To sign up to receive the latest Canadian Energy Centre research to your inbox email: research@canadianenergycentre.ca

Download the PDF here

Download the charts here

Overview

This Research Brief estimates the gross revenue contribution that Canada’s energy sector broadly speaking, and the oil and gas sector specifically, made to federal, provincial, and municipal governments between 2000 and 2021. Gross revenues include personal and corporate federal and provincial income taxes, indirect taxes, royalties, and crown lease payments. This Research Brief updates previous research that the Canadian Energy Centre undertook on this subject.¹

In brief, on an inflation-adjusted basis,

- The energy sector’s cumulative fiscal contribution to federal, provincial, and municipal government revenue was $755.4 billion between 2000 and 2021, an average of nearly $34.3 billion per year.

- The gross revenue contribution to federal, provincial, and municipal governments exclusively from the oil and gas sector was $578.7 billion between 2000 and 2021, an average of $26.3 billion per year.

Background

The broad energy sector in Canada is composed of oil and gas extraction and support activities, utilities (including renewables such as hydro, wind, and solar), petroleum and coal product manufacturing, petroleum and petroleum products merchant wholesalers, and pipeline transportation. The more specific oil and gas sector is composed of oil and gas extraction and related support activities.

The reader should be aware that:

• Numbers for the oil and gas sector are included in the broad energy sector. The reason for displaying both is that separating out the specific oil and gas sector from broader energy sector answers the question of how large Canada’s oil and gas sector is vis-à-vis the broad energy category (which also includes, for example, hydro).

The revenue estimates for the energy sector and the oil and gas sector are low

The $755.4 billion figure from the broad energy sector and the $578.7 billion figure from the more specific oil and gas sector are conservative estimates of government gross revenues. (For more detail, see Appendix A: Explaining “Gross Revenues.”) They exclude:

- Federal and provincial personal income taxes or direct taxes from persons paid by employees who worked in Canada’s energy sector between 2000 and 2006, and for 2021²;

- Indirect taxes paid by the sector in 2020 and 2021;

- Income effects resulting from spending on goods and services by Canadians who benefitted from the energy sector. (By “income effects,” we mean income generated by the broad energy industry and its agents or suppliers, which gives rise to various types of personal consumer spending across the entire economy. Such consumer spending stimulates GDP, output, and employment in other sectors such as retail, service, and leisure, which then bolsters federal, provincial, and municipal revenues); and

- Taxes, fees, and revenues from benefit agreements paid to First Nations governments.

1. See CEC’s September 2021 Research Brief #17 which conservatively estimated energy revenues to federal, provincial, and municipal governments at $701 billion between 2000 and 2019. 2. The data for the missing years are not available from Statistics Canada at this time.

Summary of Key Findings

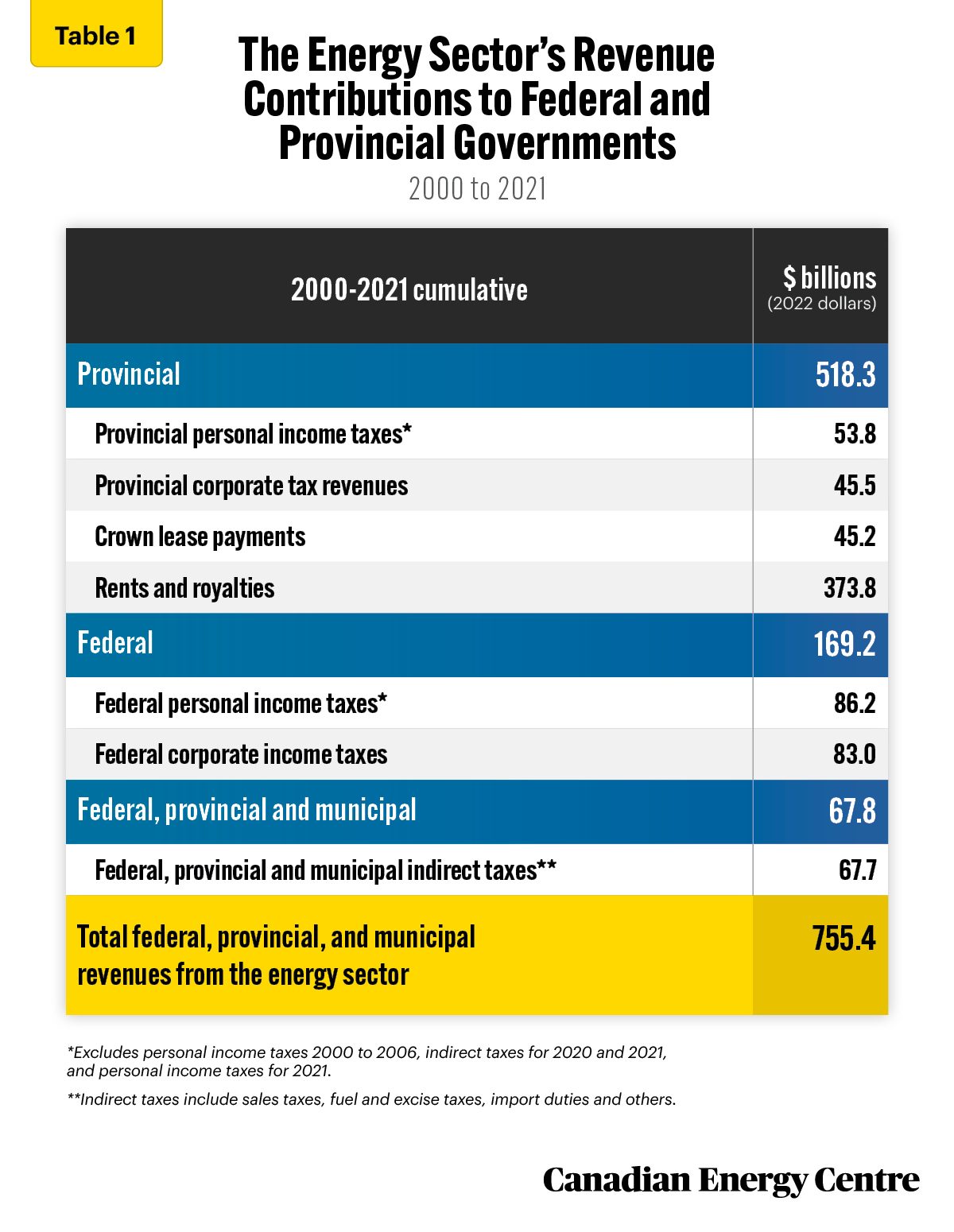

Revenues to governments from the broad energy sector: $755.4 billion

On an inflation-adjusted basis to 2022 dollars, the Canadian energy sector’s cumulative fiscal contribution to federal, provincial, and municipal government revenue was $755.4 billion between 2000 and 2021, an average of $34.3 billion per year³ (see Table 1).

The $755.4 billion figure includes $518.3 billion in direct provincial revenues, $169.2 billion in direct federal revenues, and $67.8 billion in indirect federal, provincial, and municipal taxes.

3. The nominal figure is $621.9 billion, or an average of $28.3 billion per year. Constant dollars (i.e., inflation-adjusted to 2022) is a more accurate way of comparing revenues (or any other number) over the years. This is because, for example, $10 billion in revenues in 1950 would be very different than $10 billion in 2022 given the erosion of the dollar’s value over 71 years. In this study, we thus use inflation-adjusted 2022 dollars.

Sources: Statistics Canada, 2022 (a, b, c, d), Statistics Canada 2023 (a,b), and CAPP, 2022

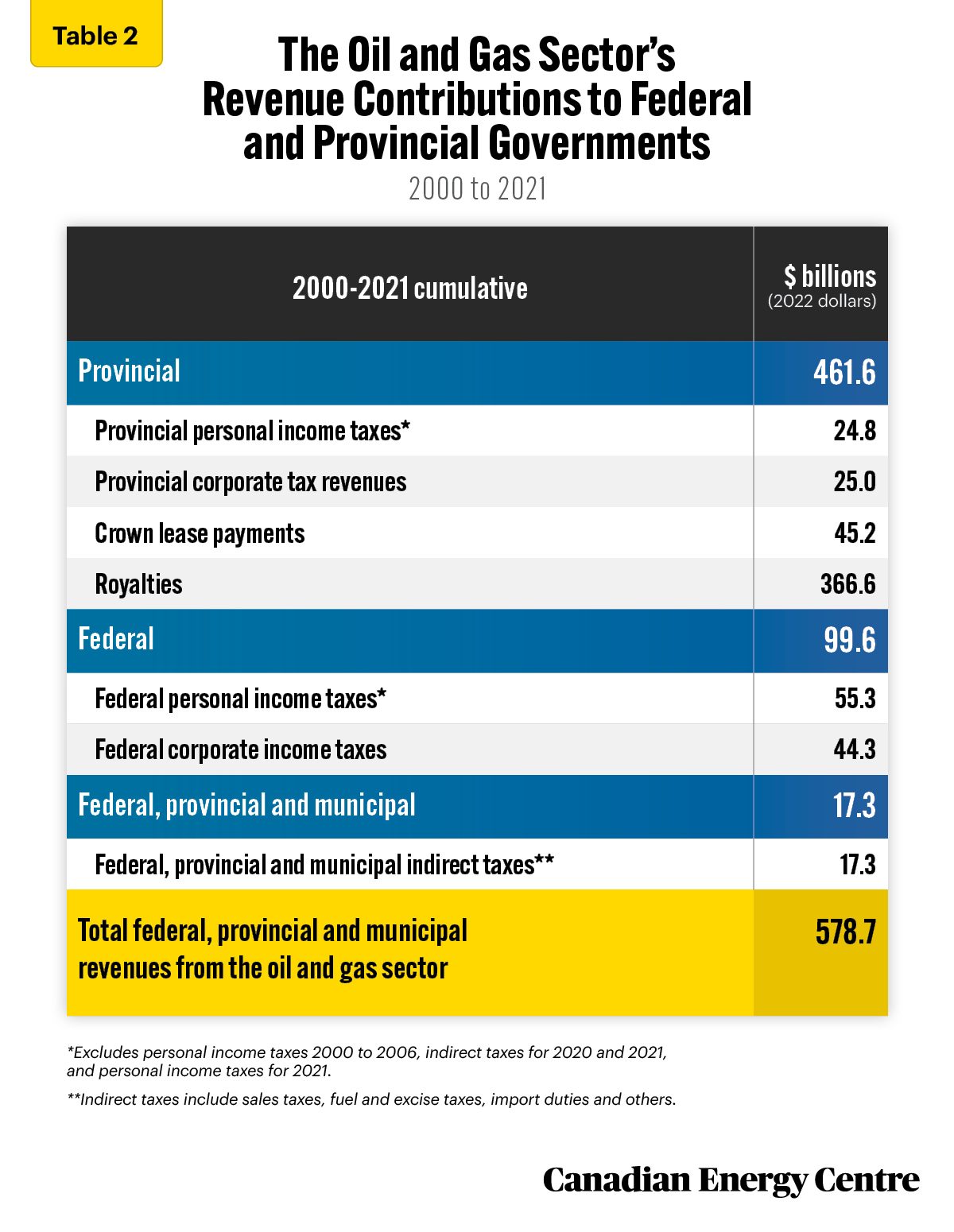

The contribution from the oil and gas sector: $578.7 billion

The gross revenue contribution to federal, provincial, and municipal governments received exclusively from the oil and gas sector was $578.7 billion between 2000 and 2021, an average of $26.3 billion per year (see Table 2).

The $578.7 billion figure includes $461.6 billion in direct provincial revenues, $99.6 billion in direct federal revenues, and $17.3 billion in indirect federal, provincial, and municipal taxes.

Sources: Statistics Canada, 2022 (a, b, c, d), Statistics Canada 2023 (a,b), and CAPP, 2022

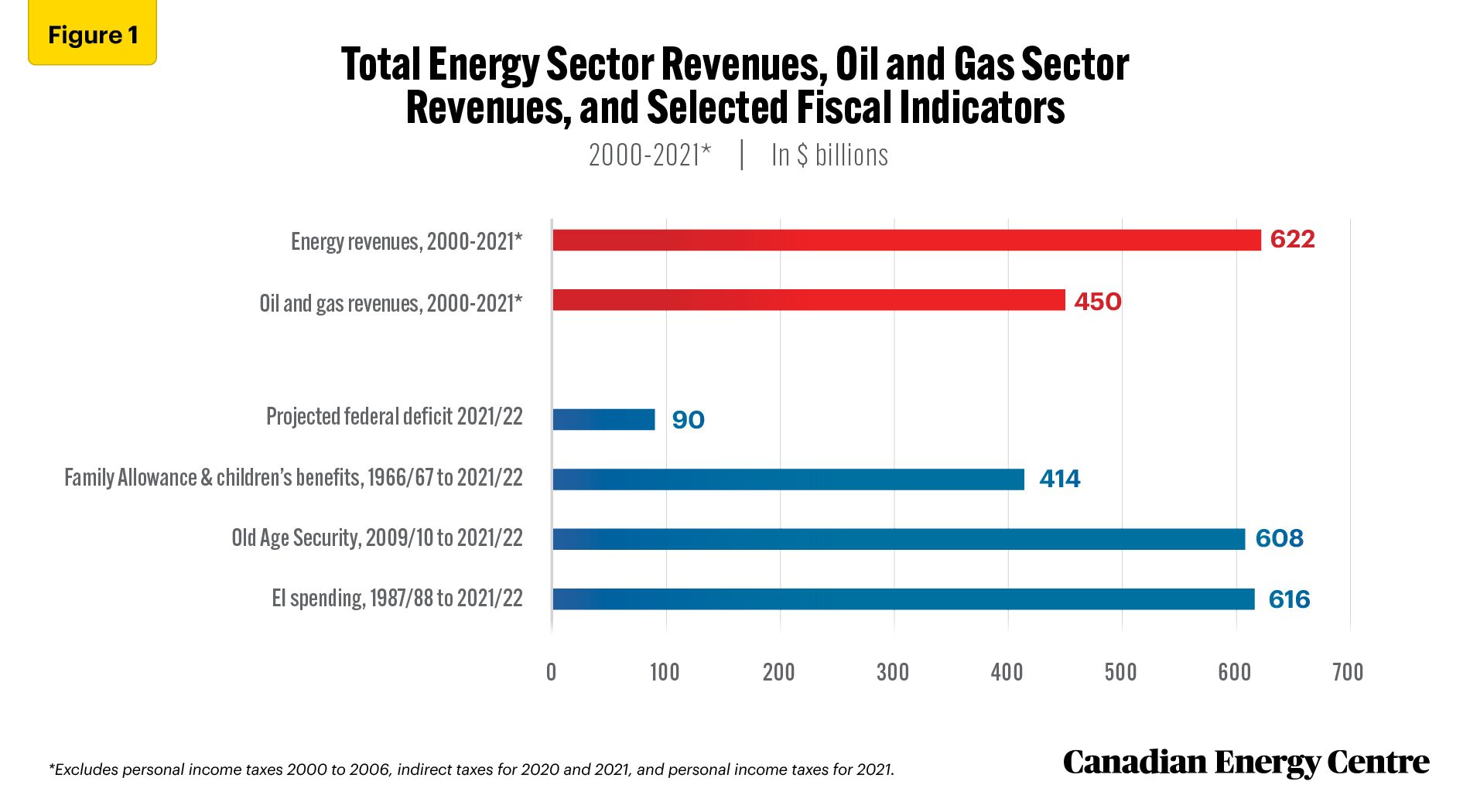

Putting $622 billion and $450 billion in nominal dollars in context

To put $621.9 billion in energy revenues and $450.3 billion in oil and gas revenues, specifically, (expressed in nominal dollars) into context, we compare those figures with recent expenditures or other recent figures.

The $621.9 billion in nominal dollars from overall energy revenues is:

- Nearly seven times larger than the federal budget deficit of $90.2 billion for 2021/22;

- More than the $607.6 billion paid out in Old Age Security (OAS) benefits between 2009/10 and 2021/22; and

- More than the $616.2 billion in Employment Insurance benefits paid out between 1987/88 and 2021/22.

The $450.3 billion in nominal dollars for specific oil and gas revenues is:

- More than the $413.7 billion in Family allowance and children’s benefits paid out between 1966/67 and 2021/22 (see Figure 1).

Sources: Statistics Canada, 2022 (a, b, c, d), Statistics Canada 2023 (a,b), Finance Canada (a,b),and CAPP, 2022

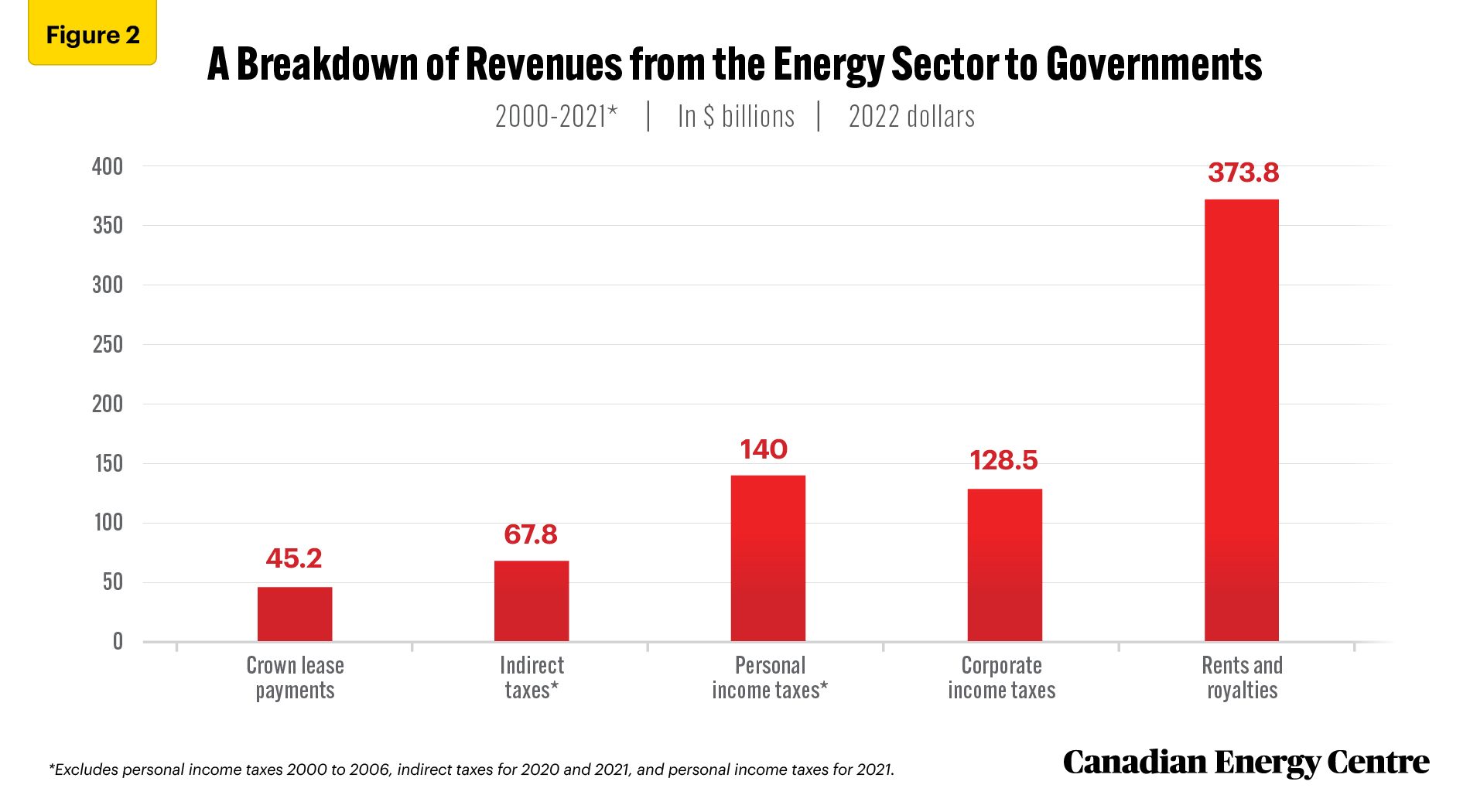

A Breakdown of Revenues from the Energy Sector: $755.4 Billion

The energy sector pays revenues to government in five main ways: crown lease payments, indirect taxes, personal income taxes, corporate income taxes, and rents and royalties (see Figure 2).

Crown lease payments: $45.2 billion

The Canadian energy sector makes crown lease payments for the leasing of rights that enable companies to explore for and develop petroleum and natural gas resources.

Between 2000 and 2021, the Canadian energy sector made $45.2 billion in crown lease payments to provincial governments, an average of about $2 billion per year.

Indirect taxes: $67.8 billion

The Canadian energy sector pays indirect taxes annually as a result of its activities. Those indirect taxes include federal and provincial sales taxes, federal and provincial gas taxes, federal excise taxes, federal import duties, and others.

Between 2000 and 2019, Canada’s energy sector paid $67.8 billion, an average of nearly $3.4 billion per year in indirect taxes to the federal government, the provinces, and municipalities.

Personal income taxes: $140 billion

Canadians employed in the energy sector pay federal and provincial income taxes, primarily on annual income earned from salaries, wages, and commissions.

Between 2007 and 2020, Canadians employed in the energy sector paid $140 billion in federal and provincial personal income taxes on salaries, wages, and commissions—about $10 billion per year. Note that this does not include federal and provincial personal income taxes collected from the energy sector between 2000 and 2006 and for 2021, which are not available from Statistics Canada at this time.

$86.2 billion was paid in federal personal income tax and $53.8 billion was paid in provincial personal income tax.

Corporate income taxes: $128.5 billion

Corporations and business enterprises in Canada’s energy sector pay federal and provincial corporate taxes on their annual net profits.

Between 2000 and 2021, the energy sector paid $128.5 billion, or over $5.8 billion per year in federal and provincial corporate income taxes.

Of that $128.5 billion, Canada’s energy sector paid $83 billion in federal corporate income taxes and $45.5 billion in provincial corporate income taxes.

Rents and royalties: $373.8 billion

The Canadian energy sector pays rents and royalties to provincial governments on the production of natural resources such as conventional oil and natural gas, oil sands, and hydro.

Between 2000 and 2021, the energy sector paid $373.8 billion, or an average of $17 billion per year in rents and royalties to provincial governments.

Sources: Statistics Canada, 2022 (a, b, c, d), Statistics Canada 2023 (a,b), and CAPP, 2023

A Breakdown of Revenues from the Oil and Gas Sector: $578.7 Billion

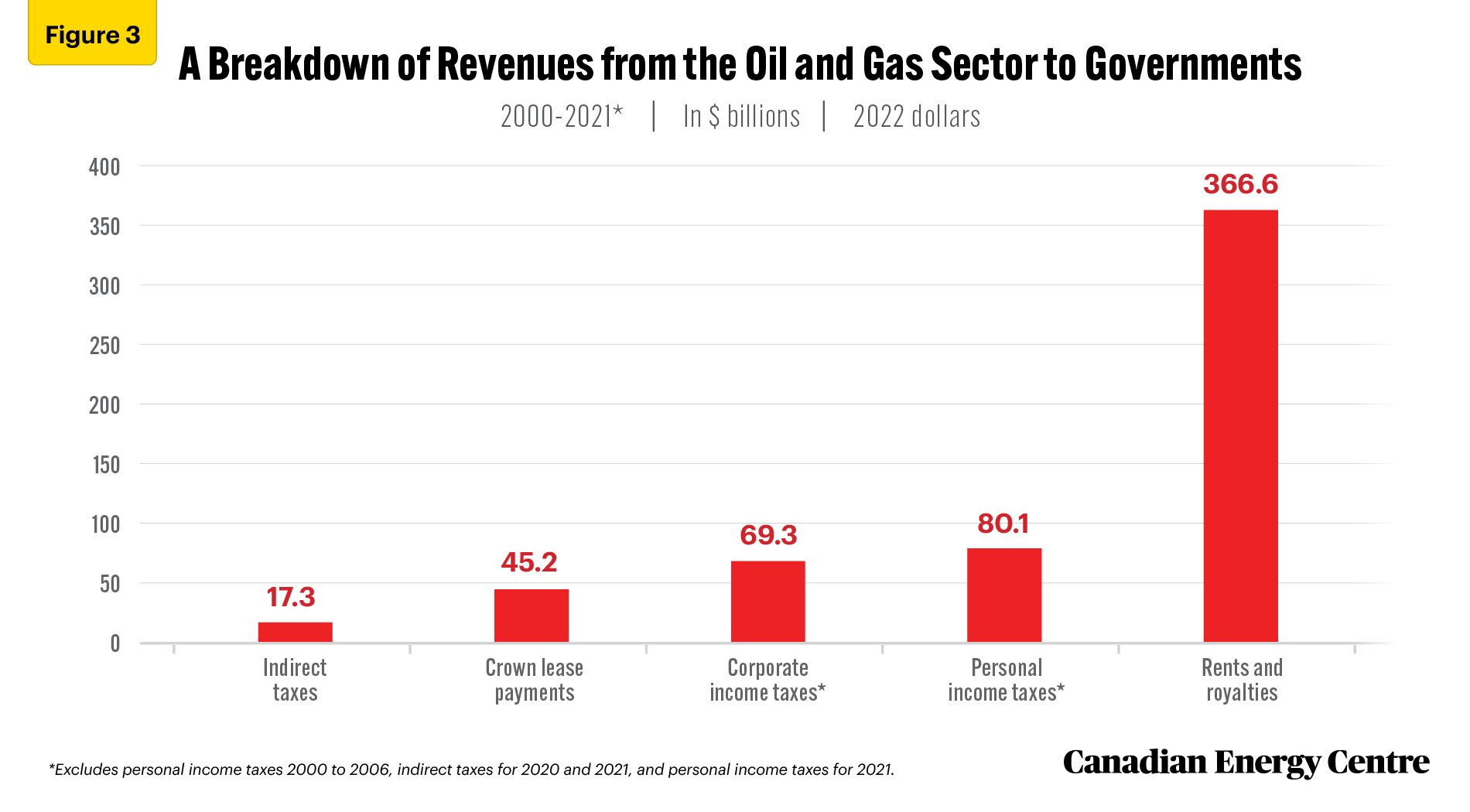

Just as the broad energy sector does, the oil and gas sector pays revenue to government in five main ways: indirect taxes, crown lease payments, personal incomes taxes, corporate income taxes, and rents and royalties (see Figure 3).

Crown lease payments: $45.2 billion

The Canadian oil and gas sector is almost the sole contributor of the crown lease payments that accrue to governments. Between 2000 and 2021, the Canadian oil and gas sector made $45.2 billion, or an average of about $2 billion per year, from crown lease payments to provincial governments.

Indirect taxes: $17.3 billion

The Canadian oil and gas sector pays indirect taxes annually as a result of its activities. Those indirect taxes include federal and provincial sales taxes, federal and provincial gas taxes, federal excise taxes, federal import duties, and others.

Between 2000 and 2019, Canada’s energy sector paid $17.3 billion, an average of $786 million per year in indirect taxes to the federal government, the provinces, and municipalities.

Federal and provincial corporate incomes taxes: $69.3 billion

Between 2000 and 2021, the oil and gas sector paid federal and provincial corporate income taxes of $69.3 billion, or about $3.1 billion per year.

Of that $69.3 billion, $42.1 billion was paid in federal corporate income taxes and $26.1 billion in provincial corporate income taxes.

Federal and provincial personal income taxes: $80.1 billion

Between 2007 and 2020, Canadians employed in the oil and gas sector paid $80.1 billion, or $5.7 billion per year, in federal and provincial income taxes on salaries, wages, and commissions. Note that this figure does not include federal and provincial personal income tax collected from the sector between 2000 and 2006, and for 2021, as those data are not available from Statistics Canada at this time.

Of that $80.1 billion, $55.3 billion was federal personal income tax revenues and $24.8 billion was provincial personal income tax revenues.

Rents and royalties: $366.6 billion

Canada’s oil and gas sector pays rents and royalties to provincial governments on the production of natural resources such as conventional oil, natural gas, and oil sands.

Between 2000 and 2021, the oil and gas sector paid $366.6 billion, or an average of $16.7 billion per year, in rents and royalties to provincial governments.

Sources: Statistics Canada, 2022 (a, b, c, d), Statistics Canada 2023 (a,b), and CAPP, 2023

Conclusion

The broad energy sector generally, and the oil and gas sector specifically, have made a significant contribution to federal, provincial, and municipal government coffers over the past two decades.

A conservative estimate of the gross revenues that Canada’s energy sector has paid to those three levels of government between 2000 and 2021 is $755.4 billion, an average of $34.3 billion per year.

A conservative estimate of the gross revenues contributed by the oil and gas sector alone is $578.7 billion between 2000 and 2021, or an average of $26.3 billion per year.

Appendix: Explaining “Gross Revenues”

Gross revenues from the broad energy sector and the narrower oil and gas sector are composed of direct and indirect taxes, royalties, and crown lease payments made annually to federal, provincial, and municipal governments. They include:

- Federal and provincial personal income taxes or direct taxes from persons paid by employees who work within Canada’s oil and gas sector and the broader energy sector;

- Federal and provincial corporate income taxes or direct taxes from corporations paid by corporations and business enterprises in Canada’s oil and gas sector and the broader energy sector;

- Federal, provincial, and municipal indirect taxes on production and products, such as GST, excise taxes, duties, import taxes, gasoline and motive fuel taxes, and others paid by Canada’s oil and gas sector and the broader energy sector;

- Rents and royalties on the production of conventional oil and gas, oil sands, and hydro paid by Canada’s oil and gas sector and broader energy sector; and

- Crown lease payments for the leasing of rights that enable companies to explore for and develop petroleum and natural gas resources.

References: (All links live as of March 21, 2023)

Canadian Association of Petroleum Producers (2022). CAPP Statistical Handbook for Canada’s Upstream Petroleum Industry. <https://bit.ly/36LFHR3>.

Finance Canada (2022a). Annual Financial Report, 2021-22. <http://bit.ly/3TulntA>.

Finance Canada (2022b). Fiscal Reference Tables, 2022. <http://bit.ly/42t8vbu>.

Statistics Canada (2022a). Table 10-10-0016-01: Canadian Government Finance Statistics for the Federal Government. <https://bit.ly/2GPmmDt>.

Statistics Canada (2022b). Table 10-10-0017-01: Canadian Government Finance Statistics for the Provincial and Territorial Governments. <https://bit.ly/3lwJhCI>.

Statistics Canada (2022c). Table 33-10-0006-01: Financial and Taxation Statistics for Enterprises, by Industry Type. <https://bit.ly/33Mkzba>.

Statistics Canada (2022d). Table 11-10-0073-01: Wages, Salaries and Commissions of Tax Filers Aged 15 years and over by Main Industry Sector and Sex. <https://bit.ly/2SEsO2X>.

Statistics Canada (2023a). Financial and Taxation Statistics for Enterprises, by Industry Type (x 1,000,000). Custom tabulation.

Statistics Canada (2023b). T1 Family File of the Centre for Income and Socio-Economic Well-Being. Annual Income Estimates for Census Families and Individuals (T1 Family File). Custom Tabulation.

CEC Research Briefs

Canadian Energy Centre (CEC) Research Briefs are contextual explanations of data as they relate to Canadian energy. They are statistical analyses released periodically to provide context on energy issues for investors, policymakers and the public. The source of profiled data depends on the specific issue.

About the authors

This CEC Research Brief was compiled by Lennie Kaplan, Executive Director of Research for the Canadian Energy Centre.

Acknowledgements

The author and the Canadian Energy Centre would like to thank and acknowledge the assistance of Philip Cross and two anonymous reviewers for their review of the data for this paper.

Creative Commons Copyright

Research and data from the Canadian Energy Centre (CEC) is available for public usage under creative commons copyright terms with attribution to the CEC. Attribution and specific restrictions on usage including non-commercial use only and no changes to material should follow guidelines enunciated by Creative Commons here: Attribution-NonCommercial NoDerivs CC BY-NC-ND.