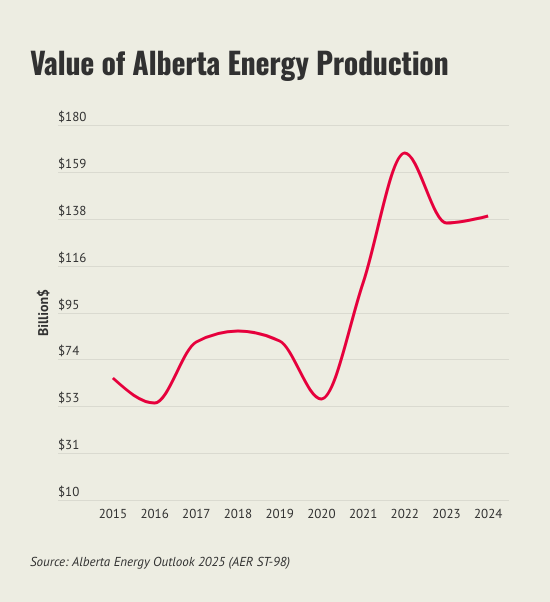

The recent expansion of the Trans Mountain pipeline helped drive a surge in the value of Alberta’s energy production, which rose to $139 billion in 2024, according to the latest Alberta Energy Outlook.

The Alberta Energy Regulator (AER) reported that last year was the second-highest value of the province’s energy production on record, after 2022’s banner year of $167 billion.

For comparison, the annual average between 2015 and 2019 was just $74 billion.

Industry experts say the strong numbers highlight the continued importance of oil and gas to Canada’s economic prosperity.

“Every Albertan will benefit from this windfall, but it trickles through the Canadian economy as well, notably in higher GDP, productivity, exports and trade diversification: all things we badly need,” said Heather Exner-Pirot, director of energy, natural resources and environment at the Ottawa-based Macdonald-Laurier Institute.

“If the case for another bitumen pipeline wasn’t already clear, this seals the deal.”

The additional export capacity provided by the Trans Mountain expansion has enabled producers to move more oil to international markets at stronger prices — fueling both production growth and higher revenues for companies and governments.

An economic powerhouse

Bitumen from the oil sands remains the largest contributor to Alberta’s energy economy, according to the AER’s analysis, and improved market access has narrowed the discount faced by Western Canadian Select crude.

“Alberta continues to lead Canada’s energy story — not only through robust oil and gas production but also by accelerating momentum in emerging resources like hydrogen, lithium, and geothermal,” said AER principal economist Afshin Honarvar.

The regulator’s annual outlook found that the value of bitumen production in 2024 totaled $95.8 billion.

Natural gas liquids including propane, butane and ethane generated $19.7 billion, followed by conventional crude oil at $18.2 billion and natural gas at $5 billion.

Western Canada also stands to benefit from continued growth in natural gas production to meet global demand, particularly with the LNG Canada export terminal now operating.

The AER undertook a reassessment of natural gas reserves, which saw Alberta’s volume increase by 440 per cent, taking Canada from 15th place to ninth place globally.

Alberta’s oil reserves – already fourth in the world – also increased by seven billion barrels.

“This is telling us that Alberta is a crucial part of the energy supply in North America,” Honavar said.

“We are a reliable source and an affordable source, without any worries that we will run out of reserves or resources.”

LNG Canada announced its first official cargo of liquefied natural gas destined for global markets on July 1, 2025. Photo courtesy LNG Canada

Benefits across the country

According to Canada Energy Regulator data, Alberta is responsible for about 84 per cent of Canada’s total oil and equivalent production and about 60 per cent of the country’s natural gas output.

Across the country, Natural Resources Canada estimates the sector employs about 450,000 people directly or indirectly.

Energy products were by far Canada’s top export in 2024, valued at $196 billion — more than double the next largest category, metal and mineral products, at $94.8 billion, according to Statistics Canada.

In 2023, the most recent year of data available, oil and gas contributed 7.7 per cent of Canada’s GDP, or $209 billion, the federal department says.

“It’s a huge industry, dominated by the oil sands, that Canada really benefits from and will continue to benefit from for decades,” said Richard Masson, executive fellow with the School of Public Policy at the University of Calgary.

He said the rise in Alberta’s production value translates directly into fiscal gains for the provincial and federal governments.

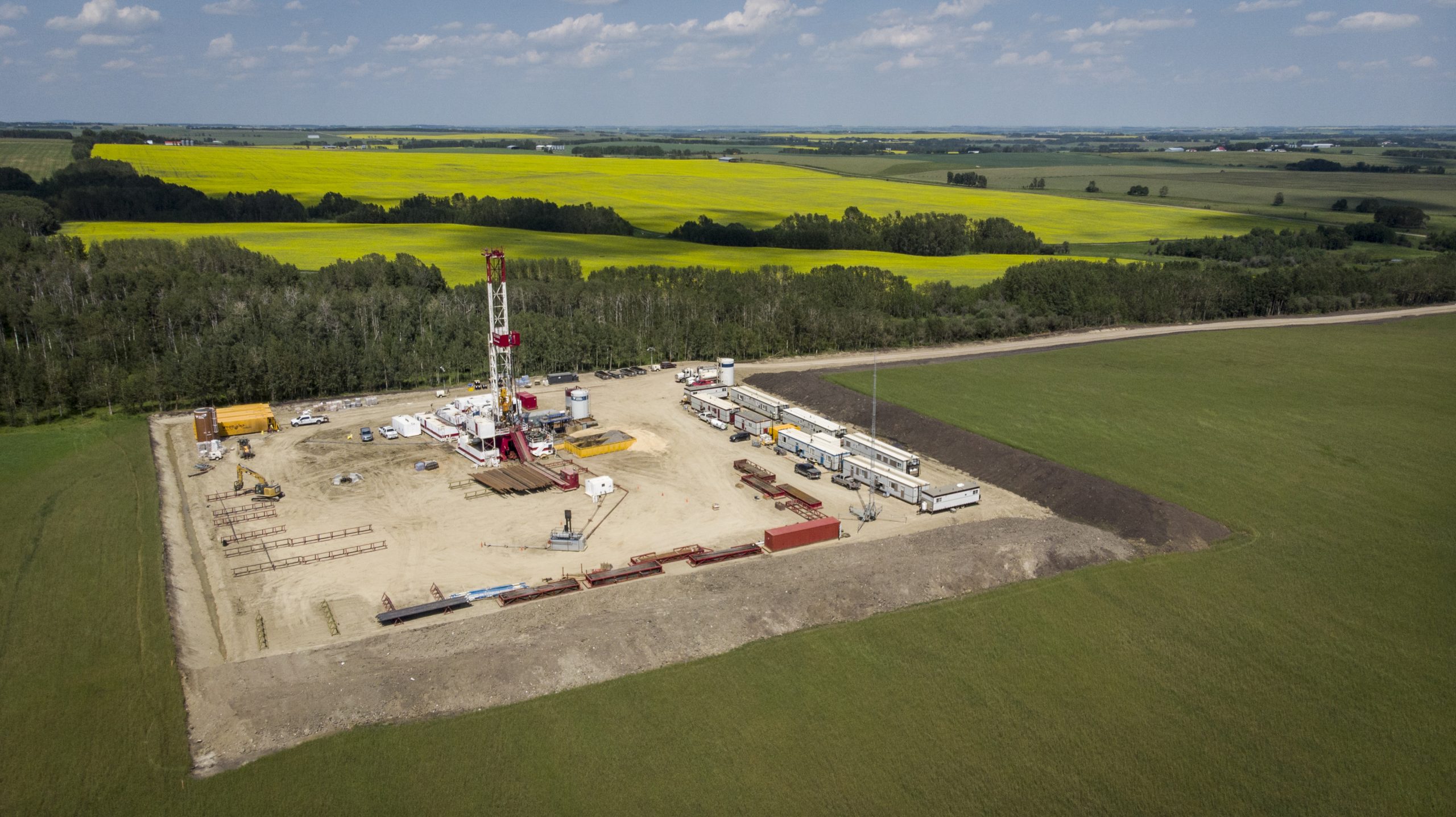

Well pad at Cenovus Energy’s Christina Lake oil sands facility southeast of Fort McMurray, Alta. CP Images photo

Alberta collected $19.2 billion in resource royalties during the 2023–24 fiscal year, with corporate taxes and income tax revenues also boosted by high industry activity.

The province also reported an unexpected $8 billion budget surplus for 2024-25 due to higher energy revenues.

“Energy royalties provide almost as much as personal income tax does for Alberta. If we didn’t have it, we would have to have a sales tax and other government revenues,” Masson said.

Rising production

According to the AER, bitumen production climbed by 4.3 per cent last year to an average of 3.56 million barrels per day. Driven by continued investment, the regulator forecasts output will rise to about four million barrels per day by 2034.

The key to realizing this potential is further expansion of export pipeline capacity to ensure additional oil production can reach international markets.

Investment in emerging energy technology

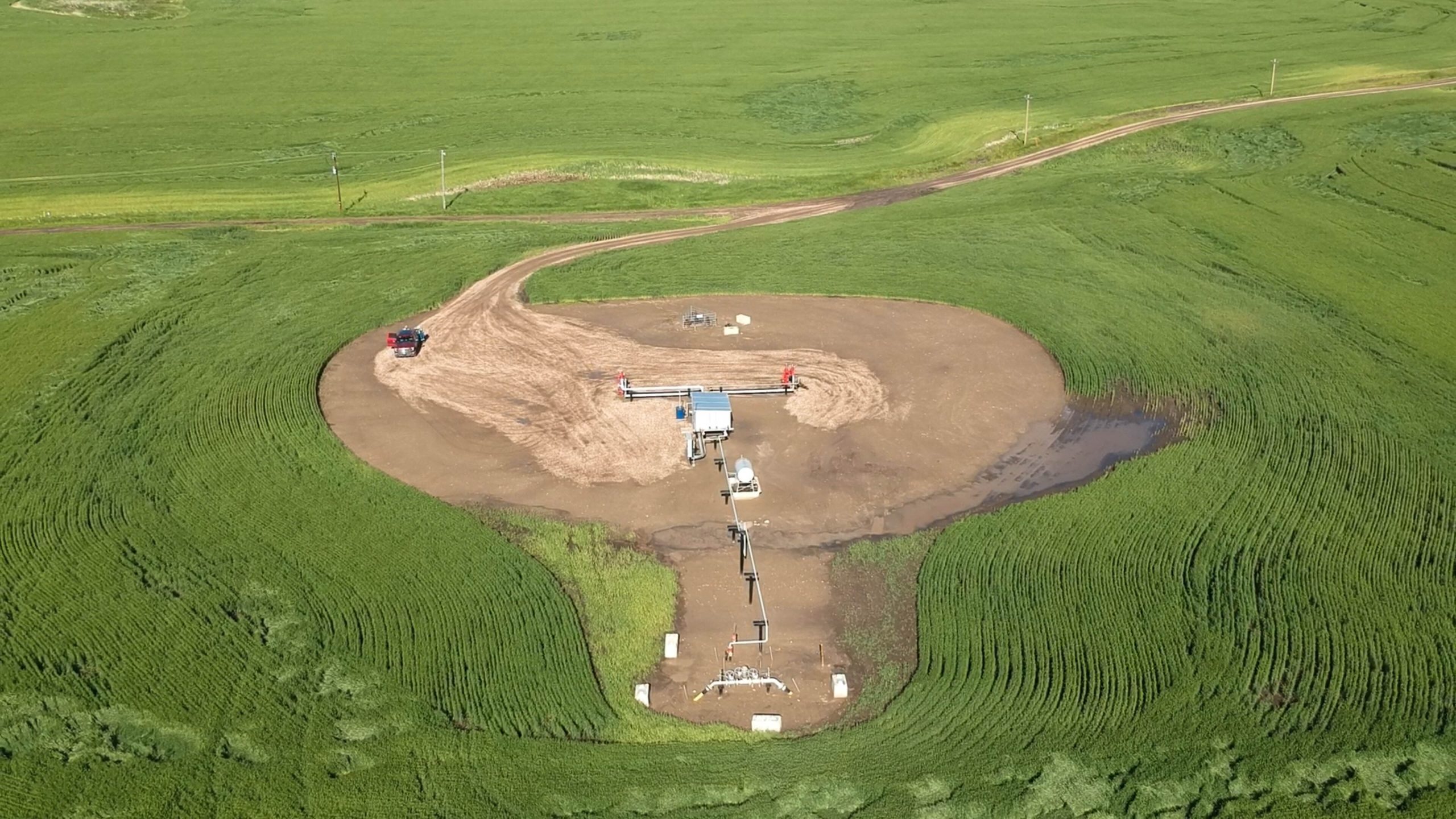

Wells at the Clive carbon capture, utilization and storage (CCUS) project near Red Deer, Alta. Photo courtesy Enhance Energy

The AER report says capital investment in Alberta’s energy sector hit $30.9 billion in 2024, the highest level in nearly a decade.

That spending included not just oil and gas, but growing investments in hydrogen, helium, lithium, and carbon capture and storage (CCS) projects.

The regulator forecasts continued momentum in both traditional and emerging sectors.

Hydrogen production in Alberta is expected to grow from 2.6 million tonnes per year to 4.4 million tonnes by 2034.

Since 2015, CCS projects have captured and stored 16 million tonnes of CO₂ deep underground — equivalent to taking over 3.7 million cars off the road for a year.

The unaltered reproduction of this content is free of charge with attribution to the Canadian Energy Centre.