To sign up to receive the latest Canadian Energy Centre research to your inbox email: research@canadianenergycentre.ca

Download the PDF here

Download the charts here

Executive Summary

There is considerable ongoing discussion about the benefits of renewable energy and its ability to meet climate change goals such as the Paris Accord by 2030 and net zero emissions (NZE) by 2050.

The IEA is calling on governments to put clean energy transitions at the heart of their stimulus packages to mitigate what they see as an increase in CO2 emissions in the recovery from the current COVID-19 and the March 2020 crude oil price war between Saudi Arabia and Russia. (IEA, 2020d). The EIA would like to see governments implementing specific financing measures and incentives for renewable projects, including auctions and tax incentives that reduce investment risk in large-scale solar and wind projects and other targeted support schemes for small-scale projects. The OECD is urging the same (OECD, 2020a). By any name, these various policy instruments are government subsidies.

While there has been substantial attention paid by many to the flawed estimates of fossil fuel subsidies, there has been little, if any, comprehensive analysis of the level of government subsidies to renewables needed to reach climate change targets in 2030 and 2050.

The assumptions behind the switch from fossil fuel subsidies to subsidies for renewables are often faulty

Data from the IEA and IRENA reveal that while the energy transition will see global fossil fuel subsidies decline, they will be partly replaced by subsidies to renewables. According to IRENA (2020a), looking towards 2050,

- Direct subsidies for fossil fuels will fall from US$447 billion in 2017 to US$165 billion in 2030 and to US$139 billion in 2050, as fossil fuel demand declines.

- Meanwhile, direct subsidies to renewables will grow from US$166 billion in 2017 to US$209 billion in 2050.

According to the IEA, under scenarios where the world moves to reduce greenhouse gas (GHG) emissions to or near zero, cumulative worldwide subsidies for renewables are estimated to reach over US$5.4 trillion through 2040 (IEA, 2018).

Unfortunately, the work that the IEA and IRENA have done to estimate the level of renewable subsidies needed to meet climate change policy goals through 2040 and 2050 has not been sufficiently disaggregated to a level that allows us to look at estimates of renewable subsidies for Canada, specifically.

There is clearly a need for a more rigorous analysis of the presumed government subsidies required to support a move to net zero emissions between 2021 and 2050. In fact, transition costs in Canada, for example, have often been underestimated.

Previous Canadian experience with a switch from coal-powered plants to renewables shows that transition costs are often dramatically under-estimated

Investments in renewables by Canada that will enable the country to assume reaching the Paris Accord targets by 2030 and the NZE goals by 2050 will be backstopped significantly by taxpayers, with only some of the assumed subsides to fossil fuels replaced by subsidies to renewables. Renewable subsidies beyond the current level of fossil fuels will likely occur. Ontario’s previous experience introducing renewables into its electricity system is instructive. The Auditor General of Ontario noted in 2015 that CA$37 billion in payments to renewable energy producers—characterized by the Auditor General as “excess payments to generators over the market price” for electricity—was the subsidy amount for just the 2006 to 2014 period. The Ontario Auditor General forecast that such payments would cost electricity consumers another CA$133 billion from 2015 to 2032 (Office of the Auditor General of Ontario, 2015a: 23; 2015b: 13).

Multiple weaknesses with trillions in subsidy estimates

Just as critical as the likely underestimation of transition costs in Canada and globally, two of the three noted estimates (OECD and IRENA) are twinned with the assumption that fossil fuel subsidies are high. Thus, the corollary implication is that all policymakers need to do is reduce those allegedly high fossil fuel subsidies and redirect the taxpayer-funded resources to green subsidies. The further implication is that the cost to governments and taxpayers around the world and in Canada will be a “wash.”

A problem arises, however, if the claim of substantial subsidies to the fossil fuel industry is faulty. This situation can happen if the “catchment” used to define a fossil fuel subsidy is so wide as to be nearly meaningless and overestimates the actual subsidies to fossil fuels.

This particular concern was highlighted in 2011 in work by economists Kenneth McKenzie and Jack Mintz (McKenzie and Mintz, 2011). They noted that measuring fossil fuel subsidies was a “tricky art.” They took issue with the methodology of a specific 2010 study that was later used as the basis of subsequent work, including by the International Monetary Fund. McKenzie and Mintz argued that four flaws led to the “billions-of-dollars” subsidy claim. The flaws included methodology that:

- Used a subsidy definition designed for a different purpose;

- Inappropriately added up individual tax expenditures and royalty relief items without accounting for critical interactions between taxes and royalties;

- Was not based upon an underlying optimizing economic model that emphasized the impact of taxes, royalties, and subsidies on investment at the margin; and

- Was not based upon an economically meaningful benchmark.

In 2017, economist Ross McKitrick (McKitrick, 2017) also analyzed energy subsidies including the International Monetary Fund estimate that US$5.6 trillion was spent on subsidizing energy worldwide. McKitrick noted numerous problems with the $5.6 trillion estimate. A few examples:

- Overstating the size of a subsidy using tax expenditure calculations, i.e., overstatements that result when a particular policy is cancelled and the subsequent effect on revenues is not accounted for;

- Labelling non-tolled roads, a “subsidy,” which “clouds the subsidy discussion if we arbitrarily select one type of public good and call it a subsidy without applying the same reasoning to all other public goods”; and

- Ignoring how “road subsidies are often financed through excise taxes on gasoline.”

McKitrick also discussed unpriced externalities, noting that once direct disbursements to fossil fuel companies are subtracted from the $5.6 trillion estimate, $5.3 trillion is left, a figure that is “dominated by uncollected externality taxes” which, as McKitrick noted, was challenged by other economists who questioned the validity of such uncollected externalities. As McKitrick writes regarding that $5.3 trillion estimate:

For the purpose of determining the actual size of subsidies to fossil fuels it would appear that conventional subsidies, that is actual payments to consumers and firms, are at the low end of the range of past estimates and are only a small percentage of the large numbers that have sometimes been put forward. To the extent we include indirect or notional concepts the numbers get dramatically higher but they also become meaningless and potentially misleading.

If, as it appears, trillion-dollar estimates of fossil fuel subsidy estimates are too high, the corollary is that there is no “pot of gold” from which to divert trillions of dollars to green/renewable subsidies. Instead, those proposed future subsidies will have to be paid for from taxes or by additional government debt.

Indeed, the limited data from the International Energy Agency (IEA) and the International Renewable Energy Agency (IRENA) show clearly that meeting climate change goals such as Paris and NZE will result in significant costs to taxpayers in the form of subsidies for renewable energy, especially if current estimates of fossil fuel subsidies are incorrect. There will be no “free lunch” for taxpayers in the energy transition, despite the claims of some anti-oil and gas activists.

In other words, countless billions of dollars will not flow seamlessly and painlessly to the renewables sector from the oil and gas sector, because much of the assumed fossil fuel subsidies that anti-oil activists claim to have spotted are mostly not there, or exist in the form of consumer subsidies for lower gasoline prices in countries such as Saudi Arabia, and Iran, but not in Canada.

Energy density also matters

In addition to questionable trillion-dollar fossil fuel estimates, the ability of certain forms of energy to contribute to a low carbon transition also matters. To understand why, consider the insights from one of the world’s leading experts on energy transitions, University of Manitoba professor of the environment (emeritus) Vaclav Smil, who has noted that “the reality of energy density (that is, how much energy can be extracted from a unit of raw material) in various forms of energy sources (be they oil, natural gas, coal, wind, solar and others) must be accounted for as part of any assumed transition.” In 2018, Science magazine cited Smil’s point that energy transitions are normally transitions away from “relatively weak, unwieldy energy sources for those that pack a more concentrated punch.” Instead, as Smil also remarked, trying to reverse that practical attention to energy density by moving to all-renewable sources of energy could require countries, to use his words from Science, to “devote 100 or even 1000 times more land area to energy production than today… [which] could have enormous negative impacts on agriculture, biodiversity, and environmental quality” (Voosen, 2018).

Similarly, as Smil wrote for the University of Saskatchewan’s Johnson Shoyama School of Public Policy in 2020, “Designing hypothetical roadmaps outlining complete elimination of fossil carbon from the global energy supply by 2050 is nothing but an exercise in wishful thinking that ignores fundamental physical realities.” In other words, before abandoning something as a source of energy, we must consider how little (or much) of that source it takes to produce the outcomes we need.

Recommendations for further research

Numerous organizations and anti-oil activists have suggested that there are ways to reach net zero emissions between 2030 and 2050 and limit the global temperature rise to 1.5°C or less.

For example, the IEA recently stated that:

the radical transformation of the global energy system required to achieve net-zero CO2 emissions in 2050 hinges on a big expansion in investment and a big shift in what capital is spent on, from just over US $2 trillion globally on average over the last five years, to almost US ($5 trillion by 2030 and to US $4.5 trillion by 2050 (our emphasis). (IEA, 2021a)

However, beyond a cursory analysis of the investments needed to reach NZE, no organization has attempted to comprehensively quantify the level of government subsidies required to underpin this goal. The IEA does not provide any estimates of the government subsidies needed to support a net zero emissions pathway, but admits that unlocking private investment will require public policies that create incentives, set appropriate regulatory frameworks, and reform energy taxes. Direct government financing is needed to boost the development of new infrastructure projects and to accelerate innovation in technologies that are currently in the demonstration or prototype phase. Projects in many emerging markets and developing economies, such as India, are often relatively reliant on public financing, and policies that ensure a predictable flow of bankable projects have an important role in boosting private investment in these economies, as does the scaling up of concessional debt financing (i.e., cheap loans) and the use of development (community-supported) finance.

Given such comments from the IEA, it is incumbent on those who purport to see a viable pathway to net zero emissions and limiting global temperature rise to 1.5°C or below to provide a rigorous analysis of the levels of government subsidies that each country will need to make annually, between 2021 and 2050, to reach these aspirational goals, as well as deal with objections from energy transition experts such as Vaclav Smil, and others.

Introduction

There has been a great deal of discussion about the role that renewables will play in meeting global greenhouse gas (GHG) emissions reduction targets. Renewables include solar, wind, hydro, biofuels, and geothermal.

Over the past decade, subsidies for renewables have been growing worldwide. According to the International Energy Agency (IEA), in 2016, about 155 countries had in place government support policies for renewables (IEA, 2016).

However, there has been little comprehensive analysis of the level of subsidies required to support the goal of renewable energy sources meeting climate change targets over the next 30 years.

According to the International Renewable Energy Agency (IRENA), “analysis of energy sector subsidies has, in the past, focussed on fossil fuels. There are relatively few institutions examining global subsidies to individual fuels or technologies using a consistent methodology and accounting approach to their calculation” (IRENA, 2020a).

In this CEC Research Brief, we examine the limited data on global subsidies to renewables between 2007 and 2019 and the estimates of global subsidies to renewables through 2050. We then examine the implications of renewable subsidies in Canada through 2050.

In our examination, we found a paucity of detailed research on the subsidies needed to support the transition to a net zero economy both globally and for Canada specifically. In light of this, there is clearly a need for more rigorous analysis of the level of government subsidies required to support a move to net zero emissions between 2021 and 2050. Transition costs in Canada, for example, have often been underestimated.

This paper defines subsidies for renewables as financial instruments offered by governments that are designed to encourage the development and deployment of renewables by helping to lower their costs or raise their revenues to compete with more conventional fossil fuel sources. Subsidy instruments for renewables include competitive auctions, feed-in-tariffs (FITs), market premiums, green certificates,

and investment tax credits, among others (IEA, 2018).

For this analysis we adhere to a strict definition of subsidies. We do not price in so-called “negative externalities” generated by fossil fuels in the form of local and global pollution emissions, as there is considerable debate over whether these externalities actually constitute subsidies (Lomborg, 2020).

Methodologies for determining global subsidies for fossil fuels and renewables

According to the International Renewable Energy Agency (IRENA), there are a number of ways to calculate subsidies for fossil fuels and renewables:

- Program-specific estimation uses a program or inventory approach, which identifies and quantifies the sources of subsidies.

- A price-gap analysis tries to identify producer and consumer support estimates based on comparing actual prices of renewables to some reference price, such as wholesale prices in the electricity market.

- Total support estimates try to identify total consumer and producer support levels, by combining the above two approaches (IRENA, 2020a).

The IEA measures fossil fuel and renewable subsidies using a price-gap approach. This compares final end-user prices with reference prices, which correspond to the full cost of supply, or, where appropriate, the international market price, adjusted for the costs of transportation and distribution. The price gap is the amount by which an end-use price falls short of the reference price; its existence indicates that a subsidy is present (IEA, 2021). A good example is gasoline. A country with a state-owned energy company that offers gasoline to consumers at a price below market (Iran, for example)— sometimes below even the cost of production—is creating a price-gap subsidy.

IRENA estimates of fossil fuel and renewable subsidies use a hybrid approach that captures tax expenditures (where possible), while using a price gap analysis to capture the use of other emissions reduction technologies through such mechanisms as mandates or auctions (IRENA, 2020a).

The OECD has created an inventory of individual government budgetary programs and tax provisions to help in the estimation of fossil fuel subsidies (OECD, 2020b).

The different methodologies that organizations use to determine fossil fuel and renewable subsidies appear to call into question some of the subsidy estimates. In order to be credible, any approach developed to determine subsidy levels must be rigorous and work up from the individual county level to the global level.

Fossil fuel subsidies are declining globally

To provide context for our analysis of renewables subsidies, it is important to look at historical trends of subsidies for fossil fuels, where possible, and the various estimates of future subsidies, even where the assumptions used to derive these subsidies (as outlined above) are flawed and questionable. This is needed because of the misguided claims by some organizations and anti-fossil fuel activists that there are no new costs for renewable subsidies as they will simply replace fossil fuel subsidies.

IEA estimates: US$317.6 billion in fossil fuel subsidies in 2019

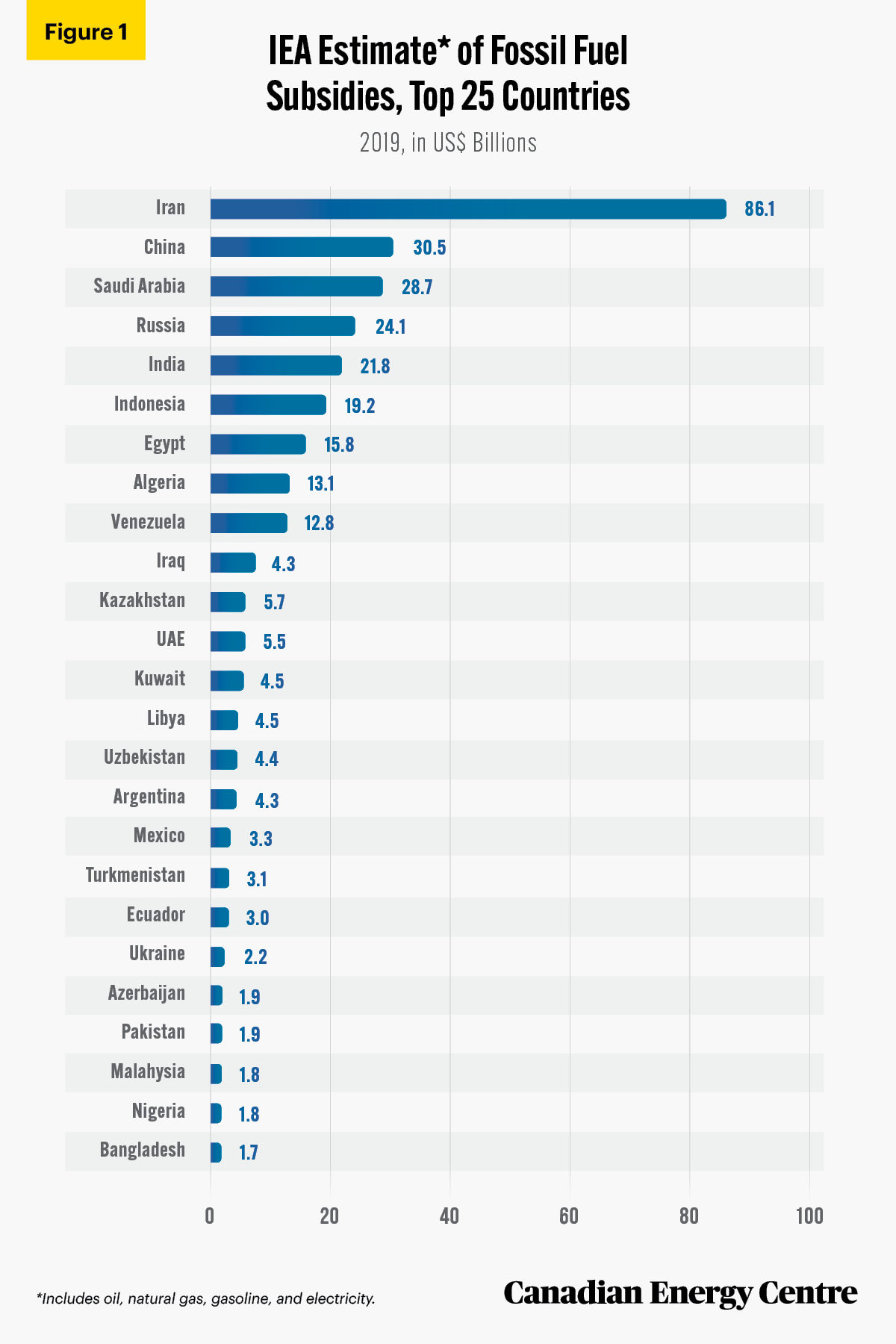

Between 2010 and 2013, the IEA estimates that fossil fuel subsidies worldwide increased from US$445.3 billion to US$530.3 billion, before steadily declining to US$317.6 billion in 2019.

Iran led the way at US$86.1 billion, followed by China at US$30.5 billion, Saudi Arabia at US$28.7 billion, Russia at US$24.1 billion, India at US$21.8 billion, Indonesia at US$19.2 billion, and Egypt at US$15.8 billion (see Figure 1). The IEA did not provide an estimate for subsidies to fossil fuels in Canada for 2019.

Source: International Energy Agency, Fossil Fuel Subsidies Database, 2020.

IRENA estimates: US$447 billion in fossil fuel subsidies in 2017

IRENA determined an alternate estimate of global fossil fuel subsidies (for 2017) by examining the IEA and OECD fossil fuel subsidy estimates and supplementing them with additional tax subsidy estimates, available in the public domain, but omitted from the OECD database.

The combined fossil fuel subsidy inventory by IRENA-IEA covers 67 countries and includes estimates of fossil fuel subsidies for coal, oil, natural gas, and electricity used to support fossil fuel extraction. They assert that their calculation results in a more comprehensive estimate of total global fossil fuel subsidies.¹

IRENA estimated total direct fossil fuel subsidies in 2017 to be around US$447 billion. The subsidy breakdown is as follows:

- Petroleum products: $220 billion

- Electricity-based support to fossil fuels: $128 billion

- Natural gas: $82 billion

- Coal: $17 billion

Of the top 10 countries by fossil fuel subsidy in 2017,

- Iran led the way at nearly US$50 billion, followed by

- Saudi Arabia at US$45 billion,

- China at US$43 billion,

- Russia at nearly US$30 billion,

- India at nearly US$23 billion,

- Indonesia at about US$20 billion and,

- Egypt at about US$19 billion.

IRENA did not provide an estimate of Canada’s direct fossil fuel subsidies in 2017.

1. Note the objections to certain assumptions in the section on implications at the end of this study.

Source: IRENA, 2020a.

Estimates for 2017, 2030, and 2050

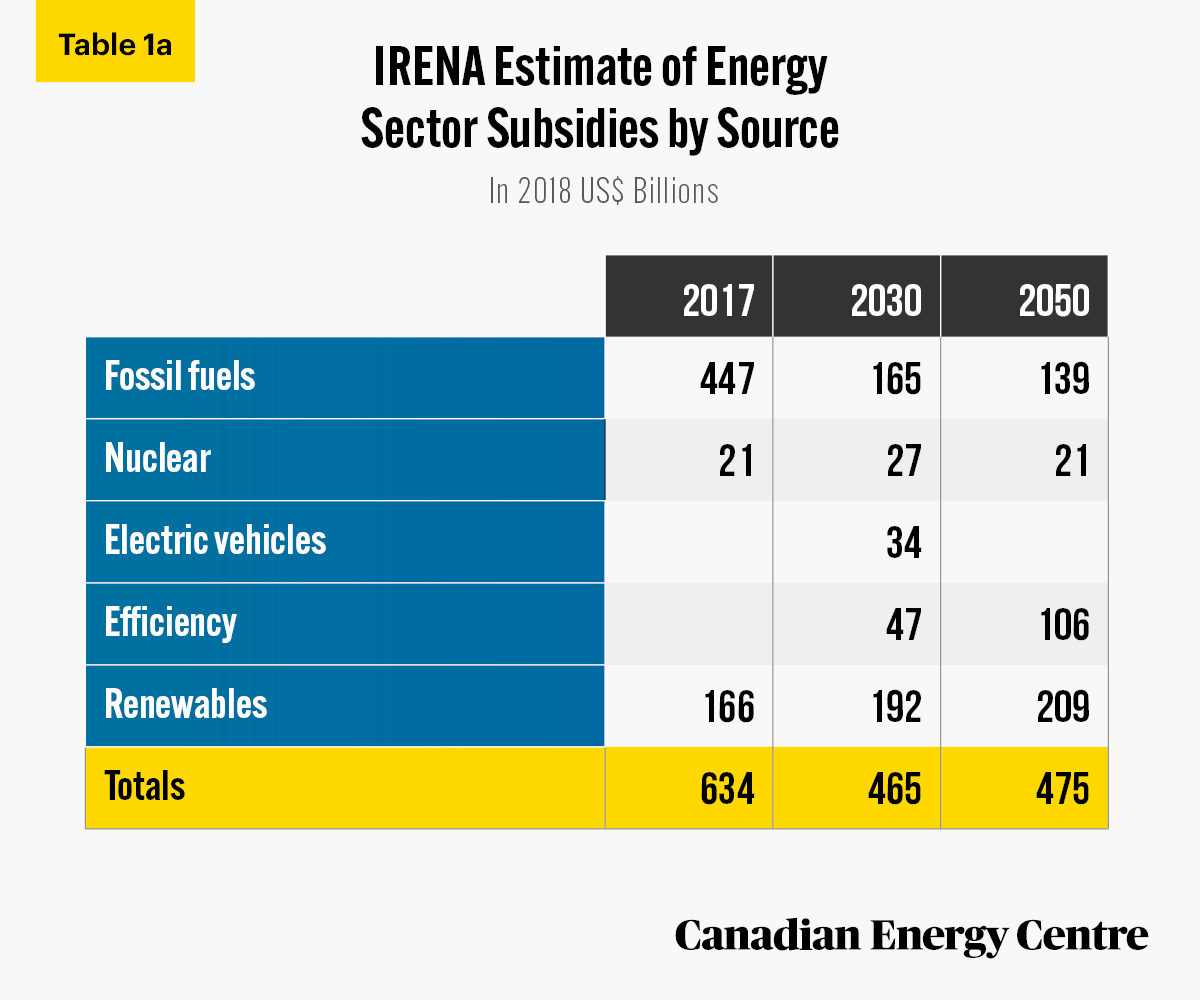

According to IRENA (2020a), as fossil fuel subsidies fall and the deployment of renewable energy accelerates, the total subsidies for renewables will grow. Looking towards 2050, as the demand for fossil fuel declines, direct subsidies for those fuels are expected to fall from US$447 billion in 2017 to US$165 billion in 2030 and to US$139 billion in 2050 (see Table 1a).

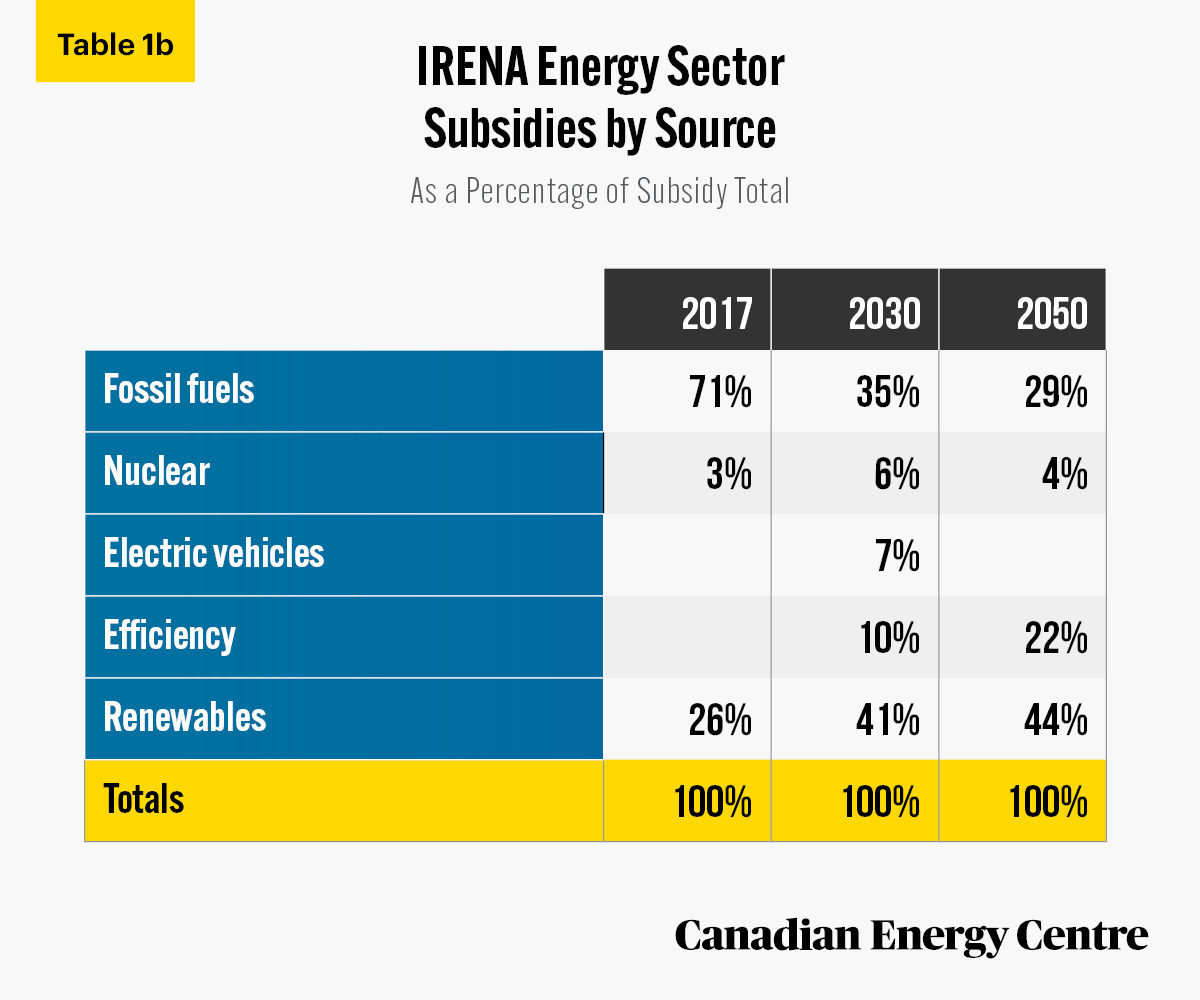

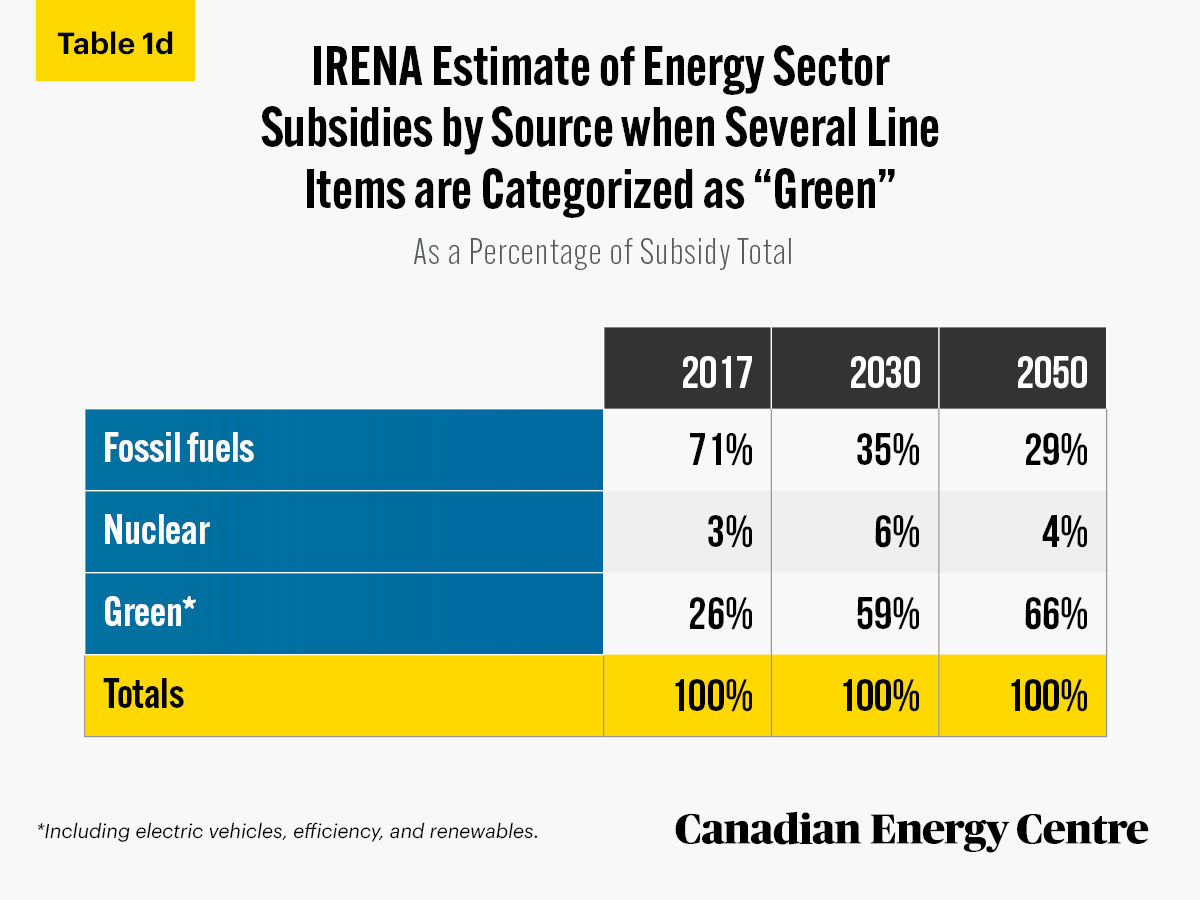

Existing fossil fuel subsidy programs are expected to be reduced significantly and by 2050 over 90 per cent of the subsidies to fossil fuels will support carbon capture and storage (CCS) in industrial applications. The share of fossil fuels in total energy sector subsidies is estimated to fall from 71 per cent in 2017 to 35 per cent in 2030 and to 29 per cent in 2050 (see Table1b).

Source: IRENA, 2020a.

Placing those eye-popping estimates in context

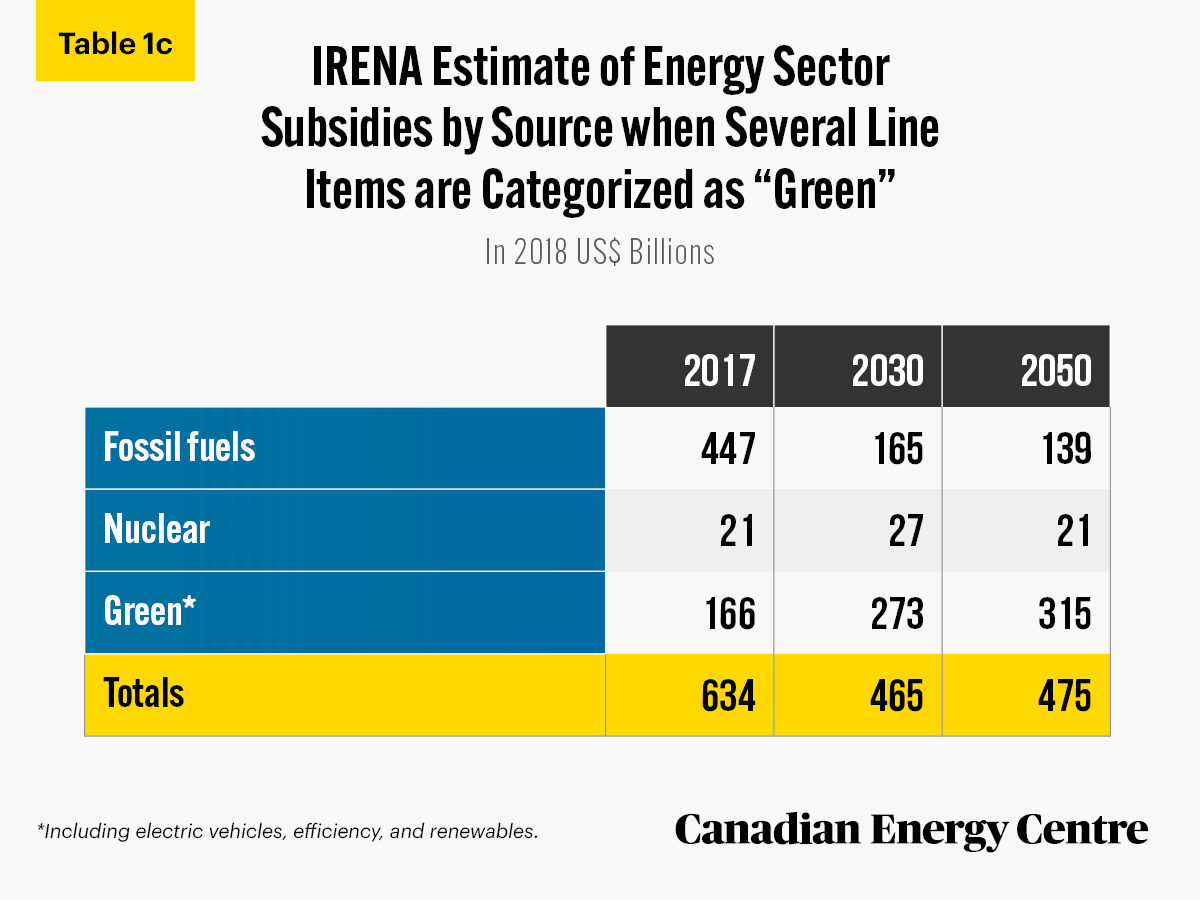

The above data appear to still show a minority share (41 per cent and 44 per cent) for renewables in 2030 and 2050 respectively, albeit they make up the biggest slice of the future subsidy pie. However, an arguably more accurate proportion results when a group of subsidies are more properly categorized as “green,” i.e., directed at attempts to dampen down emissions (particulate and carbon) and change behaviour through subsidies for electric vehicles, for example. So, too, attempts to make energy use more efficient are currently shown as a stand-alone category, but should be reclassified as “green.”

Once those categories are combined into “green,” the proportion of subsidies allocated to that category (as opposed to renewables) rises from 26 per cent for 2017 to 59 per cent by 2030 and 66 per cent by 2050 (see Table 1c and Table 1d).

This definition matters because, in essence, what advocates of green energy are proposing is the substitution of claimed present fossil fuel subsidies for future green subsidies. That, however, assumes the underlying assumptions that produce the “eye popping” large subsidy numbers, i.e., US$447 billion as of 2017, are accurate. As our Appendix outlines, that number is already in dispute.

Source: IRENA, 2020a; and calculations by authors.

Source: IRENA, 2020a; and calculations by authors.

OECD estimate: US$178.2 billion in fossil fuel subsidies in 2019

The OECD produces an inventory of individual government budgetary programs and tax provisions (the OECD Inventory of Support Measures for Fossil Fuels Inventory) that provide preferential treatment to both consumers and producers of fossil fuels. The inventory reports subsidy data are for 44 countries.

The OECD approach includes government policies that extend beyond those that directly affect fuel prices. It tracks support to both the consumption and production of fossil fuels that is provided mostly through direct budgetary spending programs and tax benefits, including tax expenditures.

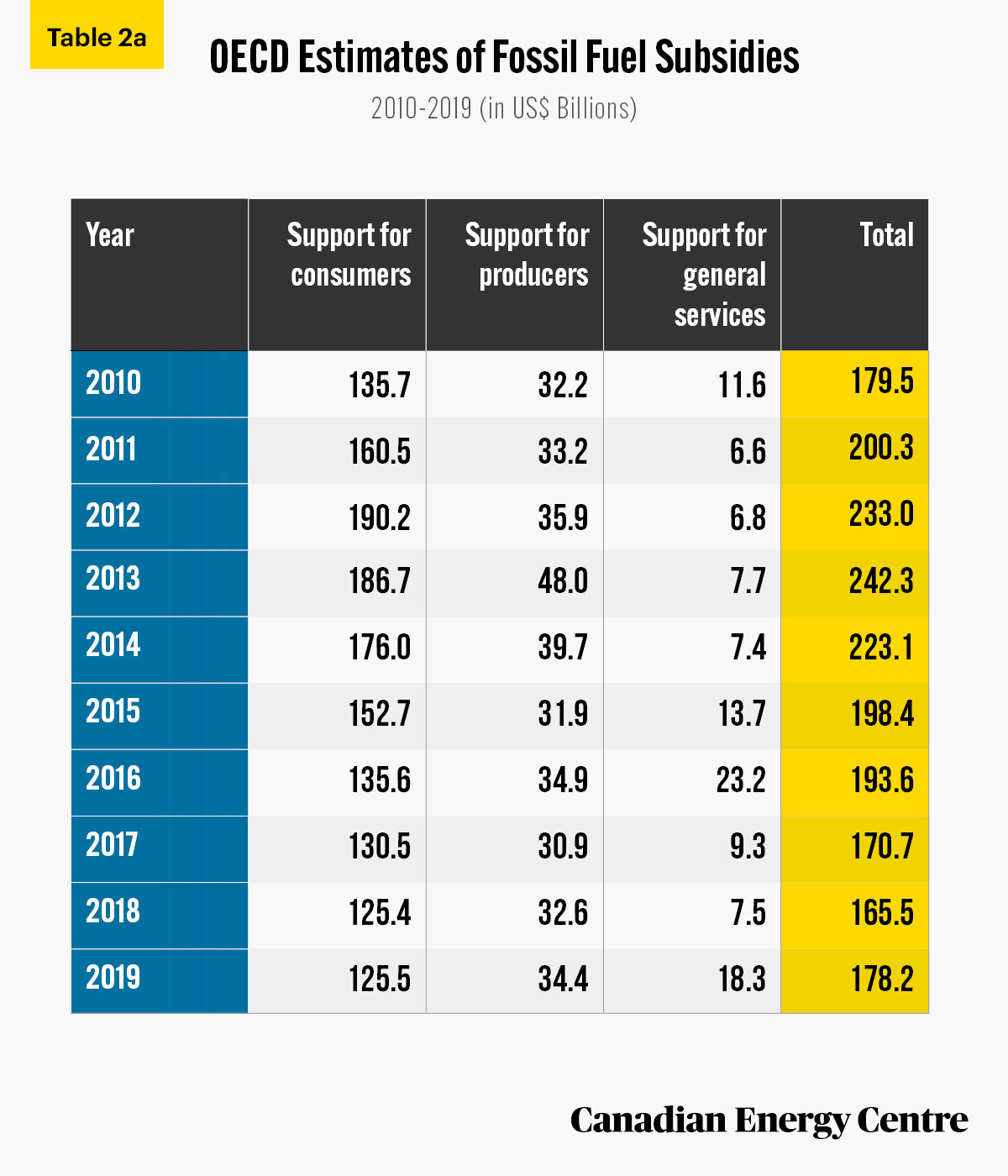

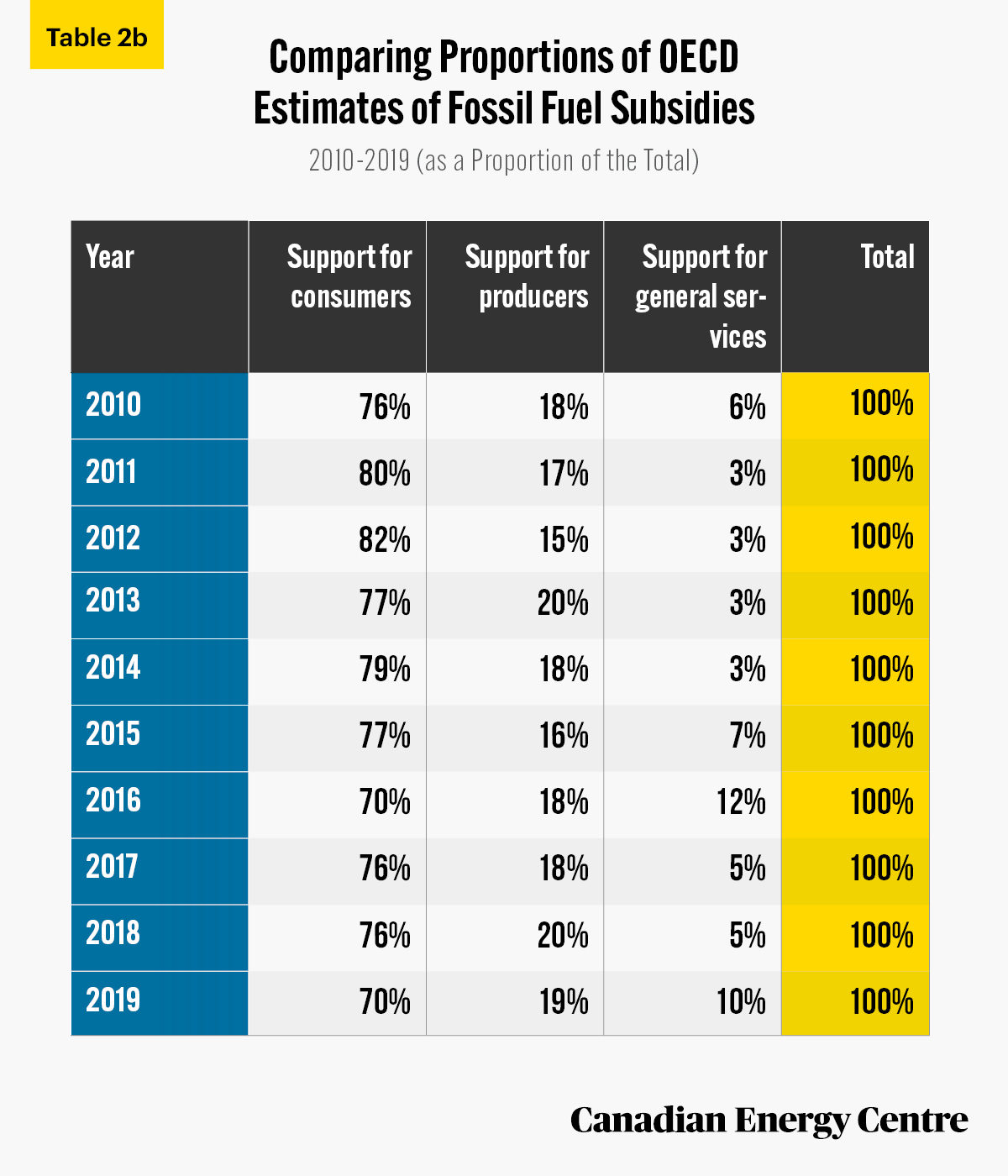

Between 2010 and 2013 annual global fossil fuel subsidies rose from US$179.5 million to US$242.3 billion and then fell gradually to US$165.5 billion by 2018 before increasing to US$178.2 billion in 2019 (see Table 2a).

Source: OECD, 2020.

Of note, “consumer support”—i.e., subsidies to consumers to make gasoline cheaper or to make home heating less expensive have ranged from 70 to 82 per cent of all fossil fuel subsidies depending on the year (see Table 2b).

The OECD estimates that subsidies to fossil fuels in Canada for 2019 were about US $3.7 billion. It also notes that total support for fossil fuels in Canada has generally declined since 2008. One driver for this development has been the phase-out of or cuts to multiple federal measures supporting the fossil fuel sector, including the oil sands (OECD, 2020).

The limited data presented above clearly shows that fossil fuel subsidies are already in decline and that a dollar-to-dollar replacement of fossil fuels subsidies with renewable subsidies as claimed by anti-oil activities does not appear to be in the cards. There will be additional costs to taxpayers as a result of the renewable subsidies. In fact, renewable subsidies appear to be growing rapidly.

Source: OECD, 2020.

Growing subsides for renewables are growing rapidly: US$143 billion in 2017 and US$5.4 trillion estimated between 2020 and 2040

IEA data

The IEA estimated that the global cost of support mechanisms for renewable-based electricity in 2017 was US$143 billion.

- Wind power and solar photovoltaics² (PV) accounted for the majority of non-hydro renewables output (70 per cent of the total) and were the primary recipients of support for renewables, accruing more than 80 per cent of the US$143 billion total in 2017.

- Bioenergy-based power plants were the third-most supported renewable energy technology, receiving more than US$20 billion in 2017 (IEA, 2018).

- In 2017, and for the first time, China became the leading provider of support for renewables, ahead of Germany, the United States, Japan, and Italy. Together, these five countries accounted for almost two-thirds of the total US$143 billion financial support for renewables in 2017 (IEA, 2018).

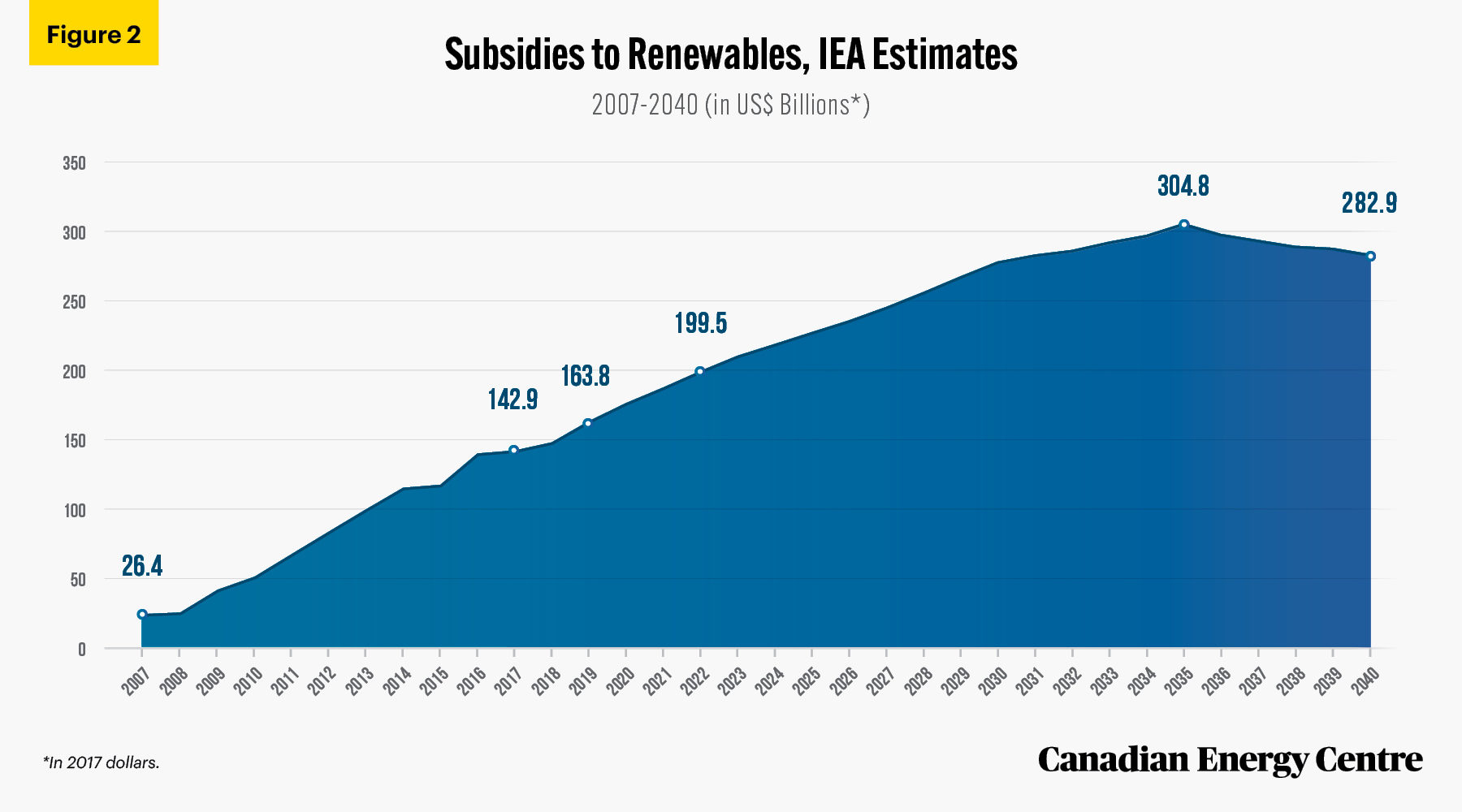

The growth in global subsidies to renewables has been significant over the past decade. In fact, according to IEA time series data, between 2007 and 2019, annual global subsidies to renewables (excluding biofuels) rose from US$26.4 billion to US$164 billion, an increase of over 521 per cent.

IEA subsidy estimates going forward

In 2018, the IEA examined the trends and calculated renewable subsidies out to 2040 under its New Policies Scenario (NPS). NPS reflects the impact of existing policy frameworks and announced policy intentions.

- Under the NPS, global support provided to renewablebased electricity will peak at just under US$305 billion in 2035 and then decline to about US$283 billion by 2040 (see Figure 2).

- Of the total cumulative support from 2017 to 2040, more than 75 per cent is earmarked for solar PV and wind power, and more than 15 per cent for bioenergy.

- Cumulative support for renewables between 2020 and 2040 is estimated at over US$5.4 trillion (IEA, 2018).

2. The conversion of sunlight into electricity.

Source: IEA, World Energy Outlook, 2018.

IRENA: US$166 billion in renewable subsidies in 2017, rising to US$209 billion in 2050

IRENA has analyzed the level of subsidies that will be directed toward renewable energy through 2050 under the Renewable Energy REmap case.³

IRENA has calculated renewable subsidies worldwide at US$166 billion in 2017, somewhat higher than the IEA number of US$143 billion, with the IEA number including renewable-based electricity, but not biofuels. In 2017, the subsidies per region or country were

- The European Union (EU): $90 billion (54 per cent)

- United States: $23.7 billion (14 per cent)

- Japan: $19 billion (11 per cent)

- China: $15.6 billion 9 per cent)

- India: $3.8 billion (2 per cent)

- The rest of the world: $14.8 billion (9 per cent) (IRENA, 2020a).

As the deployment of renewable energy accelerates, the total subsidies for renewables will grow and is expected to reach US$192 billion in 2030 and US$209 billion in 2050 in the REmap case (IRENA, 2020a).

3. REmap 2030 is a plan to double the share of renewable energy in the world’s energy mix between 2010 and 2030. The following key assumptions are part of the REmap case: Renewable energy share in power generation will reach 86 per cent by 2050; annual wind additions will reach 240 GW by 2050; total fossil fuel demand will fall by 64 per cent by 2050; total CO2 emissions will fall from 34 gigatonnes (Gt) to 9.8 Gt, or 71 per cent, from current levels by 2050.

Implications for subsidies for renewables in Canada

Unfortunately, the work that the IEA and IRENA have done to estimate the level of subsidies for renewables needed to meet global climate change goals through 2040 and 2050 has not been sufficiently disaggregated to a level that allows us to look at estimates of those subsidies for Canada.

However, investments in renewables in Canada of a magnitude that will enable the country to supposedly reach its Paris Accord targets by 2030 and net zero emissions (NZE) by 2050 will be significantly backstopped by taxpayers, with only some of the assumed subsides currently going to fossil fuels being replaced by subsidies to renewables.

There is clearly a need, then, for a more rigorous analysis of the presumed level government subsidies to renewables required to support an assumed move to net zero emissions between 2021 and 2050. Transition costs in Canada, for example, have often been underestimated.

Transition costs are often under-estimated: Ontario spent $37 billion ending coal-fired electricity—and might need to spend $133 billion more

For example, it is assumed that Canada must make a significant level of investment in renewables if it is to reach the Paris Accord target in 2030 and NZE in 2050, with the assumed subsides to fossil fuels being redirected to subsidies for renewables. However, those subsidies will of course be backstopped by taxpayers.

To put this in perspective and to gauge if this is a reasonable estimate of possible future costs, including subsidies, consider that the Auditor General of Ontario noted in 2015 that Cdn $37 billion in payments to renewable energy producers — characterized by the Auditor General as “excess payments to generators over the market price” for electricity — was the subsidy for just the 2006 to 2014 period.

At the time, Ontario’s Auditor General forecast that such payments were projected to cost electricity consumers another Cdn $133 billion from 2015 to 2032 (Office of the Auditor General of Ontario 2015a, 23; 2015b, 13).

Clearly, there will be no “free lunch” for taxpayers in any transition to renewable, despite the claims of some anti-oil and gas activists. Countless billions of dollars will not flow seamlessly and painlessly to the renewables sector from the oil and gas sector because the fossil fuel subsidies that anti-oil activists claim to have spotted are mostly not there, or they exist in the form of consumer subsidies for lower gasoline prices in countries such as Saudi Arabia, and Iran, but not Canada.

Implications of weak or erroneous assumptions about oil and gas subsidies

Two of the three estimates (those from OECD and IRENA) for renewables are partly based on the assumption that current fossil fuel subsidies are high. Thus, the corollary implication is that all policymakers need do is reduce those high fossil fuel subsidies and instead redirect taxpayer resources to green subsidies. The further implication is that the cost to governments/taxpayers around the world and in Canada for these subsidies will be a “wash.”

A problem arises, however, if the claim of substantial subsidies to the fossil fuel industry (beyond those obvious in program spending or in countries where gasoline is subsidized) is weak or even erroneous. This situation can happen if the “catchment” used to define a fossil fuel subsidy is so wide as to be nearly meaningless and overestimates the actual subsidies to fossil fuels.

Methodological objections to the “billions and trillions” subsidy figures

As we discussed in our 2020 Fact Sheet that assessed the various estimates of subsidies to fossil fuels, economists have raised objections to the “billions and trillions” of dollars that some claim are the amount of subsidies to that industry (Canadian Energy Centre, 2020). Their objections should be considered in any discussions about further subsidies—to any sector—fossil fuels or renewables or the wider green category.

Specific to Canada, a number of claims about oil and gas subsidies have been made over the past 11 years.

- One 2010 study claimed that Cdn $2.8 billion in subsidies flowed to the sector annually (Sawyer and Stiebert, 2010).

- In 2014, one reporter (Anderson, 2014) asserted that a 2013 International Monetary Fund study found that subsidies to oil and gas in Canada amounted to US $34 billion. The reporter arrived at much of that figure by arguing that “uncollected taxes” existed from externalities such as “impacts like traffic accidents, carbon emissions, air pollution and road congestion.”

In response to the Cdn $2.8 billion figure, economists Kenneth McKenzie and Jack Mintz (McKenzie and Mintz, 2011) noted that measuring fossil fuel subsidies was a “tricky art.” They took specific issue with the 2010 study methodology that later formed part of the basis of subsequent work including at the International Monetary Fund. They argued four flaws led to the “billions-of-dollars” subsidy claim. The flaws included methodology that:

- Used a subsidy definition designed for a different purpose;

- Inappropriately added up individual tax expenditures and royalty relief items without accounting for critical interactions between taxes and royalties;

- Was not based upon an underlying optimizing economic model that emphasized the impact of taxes, royalties, and subsidies on investment at the margin; and

- Was not based upon an economically meaningful benchmark.

The McKenzie-Mintz study also argued that tax and royalty policies were already being phased out through earned depletion and accelerated cost recovery. Including all tax policies and subsidies, they found that oil and gas investments were more heavily taxed than other Canadian industries, Philip Bazel and Jack Mintz (2019) found a similar result for 2018. Overall, both studies concluded that taxes and royalties are not a significant source of subsidies for oil and gas.

Others have also weighed in on the claim that Canada significantly subsidizes oil and gas.

- In 2014, in response to both the 2010 and 2014 estimates, the Montreal Economic Institute found energy sector subsidies amounted to just Cdn $71 million (Chassin, 2014). As the Montreal think tank noted, the larger numbers are arrived at in part by counting up “billions of dollars [that] simply do not exist”—the presumed subsidy value of a car accident as an example—and in other instances, by counting deferred taxes as subsidies.

- In 2017, economist Ross McKitrick also analyzed energy subsidies including the International Monetary Fund estimate that US $5.6 trillion was directed at energy subsidies worldwide. This is the figure most relevant to questions of future subsidies—be they for fossil fuels or renewables/green energy, given the significant size of the estimate and any assumed “switching” of one presumed subsidy (fossil fuel) to another (green). McKitrick noted numerous problems with the $5.6 trillion estimate. A few examples:

° Overstating the size of a subsidy when using tax expenditure calculations, i.e., overstatements that result when a particular policy is cancelled and the subsequent effect on revenues is not accounted for;

° Labelling non-tolled roads a “subsidy,” which “clouds the subsidy discussion if we arbitrarily select one type of public good and call it a subsidy without applying the same reasoning to all other public goods”; and

° Ignoring how “road subsidies are often financed through excise taxes on gasoline.”

Turning to unpriced externalities, McKitrick noted that once direct disbursements to fossil fuel companies are subtracted from the $5.6 trillion estimate, the remaining $5.3 trillion is “dominated by uncollected externality taxes” which, as McKitrick noted, was challenged by other economists who questioned the validity of such uncollected externalities. As McKitrick wrote regarding that $5.3 trillion estimate:

For the purpose of determining the actual size of subsidies to fossil fuels it would appear that conventional subsidies, that is actual payments to consumers and firms, are at the low end of the range of past estimates and are only a small percentage of the large numbers that have sometimes been put forward. To the extent we include indirect or notional concepts the numbers get dramatically higher but they also become meaningless and potentially misleading.

In summary, on the question of trillion-dollar estimates of fossil fuel subsidies, for every dollar — or trillions of dollars — by which estimates are too high, the corollary is that there is no pot of gold from which to divert those potential trillions of dollars to green/renewable subsidies. Instead, the proposed future subsidies will have to be paid for from taxes or by additional government debt.

Expressed differently, there is no “free lunch” for future subsidies for renewables.

The problem of energy density

In addition to questionable trillion-dollar estimates of subsidies, the ability of certain forms of energy to contribute to the low carbon ] transition also matters. To understand why, consider the insights from one of the world’s leading expert on energy transitions, University of Manitoba professor of the environment (emeritus) Vaclav Smil, who in his book, Energy, describes what energy is: “By far, the most common definition of energy is ‘the capacity for doing work.’” Smil then notes that the full implication of this seemingly simple statement “becomes clear only when you go beyond thinking about work as mechanical exertion—in physics terms, energy transferred through application of force over a distance, in common terms a labor to be performed….” In other words, before abandoning something as a source of energy, we must consider how little (or much) of that source it takes to produce the outcomes we need.

On the issue of the technological feasibility of changing the type of energy we use, Smil has also noted that “the reality of energy density in various forms of energy sources (be they oil, natural gas, coal, wind, solar and others) must be accounted for as part of any assumed transition.” In 2018, Science magazine cited Smil’s point that energy transitions are normally transitions away from “relatively weak, unwieldy energy sources for those that pack a more concentrated punch.” Instead, what we’re seeing in current attempts to transition away from fossil fuels does the opposite, or as Smil also remarked in 2018, trying to reverse that practical attention to energy density by moving to all-renewable sources of energy could require countries, to use his words from Science, to “devote 100 or even 1000 times more land area to energy production than today… [which] could have enormous negative impacts on agriculture, biodiversity, and environmental quality” (Voosen, 2018).

Similarly, as Smil wrote for the University of Saskatchewan’s Johnson Shoyama School of Public Policy in 2020, “Designing hypothetical roadmaps outlining complete elimination of fossil carbon from the global energy supply by 2050 is nothing but an exercise in wishful thinking that ignores fundamental physical realities” (Smil, 2020).

Recommendation for further research

Numerous organizations, including the IEA, IRENA, and the OECD, have recently been suggesting that there are pathways by which the world can reach net zero emissions between 2030 and 2050 and limit the global temperature rise to 1.5°C or less.

For example, the IEA recently stated that:

the radical transformation of the global energy system required to achieve net-zero CO2 emissions in 2050 hinges on a big expansion in investment and a big shift in what capital is spent on, from just over USD $2 trillion globally on average over the last five years, to almost USD $5 trillion by 2030 and to USD $4.5 trillion by 2050 (our emphasis). (IEA, 2021a)

However, beyond a cursory analysis of the investments the world will need to make to reach NZE, no organization has attempted to quantify the level of government subsidies required to underpin this goal.

The IEA does not provide any estimates of government subsidies needed to support a net zero emissions pathway, but admits that unlocking investment will require public policies that create incentives, set appropriate regulatory frameworks, and reform energy taxes. Direct government financing is needed to boost the development of new infrastructure projects and to accelerate innovation in technologies that are currently in the demonstration or prototype phase. Projects in many emerging markets and developing economies, such as India, are often relatively reliant on public financing, and policies that ensure a predictable flow of bankable projects have an important role in boosting private investment in these economies.

Indeed, the limited data from the International Energy Agency (IEA) and the International Renewable Energy Agency (IRENA), presented in the research brief, show clearly that meeting climate change goals such as Paris and NZE will result in significant costs to taxpayers in the form of subsidies for renewable energy, especially if current estimates of fossil fuel subsidies are incorrect. There will be no “free lunch” for taxpayers in the energy transition, despite the claims of some anti-oil and gas activists.

In other words, countless billions of dollars will not flow seamlessly and painlessly to the renewables sector from the oil and gas sector, because the fossil fuel subsidies that anti-oil activists claim to spot are mostly not there or exist in Saudi Arabia and Iran in the form of consumer subsidies, but not in Canada.

Given such realities, it is incumbent on those who purport to see a viable pathway to net zero emissions and the limiting of global temperature rise to 1.5°C or less to provide a rigorous, country-by-country analysis of the levels of investment and government subsidies required annually, between 2021 and 2050, to reach these aspirational goals. Those supporting these ambitious goals must also deal with objections from energy transition experts such as Vaclav Smil.

References (as of June 14, 2021)

Anderson, Mitchell (2014). “IMF Pegs Canada’s Fossil Fuel Subsidies at $34 Billion.” The Tyee. <https://bit.ly/2Xg7h4a>

Bazel, Philip, and Jack Mintz (2019). Is Accelerated Depreciation Good or Misguided Tax Policy? Canadian Tax Journal 67, 1.

Canadian Energy Centre (2020). Analyzing claims about oil and gas subsidies

Eye-popping estimates of fossil fuel subsidies a far cry from reality. <https://bit.ly/3xmgeHP>.

Chassin, Youri (2014). Is the Canadian Oil Industry Subsidized? Montreal Economic Institute. <https://bit.ly/2V7bep1>.

IEA (2021a). Net Zero by 2050: A Roadmap for the Global Energy Sector. <https://bit.ly/3vos8Am>.

IEA (2021b). World Energy Model, 2021. <https://bit.ly/3iKYOAq>.

IEA (2020a). Energy Subsidies: Tracking the Impact of Fossil-Fuel Subsidies <http://bit.ly/3bkNkyj>.

IEA (2020b). Renewable Energy Market Update, Outlook for 2020 and 2021. <https://bit.ly/3gyOg4M>.

IEA, 2020c. World Energy Outlook, 2020 <https://bit.ly/38MjeUA>.

IEA (2020d). Sustainable Recovery: World Energy Outlook Special Report. <http://bit.ly/2NbwN7L>.

IEA (2019). World Energy Outlook. <https://bit.ly/38JrQez>.

IEA (2018). World Energy Outlook. <https://bit.ly/3qrwX90>.

IEA (2017). World Energy Outlook. <http://bit.ly/2LytZRm>.

IEA (2016). World Energy Outlook. <http://bit.ly/3nOkudS>.

IEA (2015). World Energy Outlook. <http://bit.ly/360Dct1>.

IEA (2014). World Energy Outlook. <http://bit.ly/39CfWlQ>.

IEA (2013). World Energy Outlook. <http://bit.ly/3ienKhJ>.

IEA (2012). World Energy Outlook. <http://bit.ly/2LQk0a6>.

IEA (2011). World Energy Outlook. <https://bit.ly/3srOos0>.

IEA (2010). World Energy Outlook. <http://bit.ly/3nMafXM>.

IRENA, 2020a. Energy Subsidies: Evolution in the Global Energy Transformation to 2050. IRENA. <http://bit.ly/2KkXcyM>.

IRENA, 2020b. Global Renewables Outlook: Energy Transformation 2050. IRENA. <http://bit.ly/38Ix2PQ>.

IRENA, 2016. Roadmap for a Renewable Energy Future, REmap Results by Country. IRENA. <https://bit.ly/39CURYn>.

Keeso, Alan (2020),). Canadians Need Not Give Up the Farm to Achieve Net Zero Emissions. Policy Options. <http://bit.ly/35MwzKG>.

Lomborg, Bjorn (2020). The IMF’s Huge Miscalculation of Energy Subsidies. Forbes. <http://bit.ly/3bn06wd>.

McKenzie, Kenneth J., and Jack M. Mintz (2011). The Tricky Art of Measuring Fossil Fuel Subsidies: A Critique of Existing Studies. The School of Public Policy, University of Calgary. <https://bit.ly/2RhhIRf>.

McKitrick, Ross (2017). Global Energy Subsidies: An Analytical Taxonomy. Energy Policy 101: 379-385. <https://bit.ly/2wSZHS3>.

Morgan Stanley (2019). Decarbonization: The Race to Net Zero Emissions. <http://mgstn.ly/3nOtDTI>.

Navius Research (2021). Achieving Net Zero Emissions by 2050 in Canada: An Evaluation of Pathways to Net Zero Prepared for the Canadian Institute for Climate Choices. <http://bit.ly/37wHCbB>.

Navius Research (2020). Custom Research for the Canadian Energy Centre.

Navius Research (2019). Quantifying Canada’s Clean Energy Economy. <https://bit.ly/39EpVXO>.

Office of the Auditor General of Ontario (2015a). Summaries of Value-For-Money Audits. Annual Report. <https://bit.ly/3cxAQlS>

Office of the Auditor General of Ontario (2015b). Section 3.05: Electricity Power System Planning. Annual Report. <https://bit.ly/2VOoUW9>;

OECD (2020a). Building Back Better: A Sustainable, Resilient Recovery after COVID-19. <http://bit.ly/3oOB66P>.

OECD (2020b). Canada. Fossil Fuel Support Data and Country Notes <http://bit.ly/3sc1jxw>.

OECD (2020c). OECD Work on Support for Fossil Fuels <http://bit.ly/2NcXjOr>.

REN21 (2020). Renewables 2020: Global Status Report. <http://bit.ly/38Mx1u5>.

Sawyer, Dave, and Seton Stiebert (2010). Fossil Fuels – At What Cost? International Institute for Sustainable Development. <https://bit.ly/3ceLv83>.

Smil, Vaclav (2017). Energy: A Beginner’s Guide, 2nd Edition. One World.

Smil, Vaclav (2020). What We Need to Know about the Pace of Decarbonization. Johnson Shoyama Graduate School of Public Policy, University of Saskatchewan. <https://bit.ly/3c02HO7>;

Task Force for a Resilient Recovery, 2020. Final Report: Bridge to the Future. <https://bit.ly/3sw9hlN>.

Voosen, Paul (2018). Meet Vaclav Smil, the Man Who Has Quietly Shaped How the World Thinks about Energy. Science. <https://bit.ly/3f5eTPl>

CEC Research Briefs

Canadian Energy Centre (CEC) Research Briefs are contextual explanations of data as they relate to Canadian energy. They are statistical analyses released periodically to provide context on energy issues for investors, policymakers and the public. The source of profiled data depends on the specific issue.

About the authors

This CEC Research Brief was compiled by Lennie Kaplan, Chief Research Analyst at the Canadian Energy Centre and Mark Milke, Executive Director of Research for the Canadian Energy Centre.

Creative Commons Copyright

Research and data from the Canadian Energy Centre (CEC) is available for public usage under creative commons copyright terms with attribution to the Canadian Energy Centre. Attribution and specific restrictions on usage including non-commercial use only and no changes to material should follow guidelines enunciated by Creative Commons here: Attribution-NonCommercial-NoDerivs CC BY-NC-ND.

Photo Credits

Erik Mclean, Lukas, Karsten Würth, Johannes Havn, Jem Sanchez, Joshua Wade, Dan Meyers, Sam Forson, Kelly Lacy, John Guccione.

The unaltered reproduction of this content is free of charge with attribution to Canadian Energy Centre Ltd.