To sign up to receive the latest Canadian Energy Centre research to your inbox email: research@canadianenergycentre.ca

Download the PDF here

Download the charts here

Overview

Some analysts and pundits who examine global investment trends claim that oil and gas will soon be a sunset industry.

In this CEC Fact Sheet, we examine global investment trends over the next three decades under the International Energy Agency’s (IEA) most probable scenario, known as the Stated Policies Scenario (STEPS), using the IEA World Energy Outlook (WEO), 2021 Extended Data Set. The IEA is one of the few organizations that comprehensively tracks global investment trends in the oil and gas industry.

Background on the IEA’s World Energy Outlook Stated Policies Scenario (STEPS)

In October 2021, the IEA released its WEO 2021 Extended Data Set and updated it in January 2022. WEO 2021 makes use of a scenario approach to examine future energy trends, including global oil and gas investment. In WEO 2021, the IEA modelled four scenarios: the Net Zero Emissions by 2050 Scenario (NZE), the Announced Pledges Scenario (APS), the Stated Policies Scenario (STEPS), and the Sustainable Development Scenario (SDS) (IEA, 2021a).

Of the four scenarios, STEPS appears to be a more plausible and realistic scenario than the other more aggressive scenarios set out in the WEO 2021. According to the IEA:

STEPS provides a more conservative benchmark for the future because it does not take for granted that governments will reach all announced goals. Instead, it takes a more granular, sector-by-sector look at what has actually been put in place to reach these and other energy-related objectives, taking account not just of existing policies and measures but also of those that are actually under development (IEA, 2021a).

Cumulative investments of over $26 trillion needed to meet global crude oil and natural gas demand through 2050

The results of WEO 2021 STEPS, drawn from the IEA Extended Dataset, indicate that global demand for oil and gas, and thus the necessary investment in it, will continue to remain robust over the next three decades.

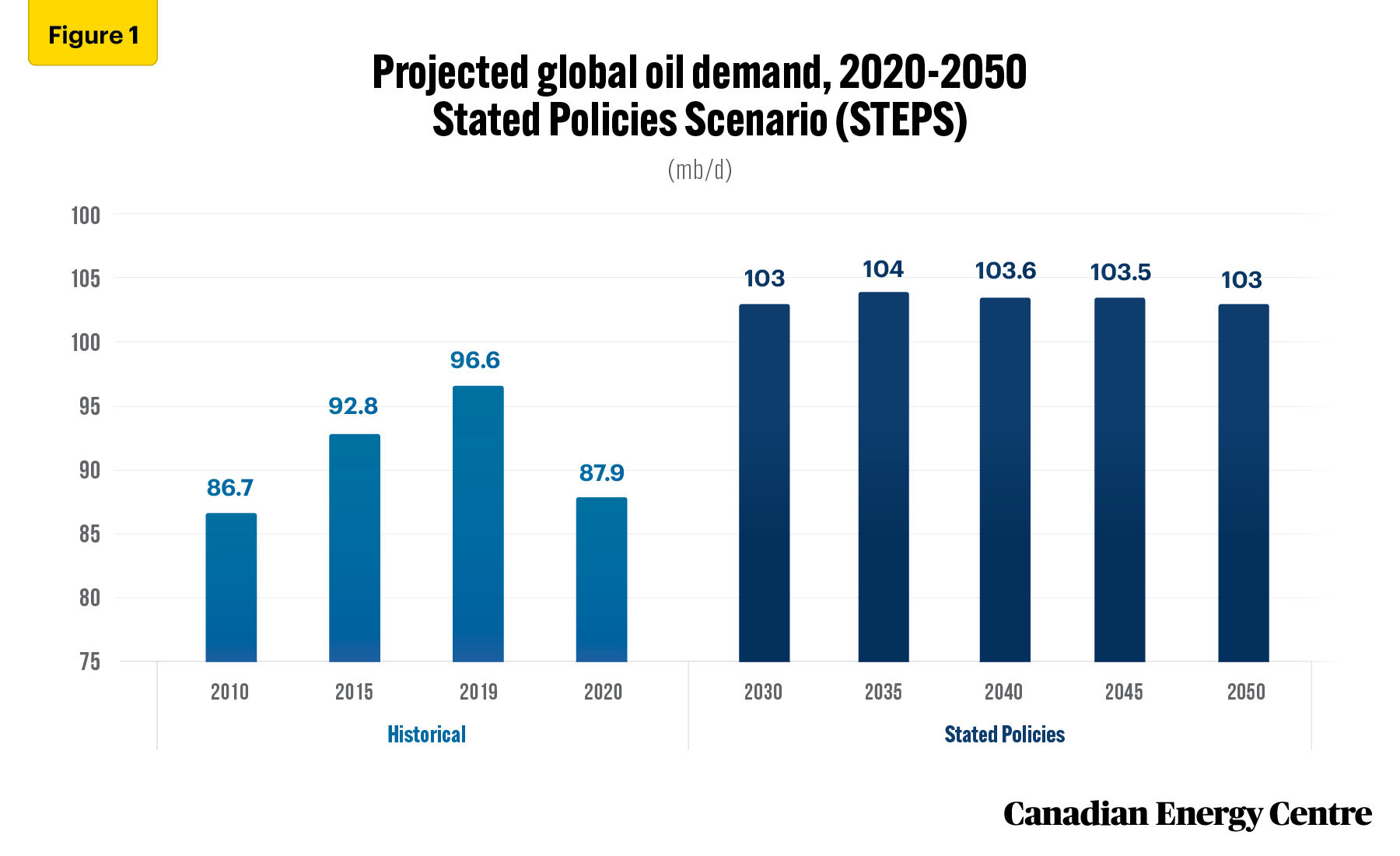

Under STEPS, world demand for oil increases from 96.6 million barrels per day (mb/d) in 2019 to 104 mb/d in 2035, before falling slightly to 103 mb/d in 2050 (see Figure 1).

Source: IEA, 2021b

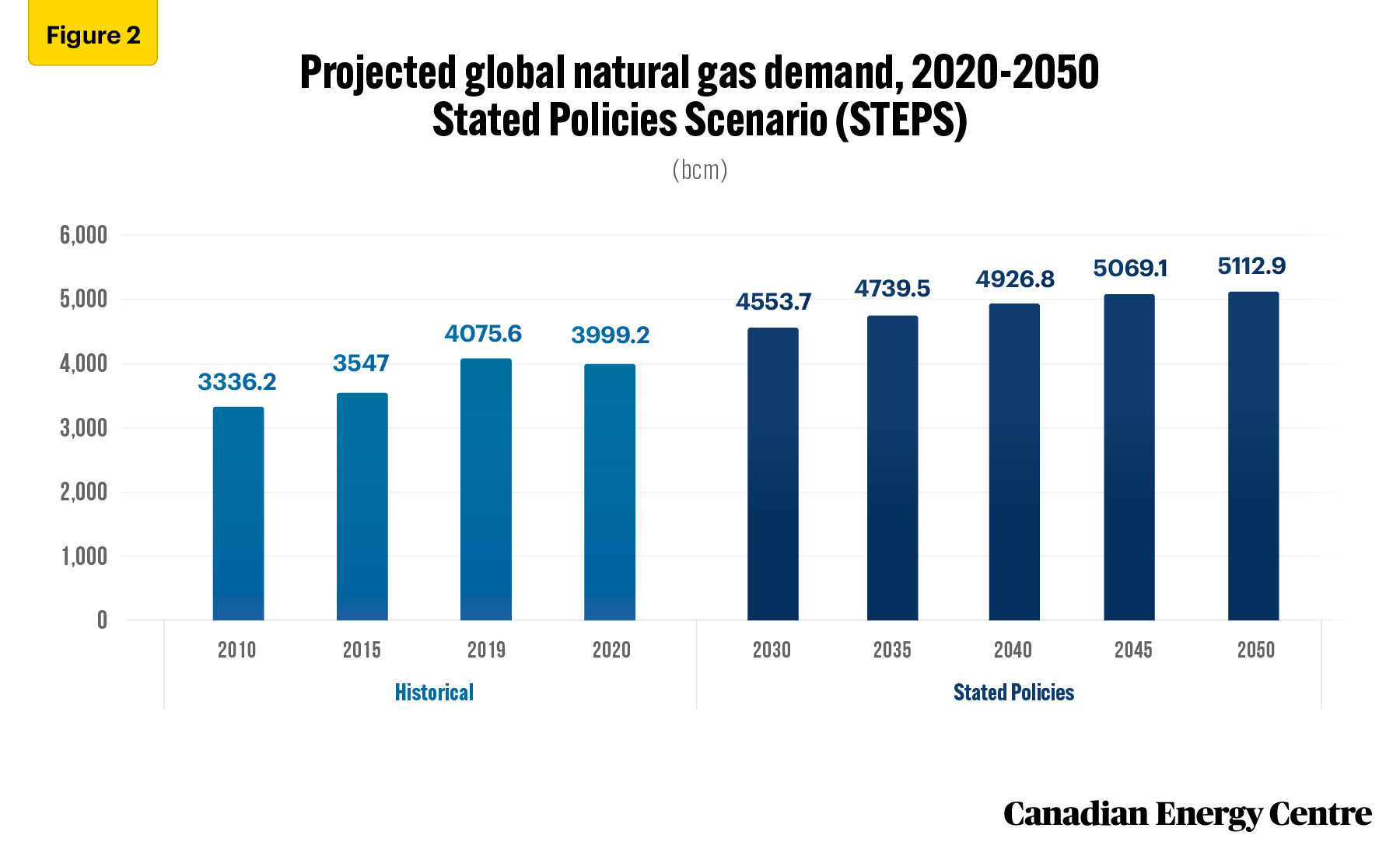

Under STEPS, world demand for natural gas increases from 3,999 billion cubic metres (bcm) in 2020 to 5,113 bcm in 2050 (see Figure 2).

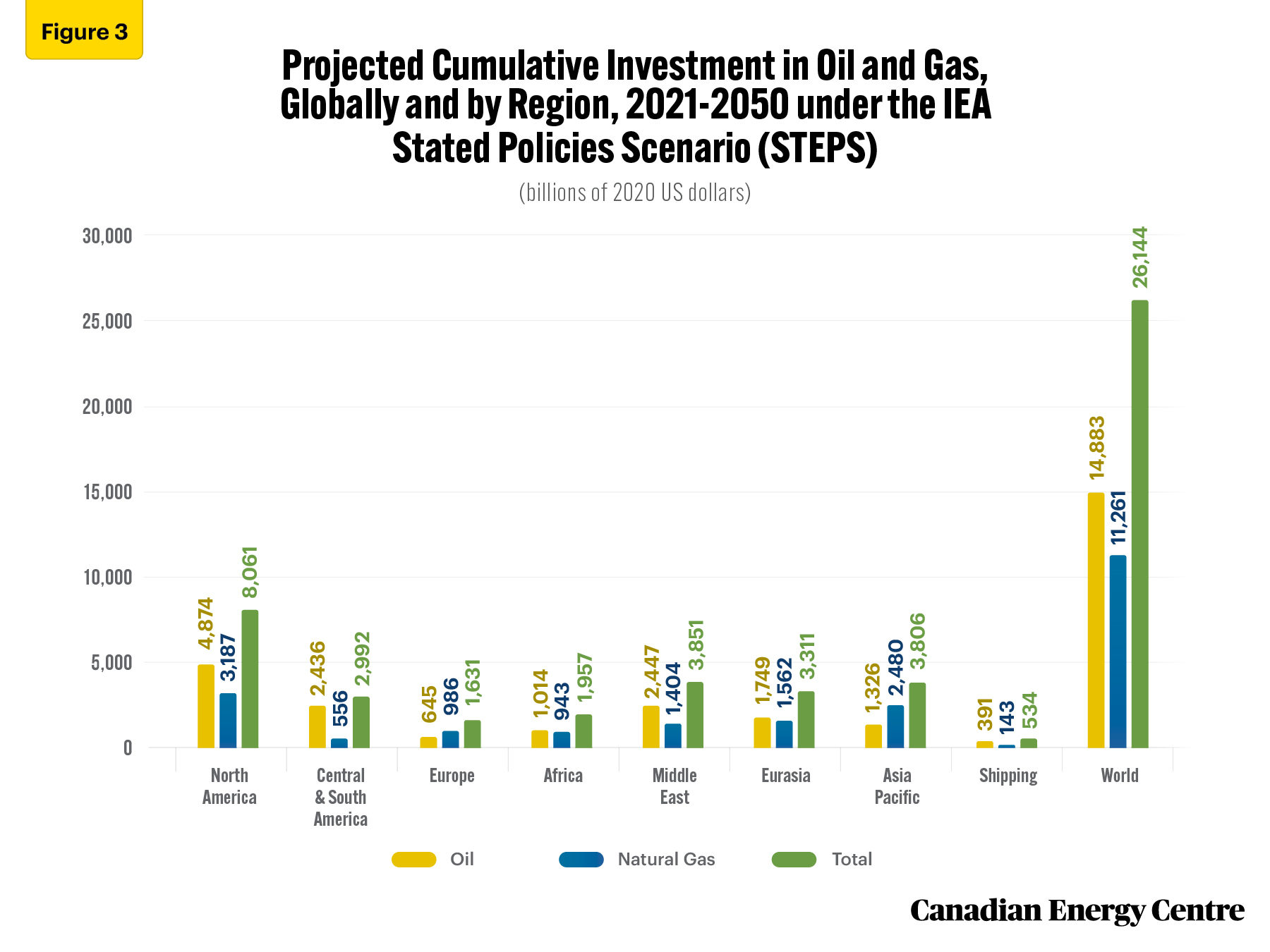

Taking into account projected global demand for oil and gas, between 2021 and 2050, global oil and gas investment under STEPs is expected to reach a cumulative $26.1 trillion (in U.S. 2020 dollars), with global oil investments estimated at nearly $14.9 trillion and natural gas at over $11.2 trillion (see Figure 3).

Source: IEA, 2021b

Oil and gas investment in North America (Canada, the U.S., and Mexico) over the period is estimated to lead the way at nearly $8.1 trillion, split between oil at nearly $4.9 trillion and gas at nearly $3.2 trillion cumulative (see Figure 3).

Oil and gas investment in the Middle East over the period is estimated at over $3.8 trillion, split between oil at over $2.4 trillion and gas at over $1.4 trillion cumulative (see Figure 3).

Oil and gas investment in the Asia-Pacific region over the period is estimated at over $3.8 trillion, split between oil at over $1.3 trillion and gas at nearly $2.5 trillion cumulative (see Figure 3).

Looking at just upstream investment under STEPS, according to the IEA,

Annual upstream oil and gas spending averages around $650 billion between 2021 and 2030, and $700 billion through to 2050, which is higher than the average investment in the 2010s. Over 60% of total upstream investment is spent on developing new oil and gas fields (IEA, 2021a).

Source: IEA, 2021b

An opportunity for Canada to increase its market share of oil and gas investment

Global investment trends drawn from the IEA STEPS scenario illustrate that the oil and gas industry will remain a strong performer over the next three decades, despite claims by some analysts and pundits that the industry is in decline.

With an estimated cumulative investment of over $26 trillion needed to meet global oil and gas demand over the next three decades, Canada could attract a significant slice of the investment pie.

Unfortunately over the past decade, Canada’s share of global oil and gas investment has declined, while the share of global investment held by Russia/Asia, and the U.S. has remained strong.

According to the Canadian Association of Petroleum Producers (CAPP),

In 2014, Canada was viewed as a top tier international investment jurisdiction for resource development and attracted $81 billion or more than 10 per cent of total global upstream natural gas and oil investment. International energy research firm Wood Mackenzie is forecasting global spending on upstream natural gas and oil production will reach $525 billion in 2022. Based on that forecast Canada has fallen to just six per cent of total market share, a four per centage point drop which represents over $21 billion in potential investment (CAPP, 2022).

While there are numerous factors that explain oil and gas investment decline in Canada, key reasons include increased regulatory burdens and delays here in Canada, along with White House opposition to the Keystone XL pipeline under the Democratic administrations of Barack Obama and Joe Biden.

Sitting on some of the world’s largest reserves of oil and natural gas, enjoying a reputation as a secure and reliable supplier, and maintaining high environmental, social and governance (ESG) scores compared with competitors such as Saudi Arabia, Iran, and Venezuela, Canada can and should be part of the medium- to long-term solution to energy security, especially considering the Russia-Ukraine conflict. The federal government must remove some of the regulatory constraints they have imposed over the past few years. Doing so will be critical to ensuring that Canada can increase its share of global oil and gas investment and assist in efforts towards North American and European energy security, with an emphasis on maintaining high environmental standards.

Notes

This CEC Fact Sheet was compiled by Lennie Kaplan at the Canadian Energy Centre (www.canadianenergycentre.ca). The author and the Canadian Energy Centre would like to thank and acknowledge Dennis Sundgaard and an anonymous reviewer in reviewing the original data and research for this Fact Sheet. Image credits: Pitchitstocker

References (all links live as of March 28, 2022)

Canadian Association of Petroleum Producers (CAPP) 2022. CAPP Projects Investment in Canada’s Natural Gas and Oil Sector will Rise to $32.8 Billion in 2022. <https://bit.ly/3LlQwdz>; International Energy Agency (IEA), 2021a. World Energy Outlook. <https://bit.ly/3qsucb7>; International Energy Agency (IEA), 2021b. World Energy Outlook 2021: Extended Dataset. <https://bit.ly/3D0OdZv>.

Creative Commons Copyright

Research and data from the Canadian Energy Centre (CEC) is available for public usage under creative commons copyright terms with attribution to the CEC. Attribution and specific restrictions on usage including non-commercial use only and no changes to material should follow guidelines enunciated by Creative Commons here: Attribution-NonCommercial-NoDerivs CC BY-NC-ND.