To sign up to receive the latest Canadian Energy Centre research to your inbox email: research@canadianenergycentre.ca

Download the PDF here

Download the charts here

Overview

The federal government, through Environment and Climate Change Canada (ECCC), has recently released a discussion paper on options to cap and cut oil sands greenhouse gas (GHG) emissions to achieve net zero emissions (NZE) by 2050.

However, the ECCC discussion paper provides no economic risk analysis of the impact on oil sands sector free cash flow, capex, net present value, and government take arising from the two options it presents to get the oil sands sector to NZE 2050.

Quantifying the impact of the energy transition or NZE on Canada’s oil sands sector is critical for business planning. Companies and governments must be able to identify, assess and manage the risks presented by NZE.

Oil sands companies are then able to mitigate NZE or energy transition risk through the adoption of low emissions technologies such as CCUS and blue and green hydrogen, among others.. Governments are able to respond to NZE risks by establishing appropriate fiscal and regulatory instruments to incent private sector investment in these low emissions technologies.

In this CEC Fact Sheet, we use data drawn from the Rystad Energy Upstream Energy Transition Risk Dashboard to assess the NZE risk for the Canadian oil sands sector. We explain and evaluate the impact of NZE risk for the Canada’s oil sands sector by quantifying how much of the sector’s valuation might be at risk if global energy markets shift from an OPEC scenario to an IEA Net Zero Emissions (NZE) pathway.

The written content in this report was prepared by the Canadian Energy Centre (CEC) and does not represent the views of Rystad Energy.

Background on Rystad Energy UCube

Rystad Energy is an independent energy research company providing data, analytics and consultancy services to clients around the globe.

UCube is Rystad Energy’s global upstream database, including production and economics (costs, revenues, and valuations) for more than 80,000 assets, covering the portfolios of more than 3,500 companies.

The UCube data set is used to study all parts of the global exploration and production (E&P) activity value chain, including operational costs, investment (capex and opex), fiscal terms, and net cash flows for projects and companies, both globally and by country.

Through the Upstream Energy Transition Risk Dashboard, Rystad Energy has developed methods to quantify energy transition risk across energy producers and energy service companies, utilizing a bottom-up approach to decompose transition risk down to single asset, products and services lines. The focus is on value at risk, utilizing an asset-based valuation framework to run alternative future scenarios on energy demand, energy prices and emission costs (Rystad Energy, 2022a).

Explaining the energy transition scenarios

NZE or energy transition risk analysis is based on six energy transition scenarios, namely Sigma+, Sigma-, Mean, OPEC, Announced Pledges Scenario (APS), and IEA Net Zero Emissions (NZE). Each scenario has different speeds of energy transition. For the oil sands sector in Canada, the difference between the scenarios leads to both resource risk and value risk.

- The OPEC scenario sees global oil demand increase by 17.6 million barrels per day (mbpd) between 2020 and 2045, rising from 90.6 mbpd in 2020 to 108.2 mbpd in 2045

- The Sigma+ scenario limits global temperature rise to 2 degrees C. Oil demand peaks in 2028 at 106 mbpd and declines to 74 mbpd in 2050

- The Mean scenario limits global temperature rise to 1.8 degrees C. Oil demand peaks at 104 mbpd in 2025 and declines to 51 mbpd in 2050.

- Announced Pledges Scenario (APS): Oil demand peaks at 102 mbpd in 2028 and declines to 83 million mbpd in 2050.

- The Sigma- scenario limits global temperature rise to 1.6 degrees C. Oil demand peaks at 102 mbpd in 2024 and falls to 33 mbpd in 2050

- The IEA NZE or NZE scenario sees the global energy sector attain net zero emissions by 2050. Global temperature rise by 1.5 degrees C. Oil demand peaks at 91 mbpd in 2021 and them falls to 21 mbpd by 2050. This scenario is based on the projections for the global oil and gas sector as laid out in IEA Report, Net Zero by 2050, May 2021 (Rystad Energy 2022b).

In this analysis, we evaluate Canadian oil sands sector transition risk as the difference between the OPEC scenario and the IEA NZE scenario for key value risk and cost risk metrics.

Free cash flow (FCF) at risk

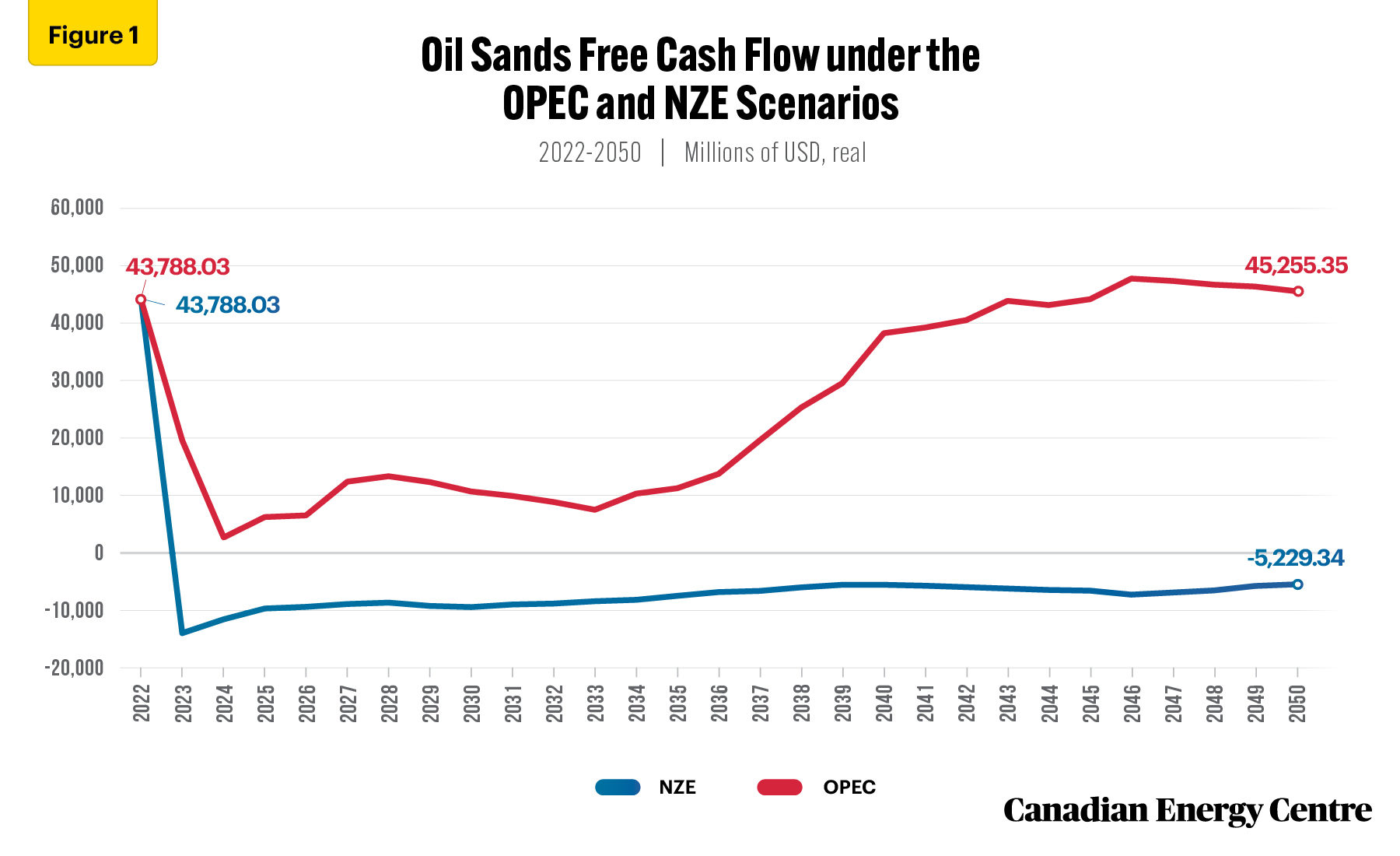

Free cash flow (FCF) represents the cash flow the oil sands sector generates after accounting for cash outflows to support operations and maintain its capital assets. The value at risk for the oil sands sector can be assessed by examining the reduction in the net present value (NPV) of future FCF between the OPEC scenario and the IEA NZE scenario. NPV represents the sum of future free cash flows (FCF) using a given discount rate; in this risk analysis, 10 per cent.

Total free cash flow (FCF) generated by the Canadian oil sands sector in 2022 is estimated at $43.8 billion (USD, real). Going forward, under the OIPEC scenario, oil sands FCF reaches $45.3 billion by 2050. On the other hand, under the NZE scenario, oil sands FCF falls to negative $5.2 billion by 2050 (see Figure 1).

On a cumulative basis, between 2022 and 2050, $907.9 billion of oil sands sector FCF is at risk.

Source: Derived from the Rystad Energy Upstream Energy Transition Risk Dashboard

Net present value (NPV) at risk

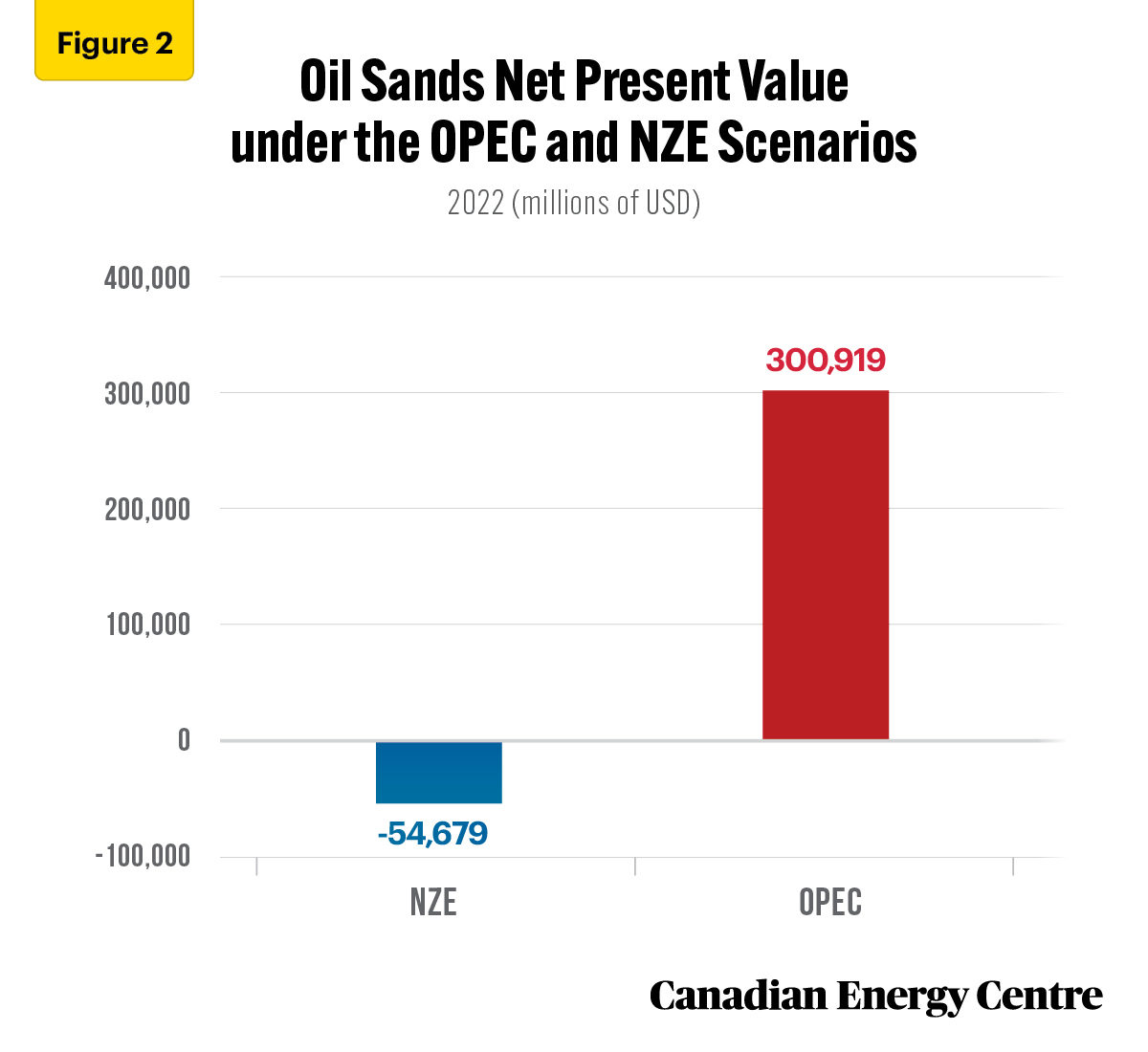

Net present value (NPV) is the difference between the present value of cash inflows for the oil sands and the present value of cash outflows over a period of time.

NPV is used in capital budgeting and investment planning to analyze the profitability of a projected oil sands investment or project. NPV is the result of calculations used to find today’s value of a future stream of payments.

If the NPV of an oil sands project or investment is negative, it means that the discounted present value of all future cash flows related to that project or investment will be negative, and therefore unattractive. In this risk analysis, the NPV calculations assume a 10 per cent discount rate.

Under the OPEC scenario, the NPV for the oil sands sector is over $300.9 billion. Under the NZE scenario, the NPV for the oil sand sector falls to negative $54.7 billion (see Figure 2).

In this risk analysis, the difference of oil sands NPV between the OPEC scenario and the NZE scenario represents the oil sands NPV at risk.

As of 2022, Canadian oil sands sector NPV at risk under the IEA net zero scenario is $355.6 billion.

Source: Derived from the Rystad Energy Upstream Energy Transition Risk Dashboard

Capex at risk

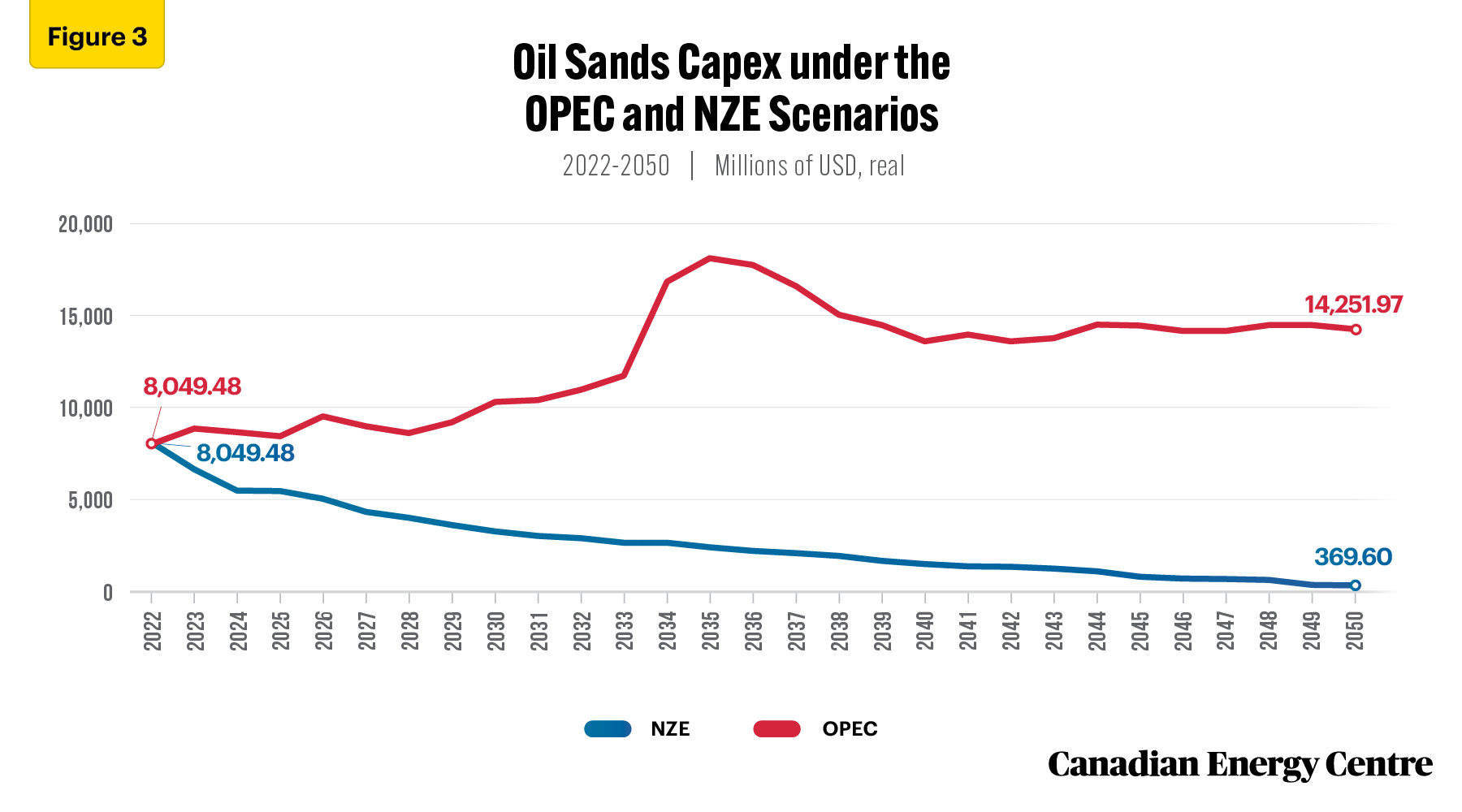

The capex risk for the oil sands sector is defined as the cumulative reduction in capital expenditures between the OPEC and the IEA NZE scenarios.

Under the OPEC scenario, Canadian oil sands sector capex rows from $8.0 billion (USD, real) in 2022 to over $14.2 billion in 2050. Under the NZE scenario, Canadian oil sands sector capex falls from over $8.0 billion in 2022 to just under $370 million in 2050 (see Figure 3).

On a cumulative basis, between 2022 and 2050, $290.6 billion of Canadian oil sands sector capex is at risk under the IEA NZE scenario.

Source: Derived from the Rystad Energy Upstream Energy Transition Risk Dashboard

Government take at risk

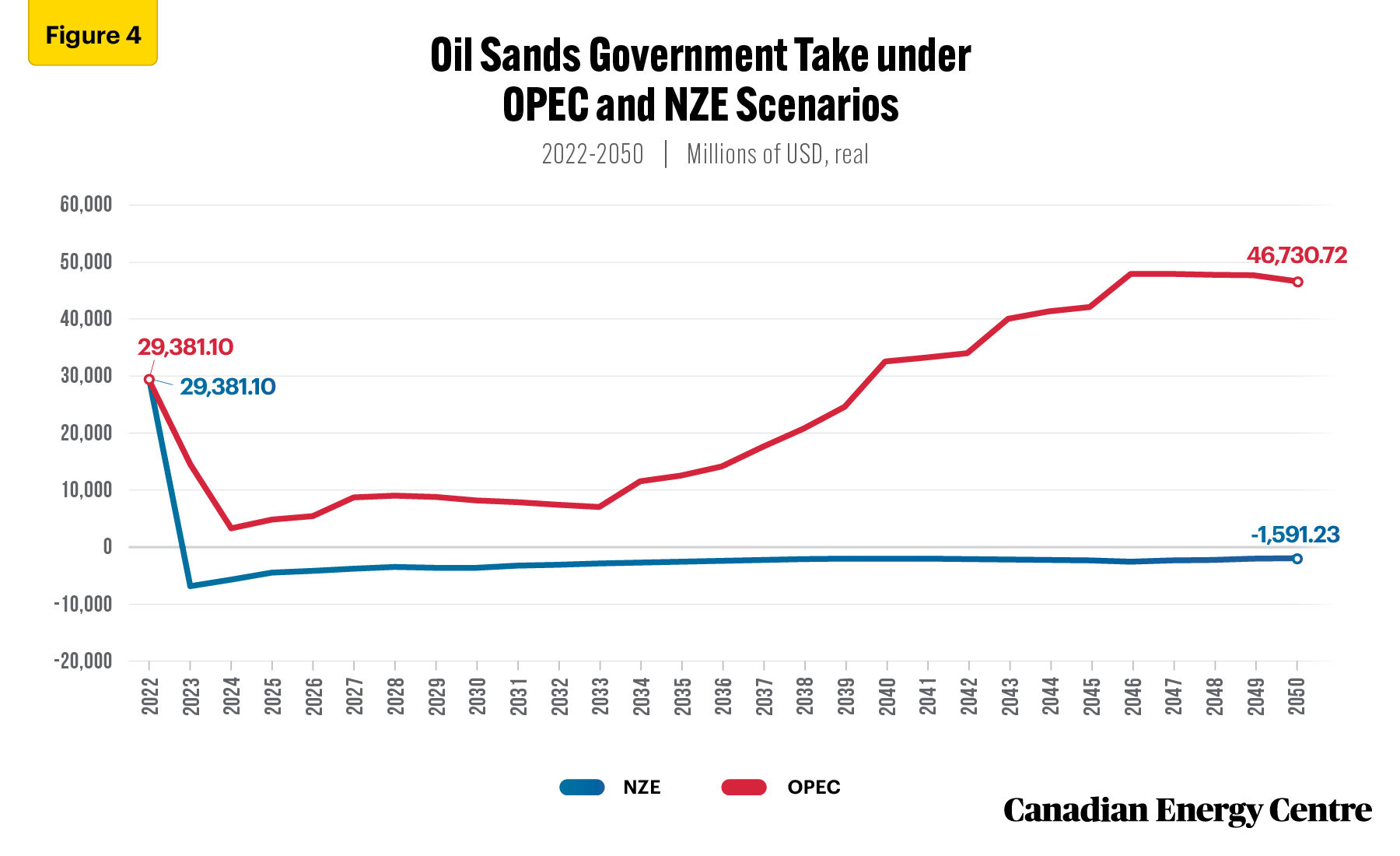

Government take is defined as oil sands sector revenues received by federal and provincial governments from income taxes, royalties and bonuses.

The government take risk for the Canadian oil sands sector is thus the cumulative reduction in government take from 2022 through 2050 between the OPEC and the IEA NZE scenarios.

Under the OPEC scenario, Canadian oil sands sector government take grows from $29.4 billion (USD, real) in 2022 to $46.7 billion in 2050. On the other hand, under the IEA NZE scenario, Canadian oil sands government take falls from $29.4 billion in 2022 to negative $1.6 billion in 2050 (see Figure 4).

On a cumulative basis, between 2022 and 2050, $727.6 billion of Canadian oil sands sector government take is at risk under he IEA NZE scenario.

Source: Derived from the Rystad Energy Upstream Energy Transition Risk Dashboard

Conclusion

The Canadian oil sands sector is significantly exposed to NZE or energy transition risk under a shift from an OPEC scenario to an IEA NZE scenario.

If the world acts decisively to limit the increase in global temperature to 1.5°C by 2050 (IEA NZE), the scale of change will revolutionize the energy industry. No oil sands company will be able to escape the effects of the energy transition, given their high energy transition risk profiles (Rystad Energy, 2021c).

Oil sands companies are taking up the challenge of energy transition with real changes. Companies are increasingly setting tangible goals and detailed strategies as they attempt to mitigate their exposure to energy transition risk. (Rystad Energy, 2021c).

A fiscal and regulatory regime that is responsive to the adoption of new emission reduction technologies will be critical to mitigating NZE risk and preserving Canada’s role as a secure and reliable supplier of low-emitting crude oil and natural gas to a world that needs energy but faces increasing uncertainty of supply due to geopolitical conflicts.

CEC Research Briefs

Canadian Energy Centre (CEC) Research Briefs are contextual explanations of data as they relate to Canadian energy. They are statistical analyses released periodically to provide context on energy issues for investors, policymakers, and the public. The source of profiled data depends on the specific issue. All percentages in this report are calculated from the original data, which can run to multiple decimal points. They are not calculated using the rounded figures that may appear in charts and in the text, which are more reader friendly. Thus, calculations made from the rounded figures (and not the more precise source data) will differ from the more statistically precise percentages we arrive at using the original data sources.

About the author

This CEC Research Brief was compiled by Lennie Kaplan, Executive Director of Research for the Canadian Energy Centre.

Acknowledgments and Notes

The authors and the Canadian Energy Centre would like to acknowledge the assistance of two anonymous reviewers

References (Links live as of August 11, 2022)

Rystad Energy. (2022a). Energy Transition Risk. <https://bit.ly/3LEk6eE>; Rystad Energy (2021b). Energy transition risk quantified: Long-term oil price risk worth $10 per barrel, E&P upstream portfolios’ value could dip 30-40%. <https://bit.ly/3LEk6eE>; Rystad Energy. (2021c). North American companies are the most exposed to energy transition risk. <https://bit.ly/3LEk6eE>; Rystad Energy. (2021d). Sizing the risk ahead: Quantifying the Energy Transition’s impact on the E&P sector. <https://bit.ly/3LEk6eE>; Rystad Energy. (2021e). The energy transition could cost $14 trillion in lost tax income. <https://bit.ly/3LEk6eE>; Rystad Energy. (2021f). Understanding the Energy Transition Risks Ahead. <https://bit.ly/3LEk6eE>; Rystad Energy. (2021g). Upstream Energy Transition Risk Special Report. <https://bit.ly/3LEk6eE>; Rystad Energy. (2021h). Upstream Energy Transition Risk Special Report. <https://bit.ly/3LEk6eE>.

Creative Commons Copyright

Research and data from the Canadian Energy Centre (CEC) are available for public usage under creative commons copyright terms with attribution to the Canadian Energy Centre. Attribution and specific restrictions on usage including non-commercial use only and no changes to the material should follow guidelines enunciated by Creative Commons here: Attribution-NonCommercial-NoDerivs CC BY-NC-ND.