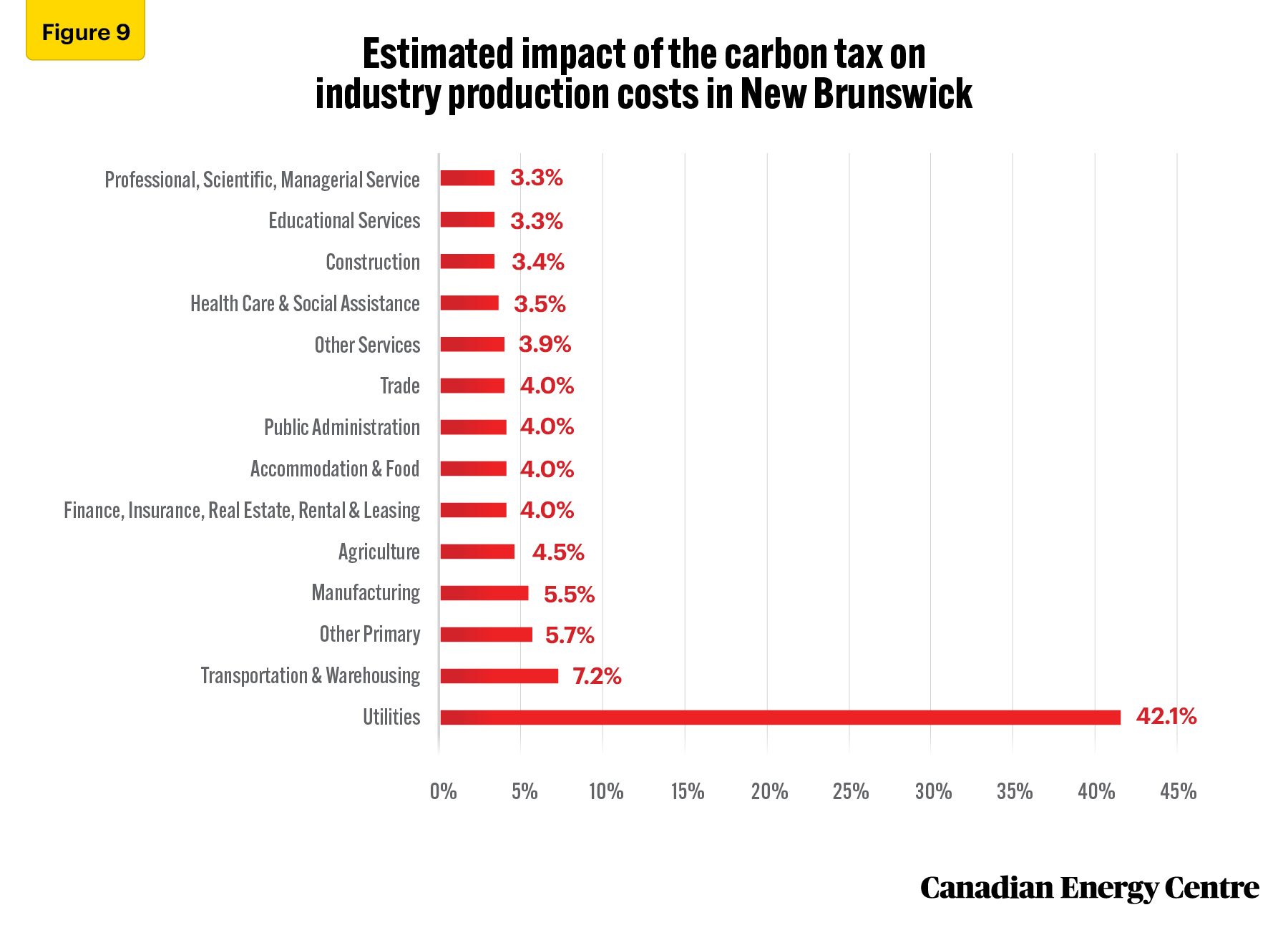

In New Brunswick, on average, the utilities sector will see the highest production cost increase in the province at 42.1 per cent (see Figure 9). This cost increase can be attributed to the fact that the sector is the most energy-intensive in the province; energy accounts for 27 per cent of its total production costs.

Figure 9 shows the significant impact of the $170 per tonne carbon tax on the transportation and warehousing sector; the tax will increase production costs for it by about 7 per cent. For the other primary sectors, which include industries such as forestry and logging, production costs will increase by more than 5 per cent. The forestry sector’s often remote working conditions mean refined petroleum products, which are easy to store and transport, account for most of the industry’s total energy input share.

Food manufacturing (comprising 24 per cent of manufacturing GDP), paper products (18 per cent of manufacturing GDP), wood products (12 per cent of manufacturing GDP), and petroleum and coal products (18 per cent of manufacturing GDP) are the province’s most significant manufacturing industries, together accounting for around 70 per cent of sectoral output. The production costs for the trade-exposed manufacturing sector will increase by more than 5 per cent under the $170 per tonne carbon tax. The paper products sector is much more energy intensive. It primarily uses electricity for its energy requirements but also uses petroleum products such as natural gas and other energy as inputs. The result is an increase in business costs of more than 5 per cent.

Source: Derived from custom data provided by Stokes Economics

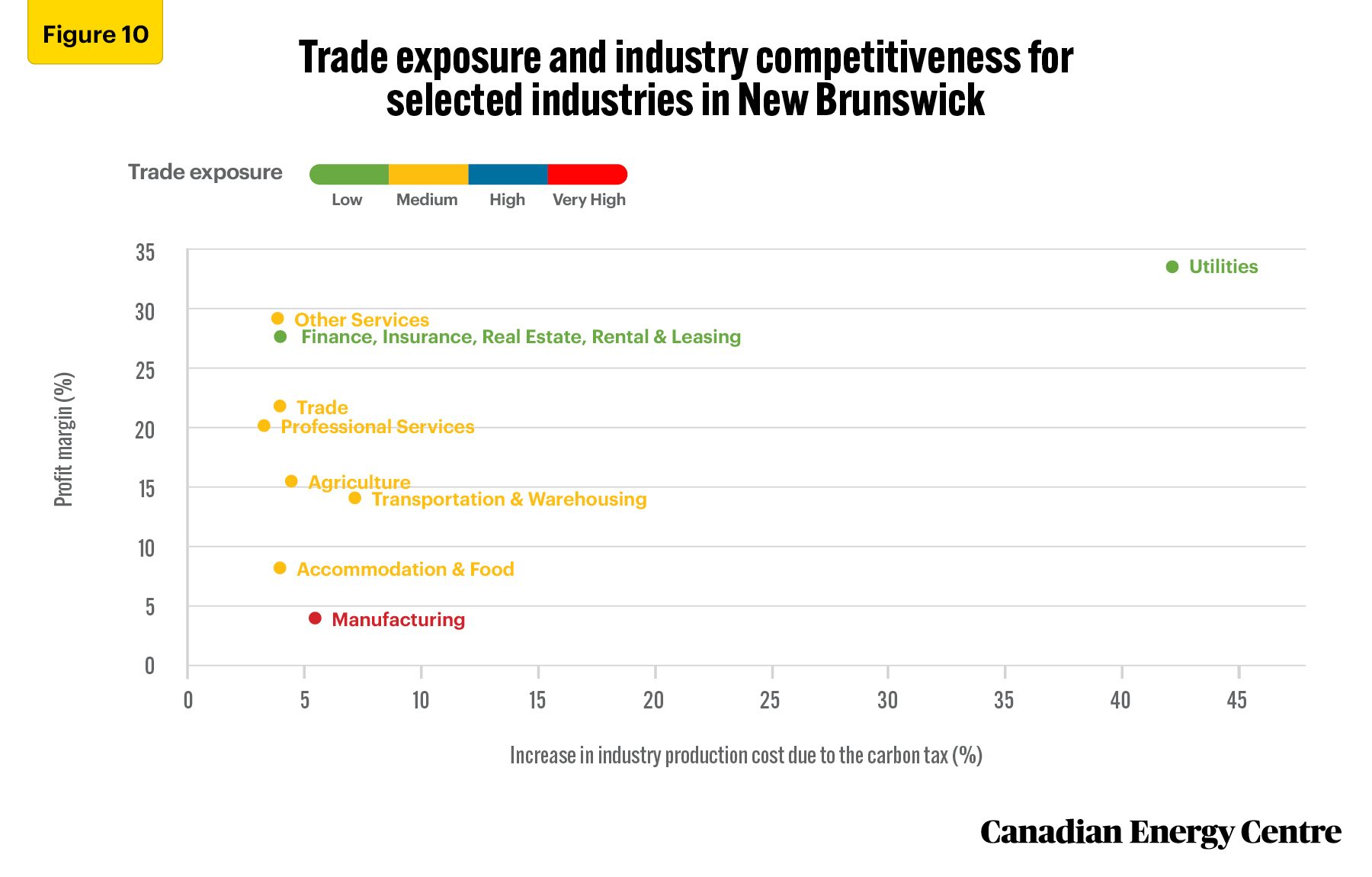

As Figure 10 shows, the increase in business costs from the $170 per tonne carbon tax will significantly impact the manufacturing industry with lower profit margins and high trade exposure. Industries with lower profit margins will find it challenging to absorb the cost increase associated with the carbon tax

Source: Derived from custom data provided by Stokes Economics

Conclusion

Undoubtedly, reducing GHG emissions is a crucial goal for policymakers, and pricing carbon can be one strategy to reduce carbon emissions. The carbon tax makes producers pay for their emissions. The problem arises when there is no uniform carbon policy across international markets.

This difference between countries in the approach to lowering carbon emissions will impose higher costs on industries, possibly leading to “carbon leakages,” or industries relocating to lower-cost regions such as the United States.

The design of output-based pricing systems is intended to mitigate this impact by targeting energy-intensive and trade-exposed industries and setting individual facility or industry emission limits. Nonetheless, as this Research Brief has shown, there is no doubt that Canadian industries will face additional costs associated with the $170 per tonne carbon tax, affecting cost competitiveness in Canada and leading to some carbon leakage.

This study analyzed the impact of the carbon tax on various industries across the Atlantic provinces. Our study shows that introducing the $170 per tonne carbon tax will increase business costs for industries in Atlantic Canada. Companies in that region could see their profits fall. Businesses will also find it difficult to pass on the cost increase associated with a carbon tax to customers.

Each business must determine how the carbon tax will apply to their specific business environment and its impact on stakeholders, employees, customers, and owners. For all of them, however, there is likely to be at least some impact from the imposition of a $170 per tonne carbon tax.

Appendix

About the estimates: Impact of the carbon tax on production costs

Stokes Economics provided macroeconomic cost projections of the impact of the carbon tax on various industries. Stokes Economics uses a provincial macroeconomic modelling system known as “PROVMODS” to estimate the impacts of the carbon tax on industry costs. The estimated impact on industry costs from carbon taxes presented in this analysis focuses solely on pricing fuel emissions subject to provincial and federal carbon taxes either directly through a fuel charge or indirectly through a cap-and-trade system.

To quantify the impact of carbon pricing, the model uses a “base case” forecast that includes the carbon price beginning at $50 per tonne in 2022 and escalating to $170 per tonne by 2030. Next, the model creates an alternate scenario where the carbon tax is immediately repealed in 2023 and remains cancelled in all future years. The two scenarios are compared for industry costs and other economic impacts. As various aspects of the carbon pricing system must be accounted for, the selected model is multi-faceted in its features and capabilities.

Limitations

This analysis focuses solely on the cost implications associated with the fuel charge component of the carbon tax. Large industrial emitters subject to the output-based pricing system (OBPS) may incur additional costs if their facility doesn’t meet emission standards set under that program. These potential costs are not included in the results presented in this analysis. Also, the analysis doesn’t include the impact of clean fuel standards.

The model relies on the relative aggregate industry data that masks heterogeneity across firms in the industry. The

model assumes that the carbon tax is an input cost and not a fixed cost in production, and the average cost is equal to the marginal cost, reflecting the long-run absence of economies or diseconomies of scale. The estimates do not consider input substitution among factors of production (energy, land, labour, and capital). Moreover, the study does not consider how the revenue from the carbon tax will be recycled to the various industry through cuts in other taxes or taxes on input production. This analysis does not assume changes in production technology or fuel switching in industrial production processes due to the carbon fuel charge. The model ignores different manufacturing processes used in various industries. Different manufacturing processes can lead to a different industry fuel mix and energy use.

CEC Research Briefs

Canadian Energy Centre (CEC) Research Briefs are contextual explanations of data as they relate to Canadian energy. They are statistical analyses released periodically to provide context on energy issues for investors, policymakers, and the public. The source of profiled data depends on the specific issue.

About the authors

This CEC Research Brief was compiled by Ven Venkatachalam, Chief Research Analyst, Canadian Energy Centre and Lennie Kaplan, Executive Director of Research, Canadian Energy Centre. The authors and the Canadian Energy Centre would like to thank and acknowledge the assistance of Stokes Economics and two anonymous reviewers in reviewing the data and research for this Research Brief

References (All links live as of June 21, 2023)

Ammar, Nasreddine, Philip Bagnoli, Krista Duncan, and Tim Scholz (2022). A Distributional Analysis of Federal Carbon Pricing under A Healthy Environment and A Healthy Economy. Canada, Parliamentary Budget Officer (PBO). https://distribution-a617274656661637473.pbo-dpb.ca/6399abff7887b53208a1e97cfb397801ea9f4e729c15dfb85998d1eb359ea5c7

Becklumb, Penny (2019). Federal and Provincial Jurisdiction to Regulate Environmental Issues. Background Paper. Library of Parliament, Economics, Resources and International Affairs Division. https://lop.parl.ca/sites/PublicWebsite/default/en_CA/ResearchPublications/201386E

Canada Energy Regulator (n.d.). Macro Indicators. Canada’s Energy Future Data Appendices. Government of Canada. https://apps.rec-cer.gc.ca/ftrppndc/dflt.aspx?GoCTemplateCulture

Environment and Climate Change Canada (2023). Greenhouse Gas Sources and Sinks in Canada. National Inventory Report 1990-2021. Government of Canada. https://publications.gc.ca/site/eng/9.506002/publication.html

Canada (n.d.). Carbon Pollution Pricing Systems across Canada. Government of Canada. https://www.canada.ca/en/environment-climate-change/services/climate-change/pricing-pollution-how-it-will-work.html

McKitrick, Ross, and Elmira Aliakbari (2021). Estimated Impacts of a $170 Carbon Tax in Canada. Revised Edition. Fraser Institute. https://www.fraserinstitute.org/studies/estimated-impacts-of-a-170-carbon-tax-in-canada

Statistics Canada (2023). Table 36-10-0400-01: Gross domestic product (GDP) at basic prices, by industry, provinces and territories, percentage share. https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3610040001

Creative Commons Copyright

Research and data from the Canadian Energy Centre (CEC) is available for public usage under creative commons copyright terms with attribution to the CEC. Attribution and specific restrictions on usage including non-commercial use only and no changes to material should follow guidelines enunciated by Creative Commons here: Attribution-NonCommercial-NoDerivs CC BY-NC-ND.