To sign up to receive the latest Canadian Energy Centre research to your inbox email research@canadianenergycentre.ca

Overview: Investment in oil and gas grew around the world, but slowed in Canada

In this CEC Fact Sheet (which can be downloaded here as a pdf), we examine trends in oil and gas investment in Canada and other regions around the world.¹ We do so for two reasons. The first is to discover if investment in Canadian oil and gas has followed worldwide trends or departed from them, and if so, where and in what magnitudes. The second reason to examine oil and gas investment trends is that one oft-heard claim is that oil and gas is a “sunset” industry, where investment in Canada can be expected to decline given worldwide secular trends, i.e., a flight from oil and gas to other forms of investment.

As the data will show, in fact, the international comparative data, which are available through 2017, show that between 2009 and 2017, no such worldwide flight from oil and gas investment occurred. Instead, investment in oil and gas increased worldwide, but with Canada a laggard when compared with the United States, Russia, and Asia. Between 2009 and 2017, only the Middle East and Africa were worse than Canada at attracting investment.

On a related matter, another oft-heard claim is that investment in Canada has declined because of this country’s high per capita greenhouse gas emissions coming from non-conventional oil extraction and production, i.e., the oil sands. While individual examples of such claims (and the resulting investment decisions) do exist, so do other reasons for a decrease in investment in Canada’s oil and gas sector, including negative political and regulatory signals.

Also, while investment in Canada fell, Russia, Asia, and the United States attracted more investment relative to Canada, despite their differing records on greenhouse gas emissions and the environment more generally. Thus, the more nuanced conclusion possible from the data is that Canada’s recent weakness as an investment magnet may result from multiple factors. Among those factors are negative regulatory and political signals, anti-oil and gas activism which hampers major projects, and poor financial returns, in addition to any concerns over greenhouse gas emissions — though the latter reason does not appear to have overridden such investment in jurisdictions with weak environmental records, such as Russia.

A forward-looking reality check: forecasts for energy consumption

Global demand for oil and natural gas is forecast to grow, although the pace of that growth will be slower depending on whether the energy source is oil or natural gas.

Short and medium-term

- According to the International Energy Agency (IEA), global oil demand will grow by 5.7 million barrels per day (mb/d) from 2019 to 2025, an average annual rate of nearly 1 mb/d. China and India are projected to account for about half of that growth.

- The U.S. Energy Information Administration forecasts that petroleum consumption worldwide will decline by 5.2 million barrels in 2020 from 2019, a 5.2 per cent reduction, before rising again in 2021 by 6.4 million barrels, a 6.7 per cent increase.

- According to a June 2020 forecast from the International Energy Agency (IEA), between 2019 and 2025 natural gas demand is expected to grow by over 350 billion cubic metres, or an average of 1.5 per cent per year. Most of the gas demand lost in 2020 is expected to be recovered in 2021, supplemented by growth from the Asia-Pacific region between 2021 and 2025 as emerging markets in China and the rest of Asia recover economically and benefit from attractive gas prices.

Long-term

- According to a pre-pandemic forecast from the U.S. Energy Information Administration (EIA), world energy consumption will rise nearly 50 per cent between 2018 and 2050, from about 600 quadrillion British thermal units (BTUs) to about 900 quadrillion BTUs.

That EIA forecast, along with others from other agencies, will be revised over the coming months in the wake of the Coronavirus pandemic and the destruction of short-term demand, but absent a long-term decline in economies spanning decades, there is no reason to assume long-term energy demand will change from previous forecast trajectories. Thus, any energy from oil and gas to alternatives will see a market for their products with relevant factors being cost, accessibility, and energy density² in meeting such demand, among others.

Specific to oil and gas, and based on the forecasts mentioned above, global demand will grow. The open question is if Canada will participate in that growth, or be left behind as has occurred in recent years.

Oil and gas investment in Canada: 2006 to 2019

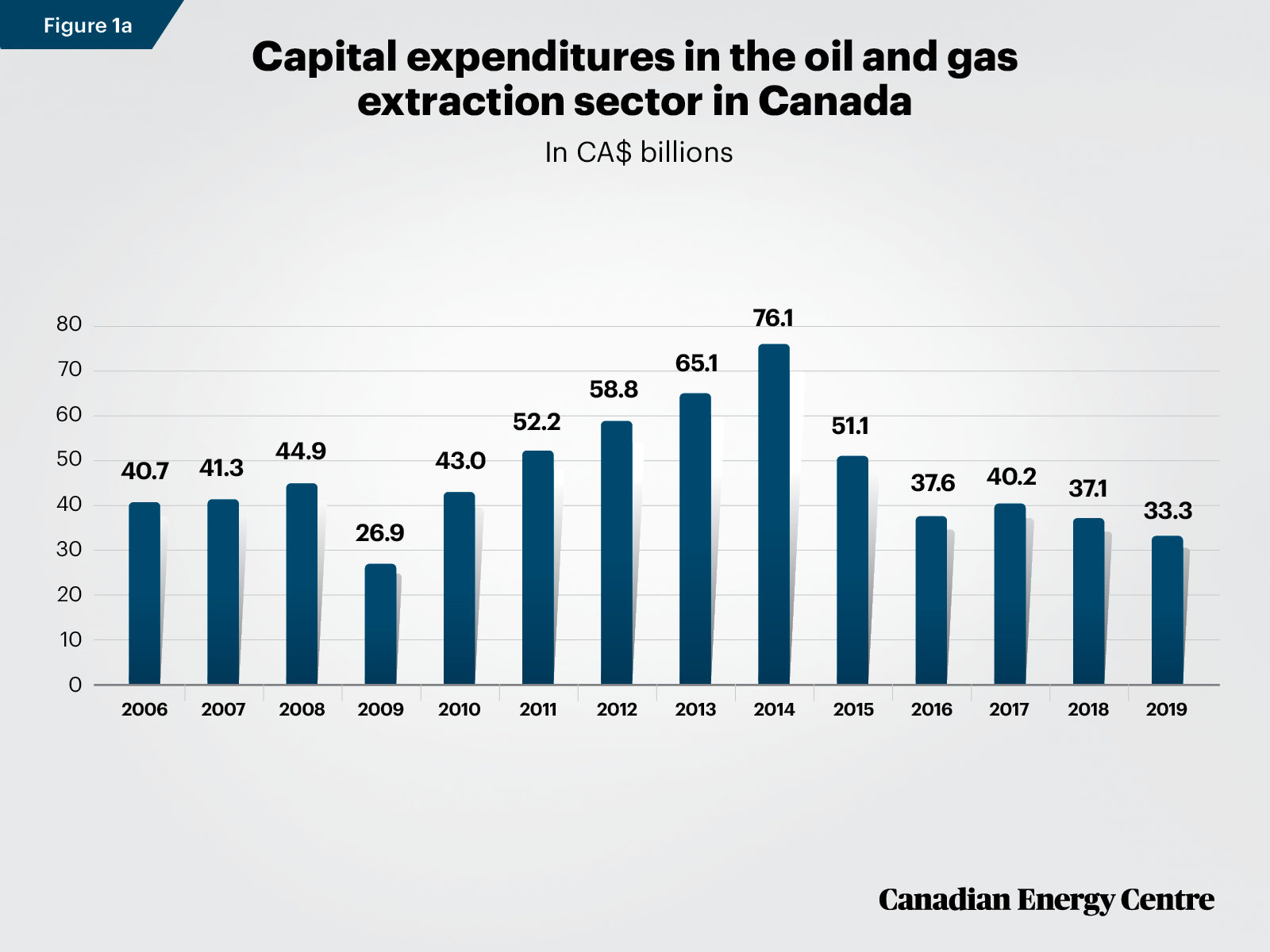

Investment (expressed as capital expenditures in non-residential tangible assets) in the oil and gas sector has been one of the drivers of Canada’s economic growth. Investment in the oil and gas extraction sector grew from nearly $41 billion in 2006 to $76 billion in 2014, before falling back to $33 billion in 2019 (see Figure 1a).

Source: Statistics Canada, Table 34-10-0035-01.

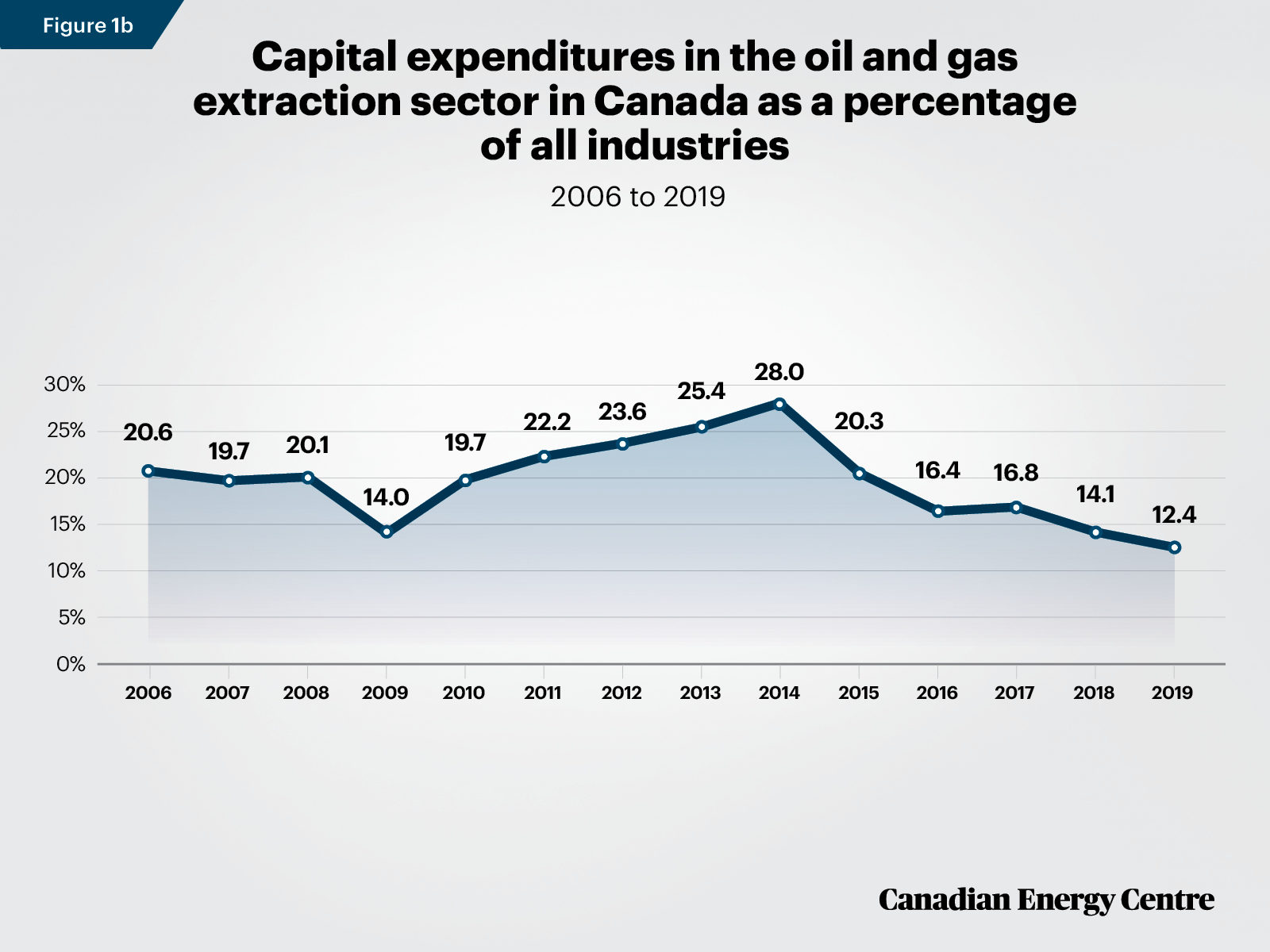

Even with the fall-back, investment in the oil and gas sector is a still a significant component of all-industry investment in Canada. As a percentage of total capital investment in all industries, oil and gas extraction investment grew from 20.6 per cent in 2006 to 28.0 per cent in 2014, before falling to a low of 12.4 per cent in 2019 (see Figure 1b).

Source: Statistics Canada, Table 34-10-0035-01.

Capital investment in Canada’s oil and gas compared to other sectors

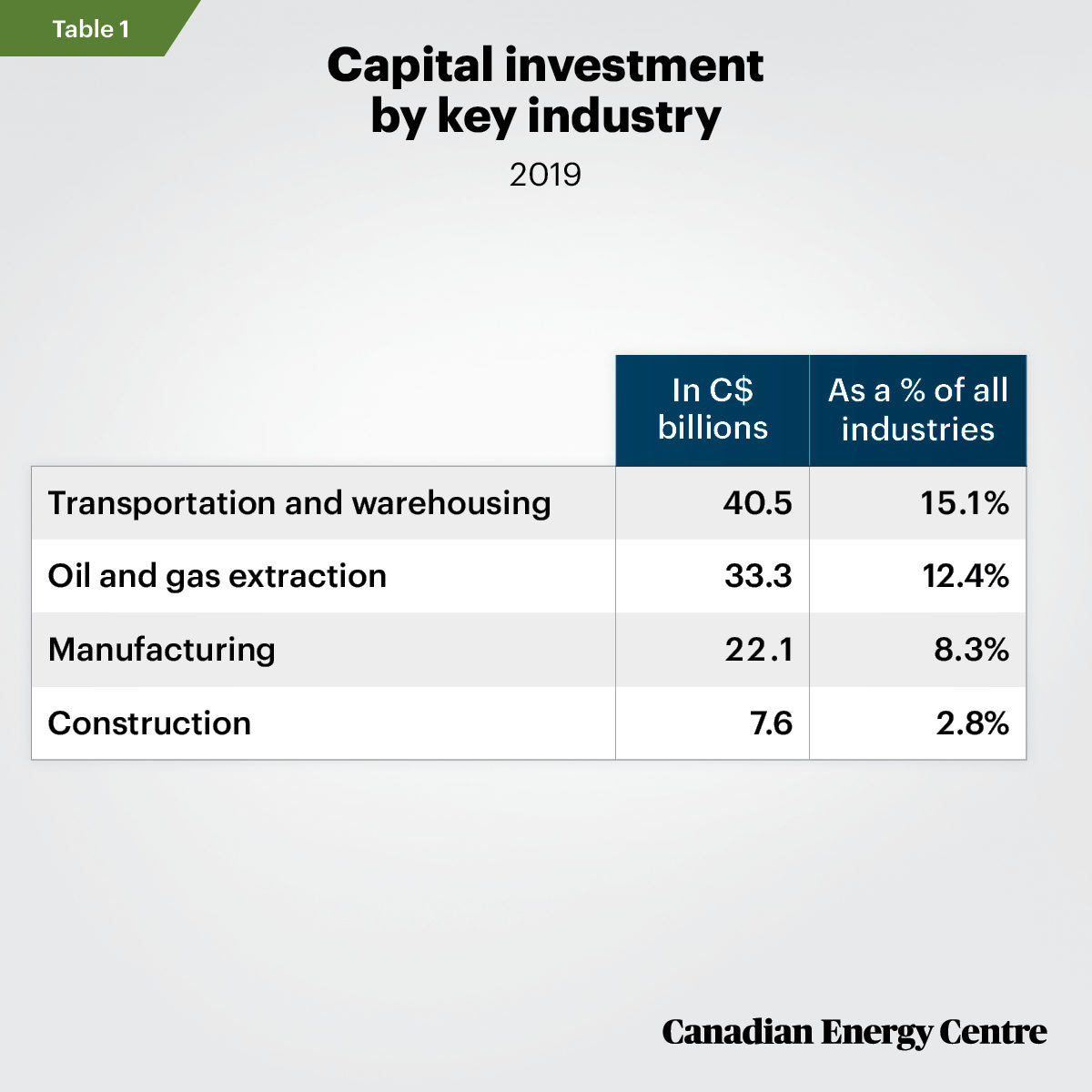

Despite the energy price decline, oil and gas extraction sector capital investment at $33.3 billion or 12.4 per cent of all capital investment in Canada in 2019 was the second largest among all key industries. It was behind only transportation and warehousing (much of which is oil-related pipelines) at $40.5 billion or 15.1 per cent, and far ahead of manufacturing at $22.1 billion or 8.3 per cent and construction at $7.6 billion or 2.8 per cent (see Table 1).

Source: Statistics Canada, Table 34-10-0035-01.

Canada’s market share of global oil and gas investment has been falling

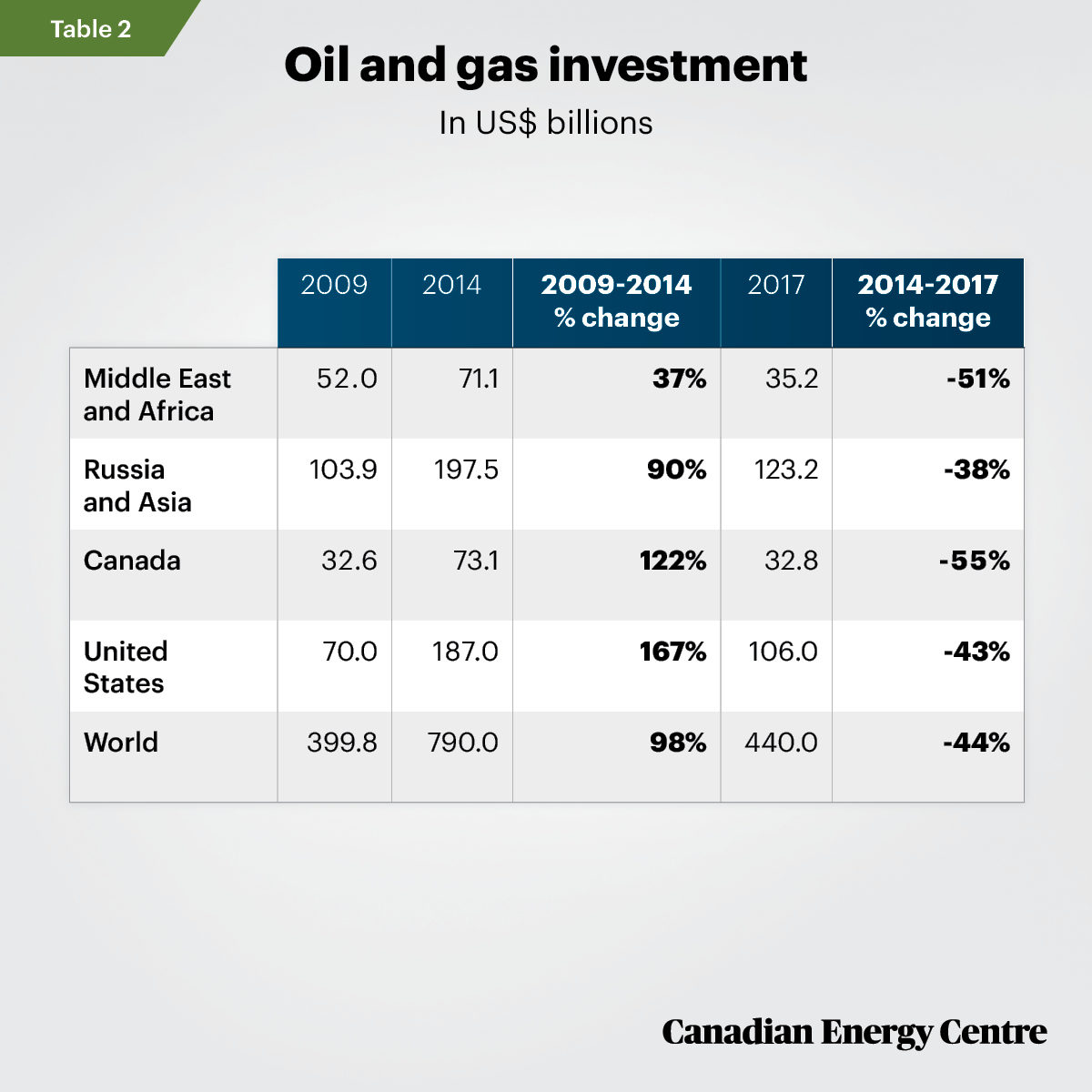

The period from 2009 to 2017³ has been marked by extreme gyrations in oil and gas investment patterns in the various countries and regions (see Table 2). The international oil and gas investment comparisons below are expressed in U.S. dollars for ease of analysis.

- Oil and gas investment in the Middle East and Africa grew from $52 billion in 2009 to over $71 billion in 2014 before collapsing to just over $35 billion by 2017;

- Investment in Russia and Asia grew from just under $104 billion in 2009 to nearly $198 billion in 2014 before declining to $123 billion as of 2017;

- Investment in the Canadian oil and gas sector (conventional and oil sands) grew from $33 billion in 2009 to $73 billion in 2014, before falling back to just under $33 billion in 2017;

- Investment in the U.S. oil and gas sector grew far more robustly than in Canada, increasing from $70 billion in 2009 to $187 billion in 2014, before falling back to $106 billion in 2017;

- In total, global investment in oil and gas grew from just under $400 billion in 2009 to $790 billion in 2014 and then dropped back to $440 billion as of 2017.

Sources: Canadian Energy Research Institute, U.S. EIA, and IEA.

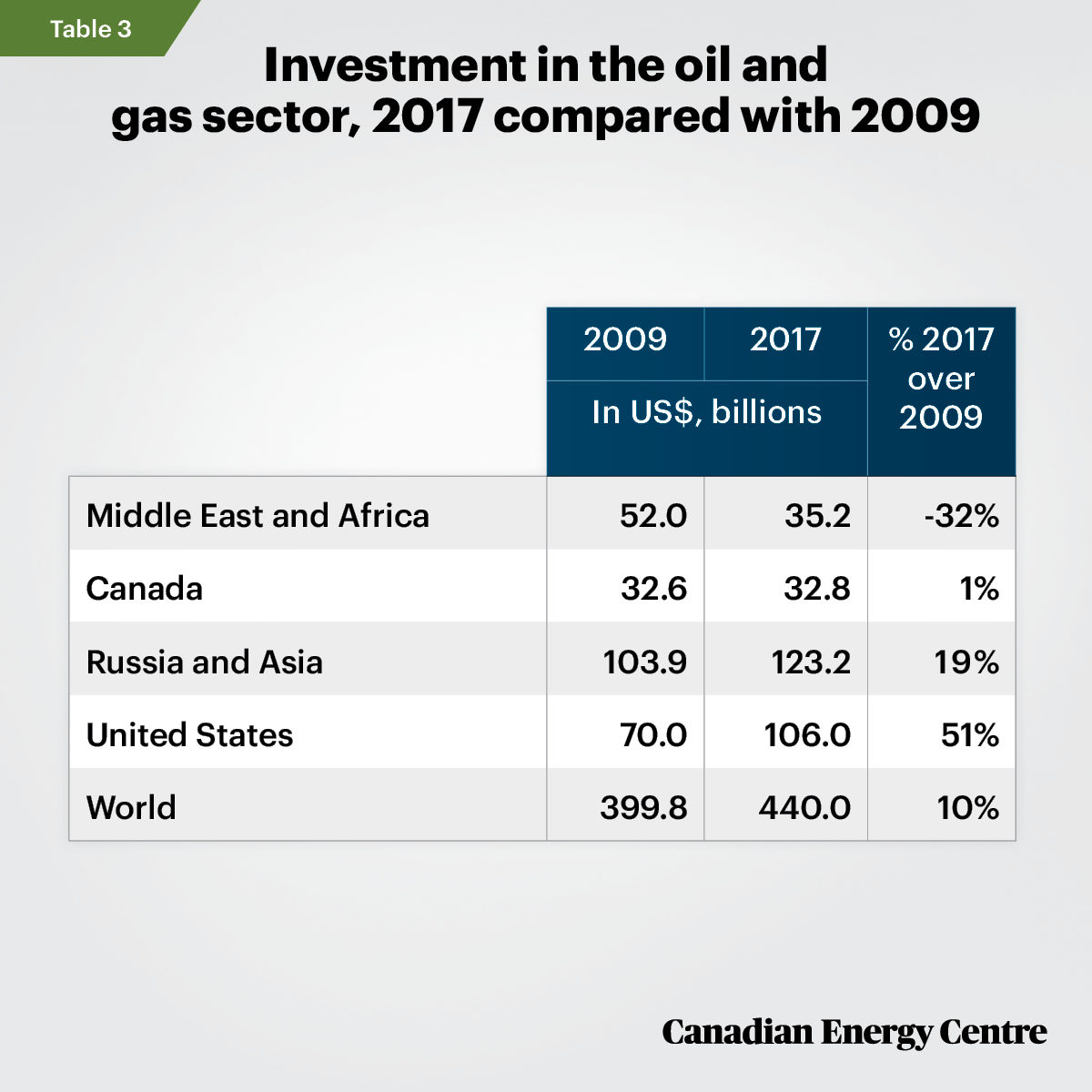

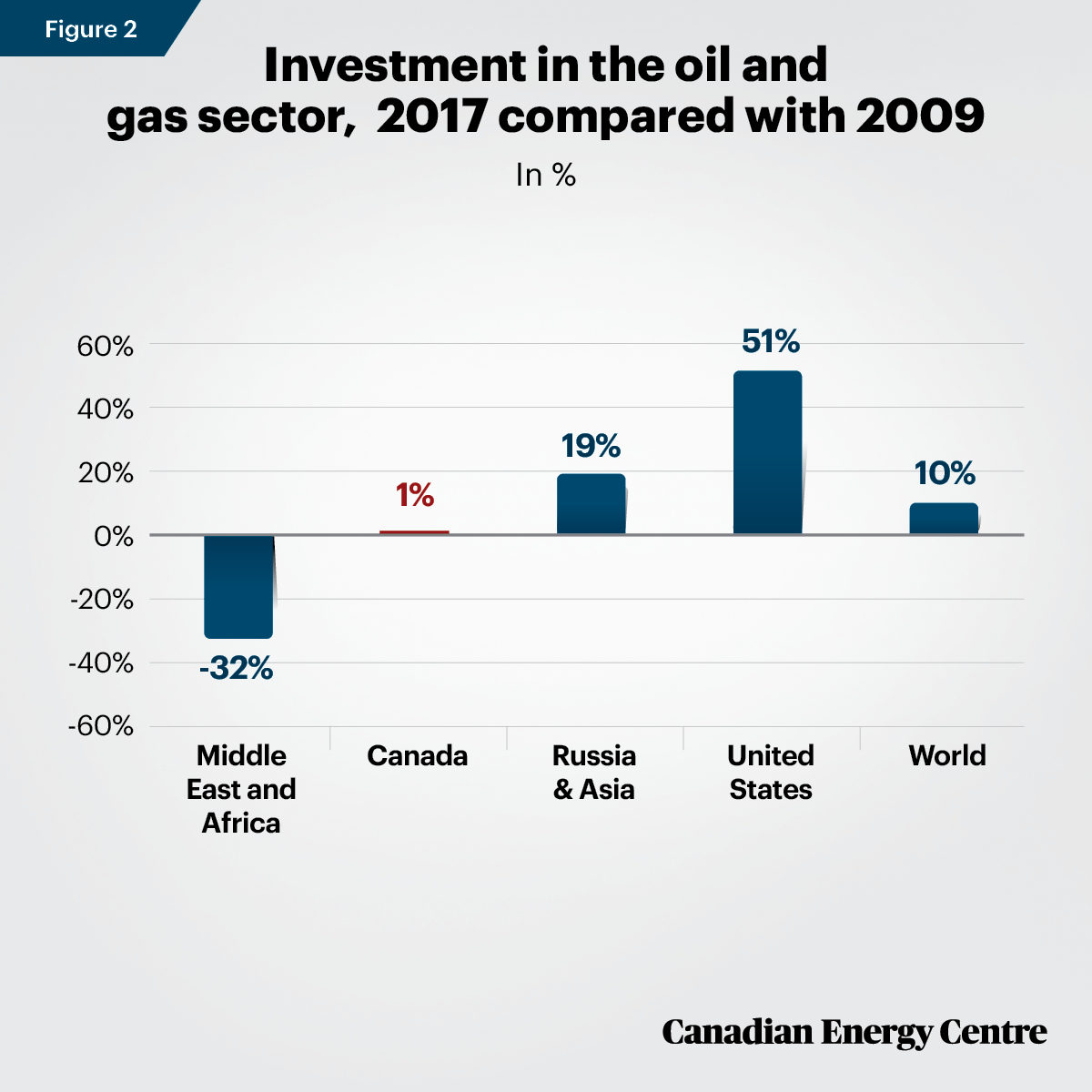

Canada’s oil and gas sector competes in a global marketplace for investment. Even with the investment declines after 2014, world oil and gas investment between 2009 and 2017 grew by 10 per cent to US$440 billion from $400 billion (see Table 3 and Figure 2). In comparison:

- Oil and gas investment in the Middle East and Africa declined to just over $35 billion in 2017 from $52 billion in 2009, or a drop of 32 per cent;

- Investment in Canada grew by just 1 per cent, to $32.8 billion from $32.6 billion;

- Investment in the Russian and Asian oil and gas sector grew to over $123 billion in 2017 from just under $104 billion in 2009, an increase of 19 per cent.

- U.S. oil and gas sector investment grew to $106 billion in 2017 from $70 billion in 2009, or by 51 per cent.

Sources: Canadian Energy Research Institute, U.S. EIA, and IEA.

Sources: Canadian Energy Research Institute, U.S. EIA, and IEA.

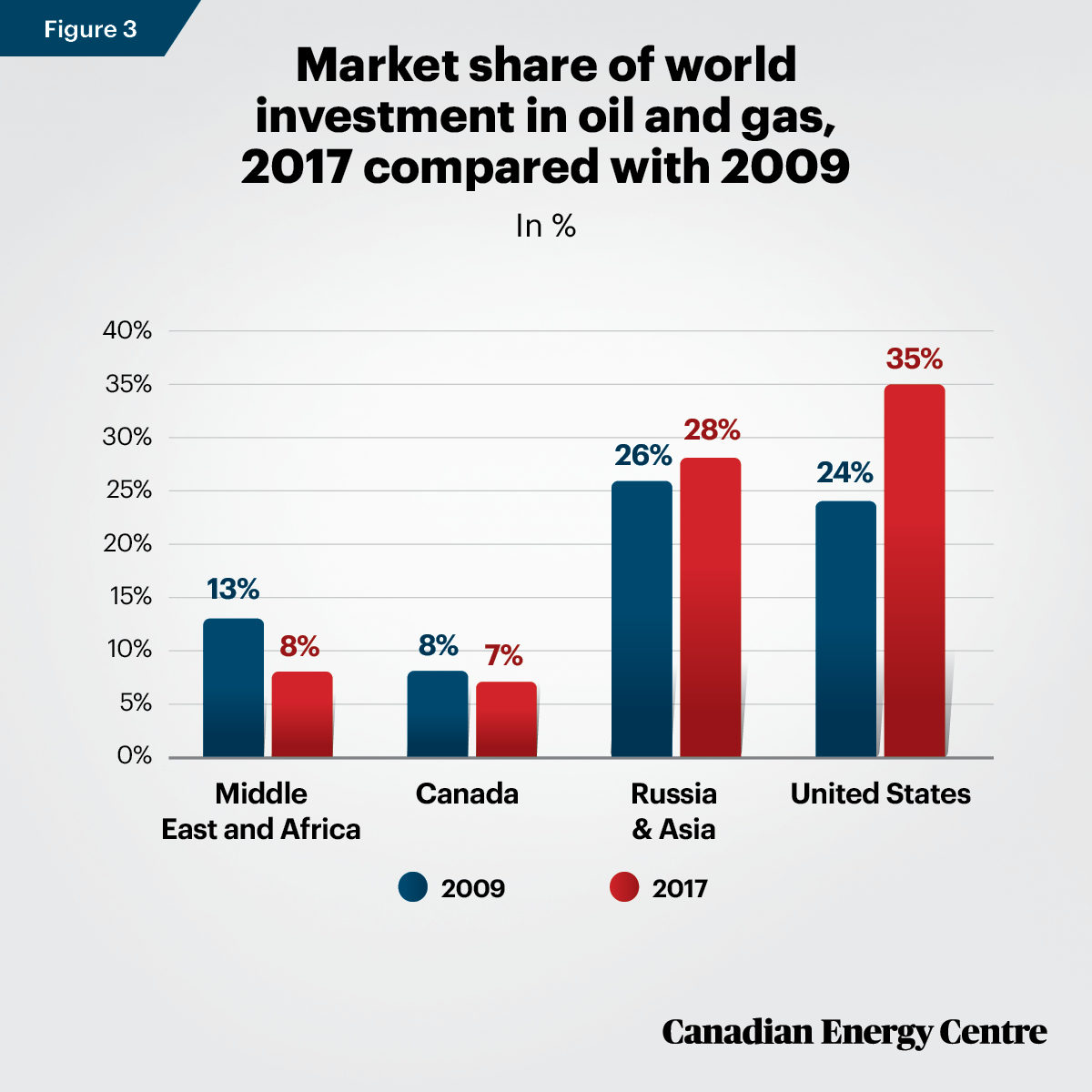

Market share: Declining for the Middle East, Africa, and Canada

On a global scale, investment in Canada’s oil and gas sector has remained steady in absolute terms since 2009, even taking into account the energy price slump between 2015 and 2017. However, on market share (see figure 3):

- Canada’s market share ranged from 8 per cent in 2009 to 11 per cent in 2011 but fell to 7 per cent in 2017;

- The Russian and Asian market share has increased marginally from 26 per cent in 2009 to 28 per cent in 2017;

- Meanwhile, the U.S. market share of global oil and gas investment has grown from 24 per cent in 2009 to 35 per cent in 2017.⁴

Sources: Canadian Energy Research Institute, U.S. EIA, and IEA.

Takeaway

The data show that between 2009 and 2017, investment in oil and gas increased worldwide, though Canada, the Middle East, and Africa lagged in attracting investment and in fact lost market share to the United States, Russia, and Asia by 2017 when compared to the previous nine years.⁵

End Notes 1. Between 2006 and 2019 for Canada and between 2009 and 2017 for the world. 2. Energy density refers to the power “punch” per unit. For more on this relative to oil, gas, and renewables, a useful introduction to the topic is from Science magazine’s 2018 profile of University of Manitoba environment professor emeritus Vaclav Smil, which can be found here: https://bit.ly/2Qe4XpC. See also Smil’s Power Density from MIT Press, first published in 2015. 3. The international comparative data is only available through 2017, so it does not take into account the oil and gas investment trends that have occurred between 2018 and 2020. 4. International comparative data are only available through 2017, so they do not account for oil and gas investment trends between 2018 and 2020, particularly the impacts of COVID-19. 5. The Canadian Energy Centre does not provide forecasts. Instead, on possible investment changes, see a 2020 Conference Board of Canada forecast: Canadian Outlook, Long-term Economic Forecast. The Conference Board writes that “the medium- to long-term prospects (for investment) have improved... and we expect the energy sector’s capacity to expand over the next 10 years.” The Board predicts real oil and gas investments will reach $56 billion in Canada by 2040.

Notes

This CEC Fact Sheet was compiled by Lennie Kaplan and Mark Milke at the Canadian Energy Centre: www.canadianenergycentre.ca. The authors and the Canadian Energy Centre would like to thank and acknowledge the assistance of Philip Cross and an anonymous reviewer in reviewing the data and research for this Fact Sheet. Image credits: Business stock analysis graphs by Teradat Santivivut from Getty Images.

Sources (Links live as of August 21, 2020)

Conference Board of Canada (2020), Canadian Outlook, Long-term Economic Forecast: 2020 <https://bit.ly/3hn8cag>; Statistics Canada (2020), Table 34-10-0035-01 <https://bit.ly/3g9haGz>; Statistics Canada (2020), Table 34-10-0036-01 <https://bit.ly/2CJb6He>; Statistics Canada (2020), Table 34-10-0040-01 <https://bit.ly/3l10Z1Q>; Statistics Canada (2020), Table 36-10-0096-01 <https://bit.ly/3haIo0G>; Canadian Association of Petroleum Producers (2018), Statistical Handbook, <https://bit.ly/3aCgUP6>; Conference Board of Canada (2020), Canadian Outlook, Long-term Economic Forecast; International Energy Agency (2019), World Investment, 2019; International Energy Agency (2020), Oil 2020, Analysis and Forecast to 2025; International Energy Agency (2020), Gas 2020; International Energy Agency (2020), World Energy Investment 2020 <https://bit.ly/3iPdYSf>; Canadian Energy Research Institute (2020), Global Oil and Gas Investment Outlook <https://bit.ly/2YehbCX>; Canadian Association of Petroleum Producers (2019), September 2019 Capital Investment & Drilling Forecast Update, <https://bit.ly/2EMp8J2>; Canadian Association of Petroleum Producers (2020), January 2020 Capital Investment & Drilling Forecast Update; Fraser Institute (2019), Investment in the Canadian and U.S. Oil and Gas Sectors: A Tale of Diverging Fortunes, <https://bit.ly/3j33MFA>; Fraser Institute (2020), Trudeau government energy policies making jobs and investment disappear <https://bit.ly/3l60G5C>; Natural Resources Canada (2020), Energy and the Economy <https://bit.ly/31d1BcR>; U.S. Energy Information Administration (2019), International Energy Outlook 2019, <https://bit.ly/3j5SzEz>; U.S. Energy Information Administration (2020), Short-Term Energy Outlook <https://bit.ly/3iRh6gd>; Vooson, Paul (2018), “Meet Vaclav Smil, the Man Who Has Quietly Shaped How the World Thinks About Energy,” Science <https://bit.ly/2Qe4XpC>; U.S. Energy Information Administration (2020), Annual Energy Outlook 2020 <https://bit.ly/2EfifQ3>.

Creative Commons Copyright

Research and data from the Canadian Energy Centre (CEC) is available for public usage under creative commons copyright terms with attribution to the CEC. Attribution and specific restrictions on usage including non-commercial use only and no changes to material should follow guidelines enunciated by Creative Commons here: Attribution-NonCommercial-NoDerivs CC BY-NC-ND.