Like the cancellation of Canada’s Keystone XL pipeline, the unprecedented depletion of the U.S. Strategic Petroleum Reserve is contributing to a less energy secure world, says a veteran Wall Street energy analyst.

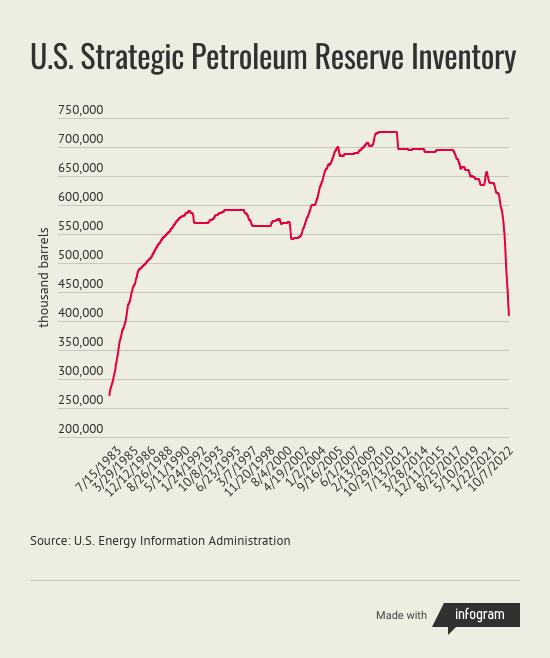

SPR inventories are at their lowest level in nearly 40 years as the White House releases oil to temper U.S. gasoline prices ahead of midterm elections.

“The original intention of the SPR was to protect the U.S. against geopolitical disruptions versus simply trying to tame high oil prices. The spare capacity cushion is pretty tight right now,” says Arjun Murti, a former partner with Goldman Sachs.

“Keystone XL and more Canadian production would help support long-term energy security and reliable supply.”

There’s not enough consideration of the “S” in SPR, says Adam Rozencwajg, managing partner with New York-based Goehring & Rozencwajg Natural Resource Investors.

“This petroleum reserve was very strategic. It was put in place after OPEC used oil as a weapon in the 1970s,” he said on a recent podcast.

“It happened twice. In both cases, in order to punish the West, Saudi Arabia withheld oil from the market, and it created huge problems.”

The move to tap the SPR today is attributed to the fallout from Russia’s invasion of Ukraine, but the government’s withdrawals started months before the war began. And it hasn’t done much to reduce gasoline prices.

The Canadian Energy Centre is reaching millions of Americans with its “Look North” campaign promoting Canada’s responsible oil and gas. Learn more here.

When President Joe Biden took office in January 2021 – and cancelled Keystone XL on his first day – gasoline averaged $2.42 per gallon, according to the U.S. Energy Information Administration.

Despite repeated appeals from the White House to OPEC nations led by Saudi Arabia to increase production, the price at the pump has only gone higher.

Since November 2021, when the government started drawing from the SPR, gasoline prices have averaged $4.06 per gallon, EIA data shows.

Meanwhile, importing oil from Canada has been found to help lower U.S. consumer energy costs and support jobs, according to a 2021 study published by the American Petroleum Institute.

That’s mainly because U.S. refineries are largely configured to process heavy oil like that produced in Canada.

“Most of the U.S. refining capacity that takes oil and turns it into refined products like gasoline, diesel and jet fuel was actually built to accommodate heavier crudes from both Canada and Venezuela,” Rozencwajg said.

U.S. imports of Canadian oil – which doubled between 2005 and 2019 – have been a “godsend” for energy security, according to Christopher Guith, senior vice-president of the U.S. Chamber of Commerce Global Energy Institute.

“It transformed our energy economy incredibly and enabled us to push out OPEC imports,” he said.

Even with the growing role of renewable energy, the U.S. is expected to import about as much oil in 2035 as it does today, according to the U.S. Energy Information Administration.

The unaltered reproduction of this content is free of charge with attribution to Canadian Energy Centre Ltd.