While some of Canada’s leaders question the business case for accelerating liquefied natural gas (LNG) exports, one U.S. company alone is in the process of building five new LNG facilities in the Gulf of Mexico.

The first is expected to be finished in March 2023 and the next four “every few months” after until all are operational in 2024.

Energy-short Europe is a near-term target market, but New Fortress Energy says that long-term, the booming LNG business is global.

“We started creating our own supply long before there was a crisis, and we did so in order to satisfy what we view as a virtually inexhaustible amount of demand,” CEO Wes Edens told analysts on the company’s third quarter results call.

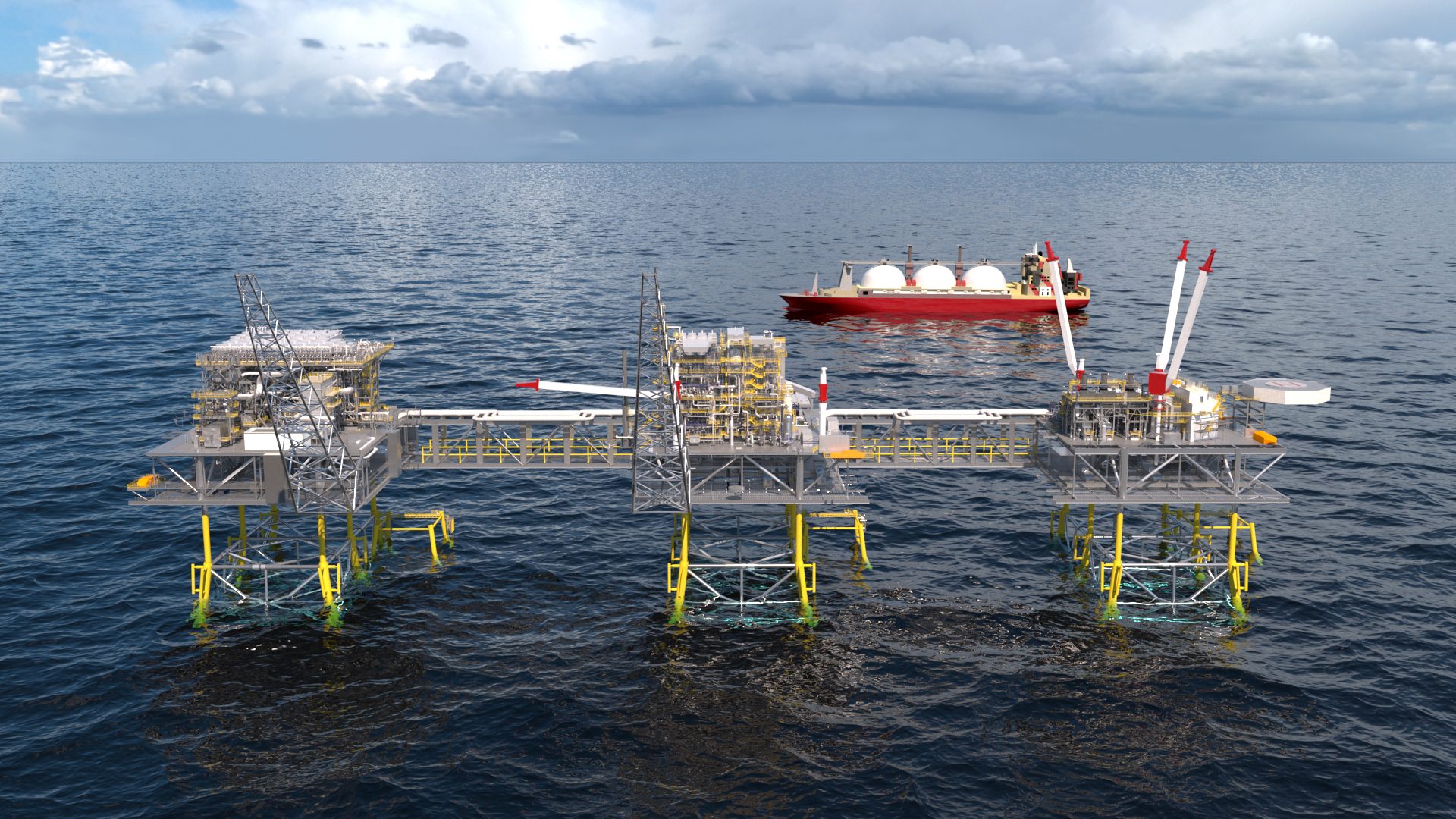

With supportive permitting by regulators in both the U.S. and Mexico, repurposed offshore drilling rigs and floating platforms, New Fortress Energy expects to bring online seven million tonnes per annum (MTPA) of LNG export capacity before the end of 2024.

LNG buyers can move fast too. Germany just finished building its first floating LNG import terminal, completed in just 200 days.

Germany’s federal economics minister Robert Habeck said the new terminal is a “central building block for energy security,” according to German broadcaster NDR.

“Germany can be fast and advance infrastructure projects with great determination when the federal and regional governments, together with the project participants, all pull together,” he said.

There are 33 LNG import terminal projects in Europe that are either under construction or in the planning phase, according to the Institute for Energy Economics and Financial Analysis.

The supply is desperately needed to replace imports from Russia, which supplied about 40 per cent of Europe’s natural gas before its invasion of Ukraine.

“We like to go back to one simple metric, which is in 2021 there was 122 MTPA of Russian gas supply through pipelines; in 2022, there was 67 MTPA and in 2023, we expect it to be zero,” said New Fortress managing director Andrew Dete.

“That’s effectively replacing 1,500 LNG cargoes, and you need 20 plus new LNG terminals to do it.”

The company is just one example of America’s massive LNG expansion. The U.S. rose from zero LNG exports in 2015 to become the world’s largest LNG exporter in 2021. It’s now set to triple current capacity by 2033, according to Wood Mackenzie.

Plans for what became the first U.S. LNG export project were announced in 2010, about one year before Shell purchased the site at Kitimat, B.C. where Canada’s first LNG project is being built. It is expected to be complete in 2025.

While LNG from B.C. will mainly be destined for Asia (where it can reduce emissions by replacing coal), analysts say it can also help meet demand in Europe.

“More western Canadian LNG would allow a lot of the other sources to go to Europe. It’s like a domino,” said Matthias Bloennigen, director of Americas consulting with Wood Mackenzie.

Asia represents 67 per cent of world LNG demand today, and that share is expected to grow to 73 per cent while demand doubles to reach 700 MTPA by 2040.

“We’re at the early stages of an LNG boom cycle,” said Kateryna Filippenko, Wood Mackenzie’s director of global gas research.

“Europe will continue to compete with Asia for LNG supply at times of high demand.”

Analysts estimate that by 2025, nearly US$200 billion will be spent on new LNG plants in North America. Canada must move faster to take part.

The unaltered reproduction of this content is free of charge with attribution to Canadian Energy Centre Ltd.