New data released in 2023 shows the progress Canada’s oil and gas industry is making to reduce its environmental footprint.

From emissions to water use and reclamation, here are some key performance statistics.

1. Methane emissions reduction target achieved three years ahead of schedule

The Alberta Energy Regulator (AER) released data in November showing that oil and gas producers in the province achieved the target of reducing methane emissions by 45 per cent compared to 2014.

The milestone was achieved in 2022, three years ahead of the 2025 government deadline.

Reducing methane emissions comes primarily from reducing small leaks from valves, pump seals, and other equipment, as well as reducing flaring and venting.

2. Oil sands emissions stay flat despite production growth

An updated study by S&P Global in August found oil sands emissions did not increase in 2022 even though production grew.

It’s a significant first that indicates oil sands emissions may start decreasing sooner than previously expected, said Kevin Birn, S&P Global’s vice-president of Canadian oil markets.

Total oil sands emissions were 81 megatonnes in 2022, nearly flat with 2021 despite a production increase of about 50,000 barrels per day.

In 2022, S&P Global predicted peak oil sands emissions around 2025. The new findings indicate it could happen faster.

3. Producers spend millions more than required on oil and gas cleanup

Oil and gas producers in Alberta spent significantly more than required in 2022 cleaning up inactive wells, facilities and pipelines, the AER reported in October.

The regulator’s industry-wide minimum “closure” spend for 2022 was set at $422 million. But the final tally showed producers spent $685 million, or about 60 per cent more than the regulator required.

Industry abandoned 10,334 inactive wells, pipelines and facilities in 2022 – nearly double the amount abandoned in 2019 and 2020, the AER reported.

Reclamation activity also accelerated, with the AER issuing 461 reclamation certificates, an increase of one third compared to 2021.

The regulator reports that 17 per cent of licensed wells in Alberta are now considered inactive, down from 21 per cent in 2019. And about 30 per cent of licensed wells are now considered reclaimed, up from 27 per cent in 2019.

4. Oil sands reclaimed land growing

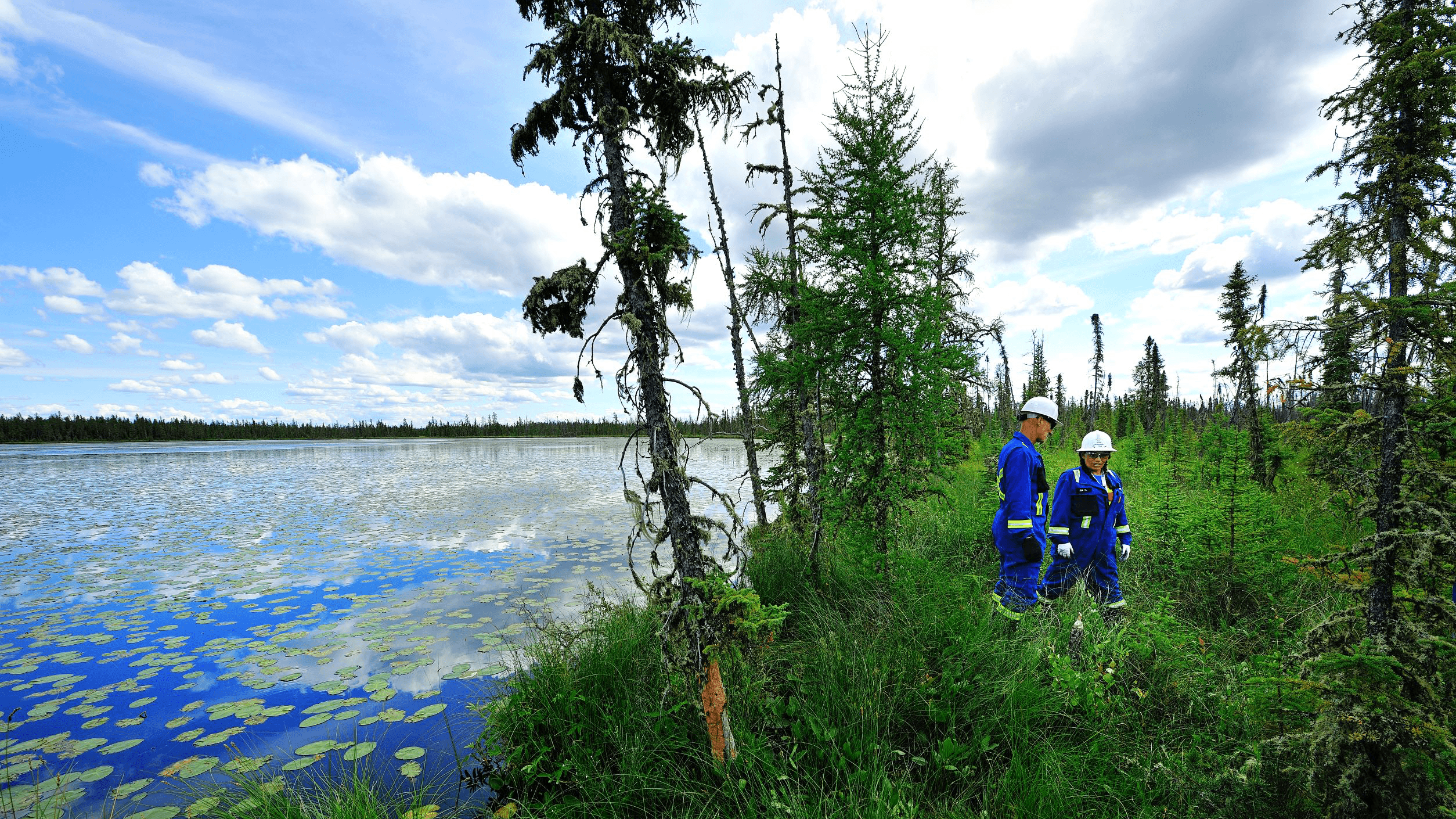

Wetland in reclaimed area in the Athabasca oil sands region. Photo by Greg Halinda for the Canadian Energy Centre

Data released by Canada’s Oil Sands Innovation Alliance highlights the growing spread of the industry’s reclaimed land.

As of 2021, oil sands operators had permanently reclaimed 10,344 hectares, the equivalent area of more than 20,000 NFL football fields – a 16 per cent increase from 2019.

Of this, 1,296 hectares (about 2,500 NFL football fields) is permanently reclaimed to wetlands and aquatics.

5. Fresh water use per barrel declining

New data on water use in Alberta’s oil and gas industry released in December shows producers continue to reduce the use of fresh water from lakes, rivers and shallow groundwater

The oil and gas industry used less than one per cent of Alberta’s available fresh water in 2022, the AER reported.

Thanks primarily to increased water recycling, fresh water use per barrel in Alberta oil and gas has decreased by 22 per cent since 2013.

Overall, 82 per cent of water used in Alberta oil and gas in 2022 was recycled; 80 per cent in oil sands mining, and 90 per cent in drilled or “in situ” oil sands production.

The unaltered reproduction of this content is free of charge with attribution to Canadian Energy Centre Ltd.