To sign up to receive the latest Canadian Energy Centre research to your inbox email: research@canadianenergycentre.ca

Download the PDF here

Download the charts here

Overview

There has been considerable discussion recently about supply costs in the Canadian upstream oil sector and whether Canada can remain competitive in the future with other energy producing jurisdictions.

In this Canadian Energy Centre (CEC) Fact Sheet, we use time series data drawn from the Rystad Energy UCube to examine historical trends in supply costs for the Canadian upstream oil sector.

The written content in this report was prepared by the CEC and does not represent the views of Rystad Energy.

Background on Rystad Energy UCube,

Rystad Energy is an independent energy research company providing data, analytics and consultancy services to clients around the globe.

UCube is Rystad Energy’s global upstream database, including production and economics (costs, revenues, and valuations) for more than 80,000 assets, covering the portfolios of more than 3,500 companies.

The UCube data set is used to study all parts of the global exploration and production (E&P) activity value chain, including operational costs, investment (capex and opex), fiscal terms, and net cash flows for projects and companies, both globally and by country (Rystad Energy, 2023).

Explaining cost of supply and average breakeven oil price

The cost of supply for the Canadian upstream oil sector is the minimum constant dollar price needed to recover all capital expenditures, operating costs, royalties, taxes, and earn a specified return on investment. Supply costs indicate whether the upstream oil sector is economically viable (Rystad Energy, 2023).

The weighted average breakeven oil price for the Canadian upstream oil sector is the flat real oil price, represented as US Brent per barrel, at which continued operation of the oil sector is commercial, seen from the current year, i.e., the oil price required for a positive net present value (NPV), using a 7.5 per cent discount rate (Rystad Energy, 2023).

Canadian overall upstream oil sector supply costs down by 35%

Supply costs within Canada’s upstream oil sector declined significantly between 2015 and 2022.

At the end of 2015, the weighted average breakeven oil price for the Canadian upstream oil sector was nearly $76.00 US Brent per barrel. By the end of 2022, the weighted average breakeven oil price for the Canadian upstream oil sector was $49.09 US Brent per barrel, a decline of $26.91 per barrel, or over 35 per cent since 2015 (see Figure 1). This number incorporates producing, under development and discovery phases of oil production.

Source: Derived from Rystad Energy, 2023

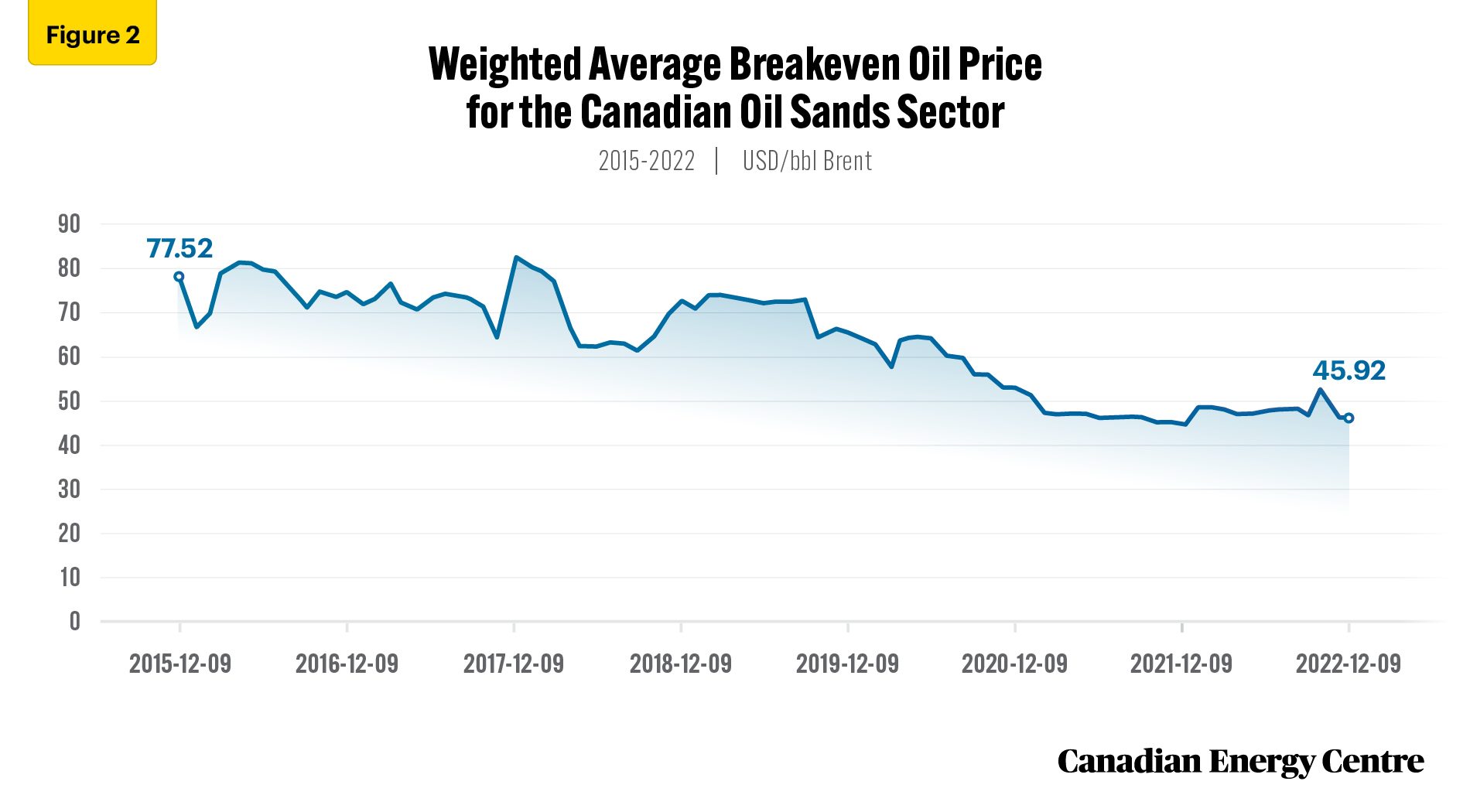

Canadian oil sands sector supply costs down by 41%

A key sector with significant supply cost reductions over the past seven years is the Canadian oil sands.

From December 2015 to December 2022, the average weighed breakeven price for the oil sands sector declined from $77.52 US Brent per barrel to $45.92 US Brent per barrel.

This represents a decline of $31.60 US Brent per barrel over the past seven years, or a percentage reduction of over 41 per cent (see Figure 2). This number incorporates producing, under development and discovery phases of oil sands production.

Source: Derived from Rystad Energy, 2023

According to Rystad Energy,

The main reason for the large decline is that many phases of oil sands projects (have been and) will be developed as smaller, incremental brownfield expansions rather than large-scale greenfield projects. In several cases, operators have not only indicated smaller expansions, but also plans to achieve cost savings by tying these into existing central processing facilities (CPFs) rather than building new CPFs – which might have happened several years ago when the pace of development was much quicker (Rystad Energy, 2021).

As Kent Fellows recently noted, “…the oil sands are not high cost, especially in a way that matters for the relationship between global demand and domestic production. This report shows that nearly all oil sands producers will continue to produce as long as the prevailing price of Western Canadian Select (WCS) crude oil remains above C$40 per barrel” (Fellows, 2022).

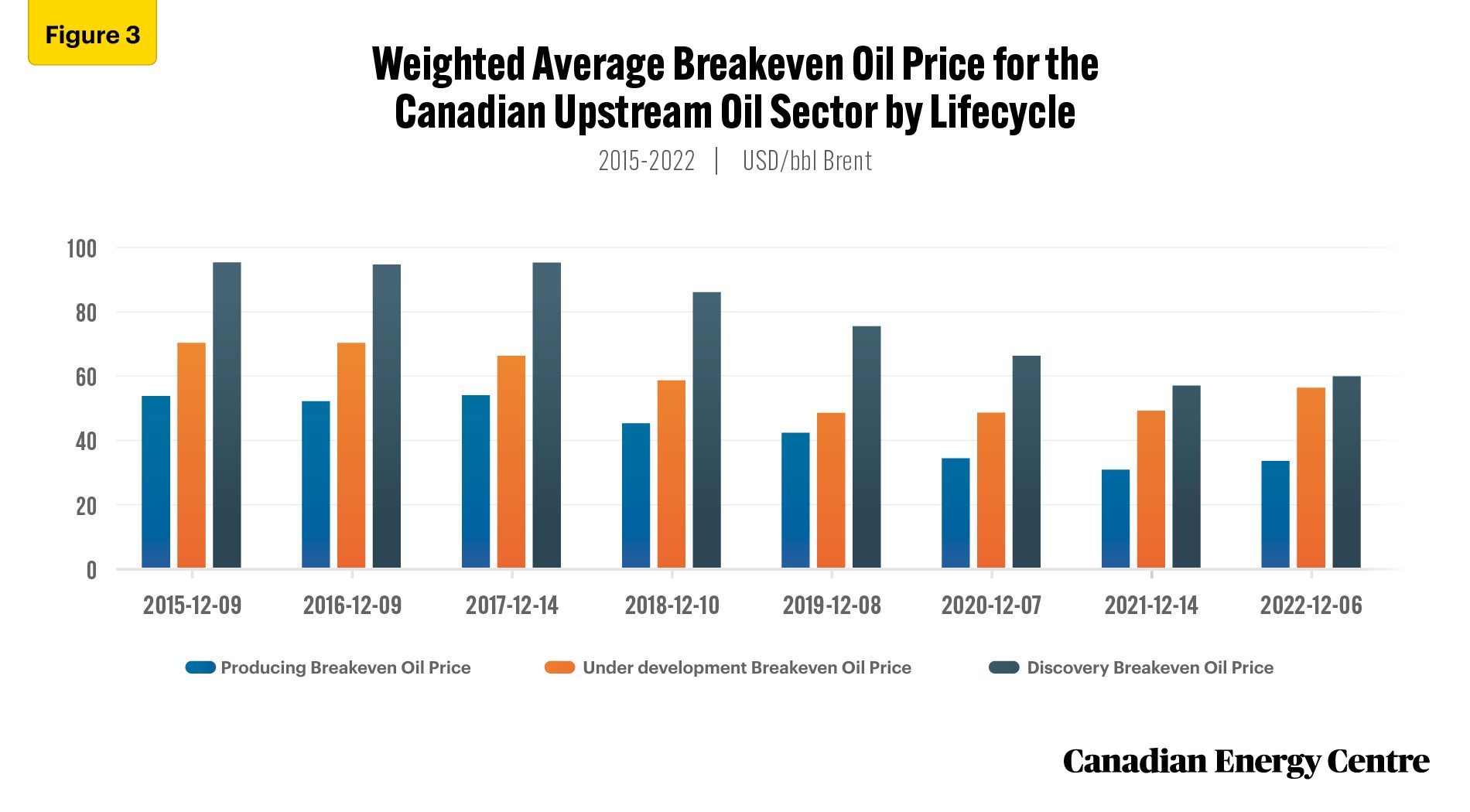

Downward trends in Canada’s upstream oil sector supply costs by life cycle

Over the past seven years, the Canadian upstream oil and gas sector has recorded supply cost reductions across the board when it comes to life cycle production.

Breakeven costs for Canadian upstream oil sector producing assets have fallen from $52.38 US Brent per barrel in 2015 to $32.54 US Brent per barrel in 2022, a decline of $19.84 US Brent per barrel, or nearly 38 per cent (see Figure 3).

Breakeven costs for Canadian upstream oil sector under development assets have fallen from $68.68 US Brent per barrel in 2015 to $54.90 US Brent per barrel in 2022, a decline of $13.78 US Brent per barrel, or 20 per cent (see Figure 3).

And breakeven costs for Canadian upstream oil sector discovery assets have fallen from $93.29 US Brent per barrel in 2015 to $58.43 US Brent per barrel in 2022, a decline of $34.86 US Brent per barrel, or over 37 per cent (see Figure 3).

Note that there are some limitations in this comparison in that assets shift between life cycles according to approval and start-up date, but nevertheless this does provide a good general comparison based on using a smaller sample of cube dates.

Source: Derived from Rystad Energy, 2023

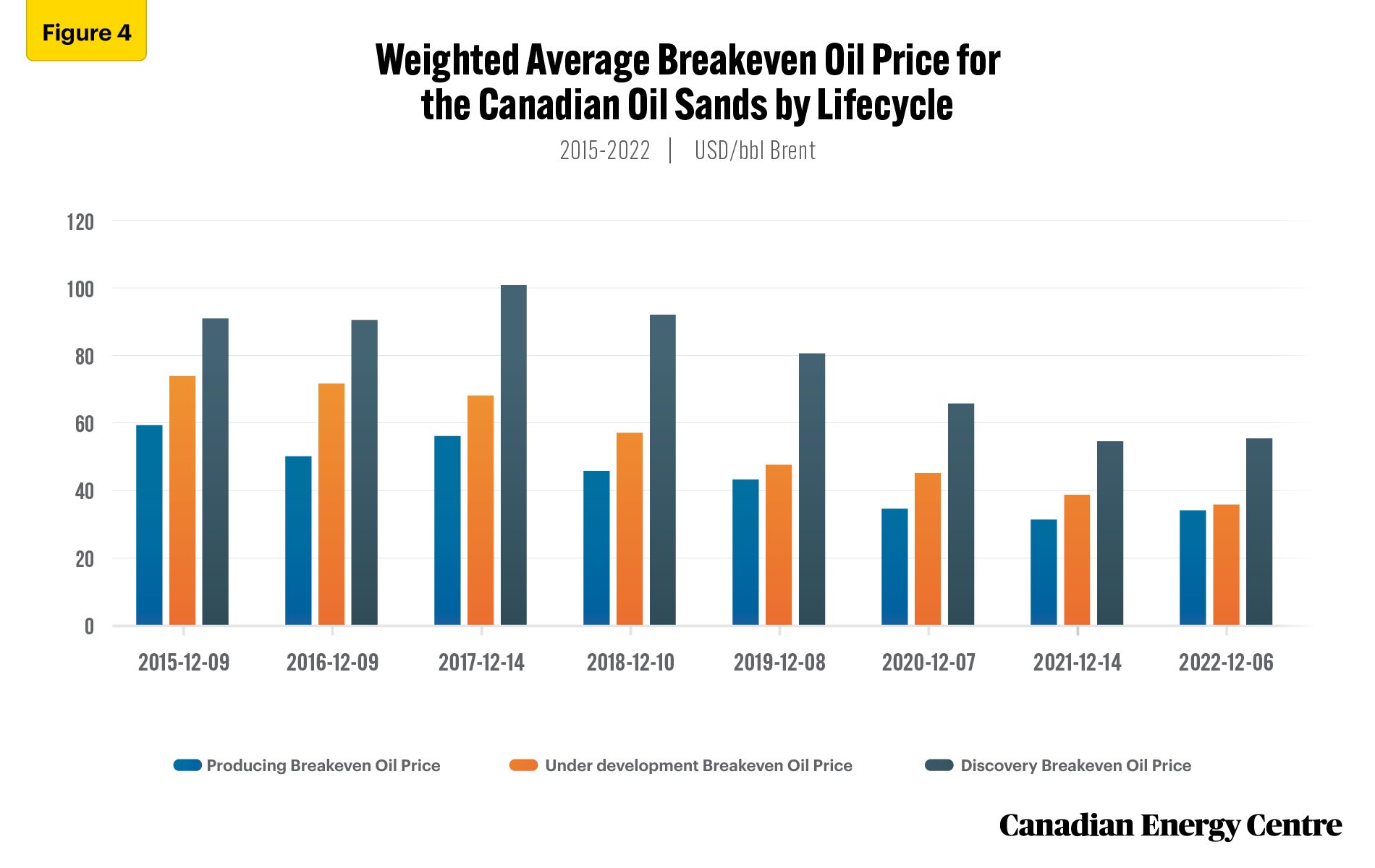

Downward trends in Canada’s oil sands sector supply costs by life cycle

Over the past seven years, the Canadian oil sands sector has also recorded significant supply cost reductions when it comes to lifecycle production.

Breakeven costs for Canadian oil sands sector producing assets have fallen from $59.30 US Brent per barrel in 2015 to $33.97 US Brent per barrel in 2022 a decline of $25.33 US Brent per barrel, or nearly 43 per cent (see Figure 4).

Breakeven costs for Canadian oil sands sector under development assets have fallen from $73.96 US Brent per barrel in 2015 to $35.74 US Brent per barrel in 2022, a decline of $38.22 US Brent per barrel, or nearly 52 per cent (see Figure 4).

And breakeven costs for Canadian oil sands sector discovery assets have fallen from $91.11 US Brent per barrel in 2015 to $55.43 US Brent per barrel in 2022, a decline of $35.68 US Brent per barrel, or over 39 per cent (see Figure 4).

Note that there are some limitations in this comparison in that assets shift between life cycle according to approval and start-up date, but nevertheless this does provide a good general comparison based on a smaller sample of cube dates.

Source: Derived from Rystad Energy, 2023

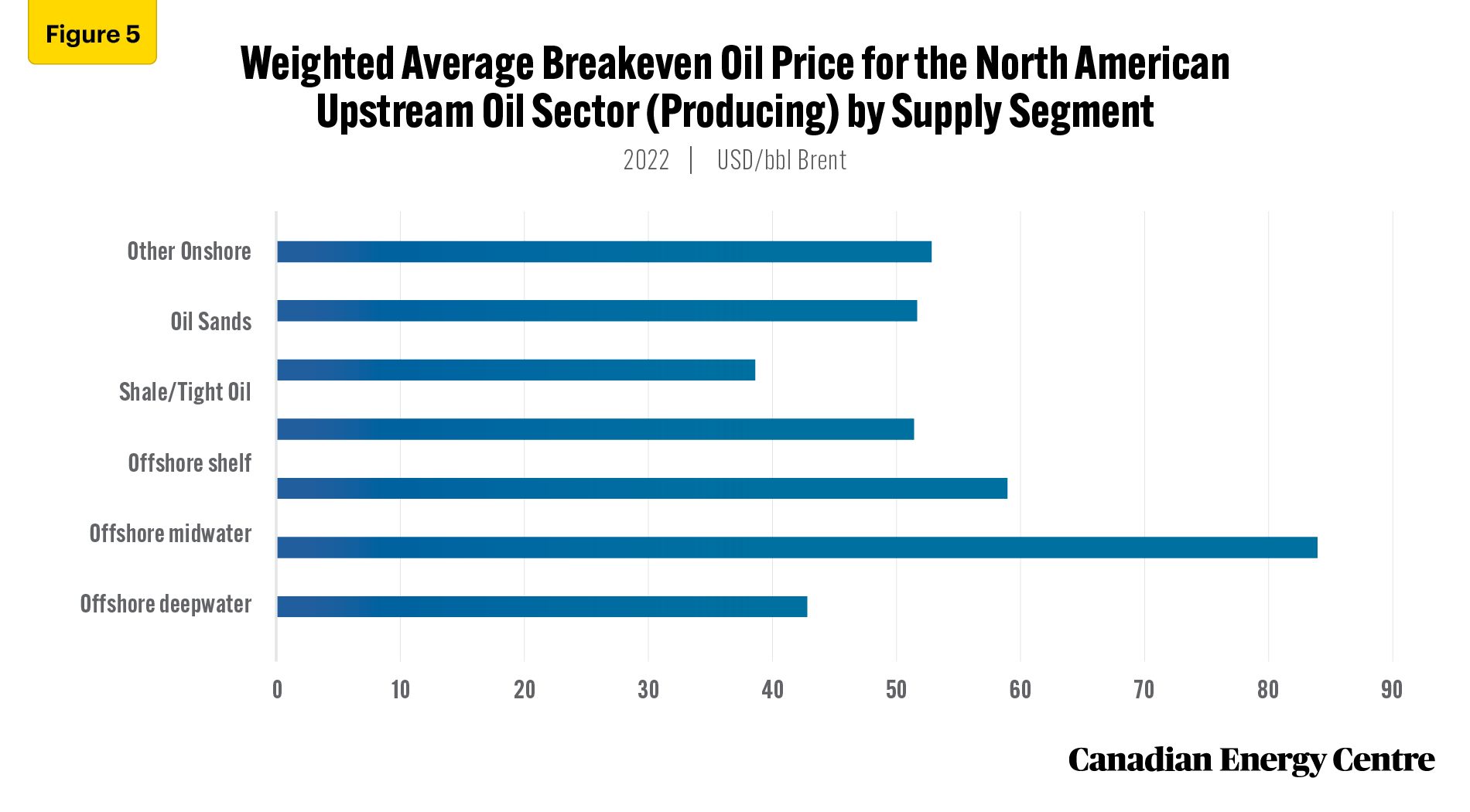

Benchmarking supply segments in the North American upstream oil sector

Using the Rystad Energy UCube, we can also benchmark supply segments within the North American upstream oil sector. Figure 5 shows how key supply sources rank in terms of weighted average breakeven $US Brent price per barrel.

Canada’s oil sands sector stands out in terms of breakeven oil price. Given a flat oil price of $70 US Brent per barrel, producing oil sands sector assets have a weighted average breakeven oil price of $38.23 US Brent per barrel. This illustrates how competitive oil sands operators have become on supply cost over the past few years, especially when compared to North American offshore deepwater, offshore midwater, offshore shelf, and other onshore. North American shale/tight oil still has the lowest weighed average breakeven cost at $26.79 US Brent, based on a flat Brent oil price of US $70 per barrel (see Figure 5).

Source: Derived from Rystad Energy, 2023

Benchmarking costs of under development Canadian upstream oil sands assets shows an average breakeven oil price of $38.61 US Brent, based on a flat Brent oil price of USD $70 per barrel. This again compares favourably to North American offshore deepwater, offshore shelf, and other onshore (see Figure 6).

ource: Derived from Rystad Energy, 2023

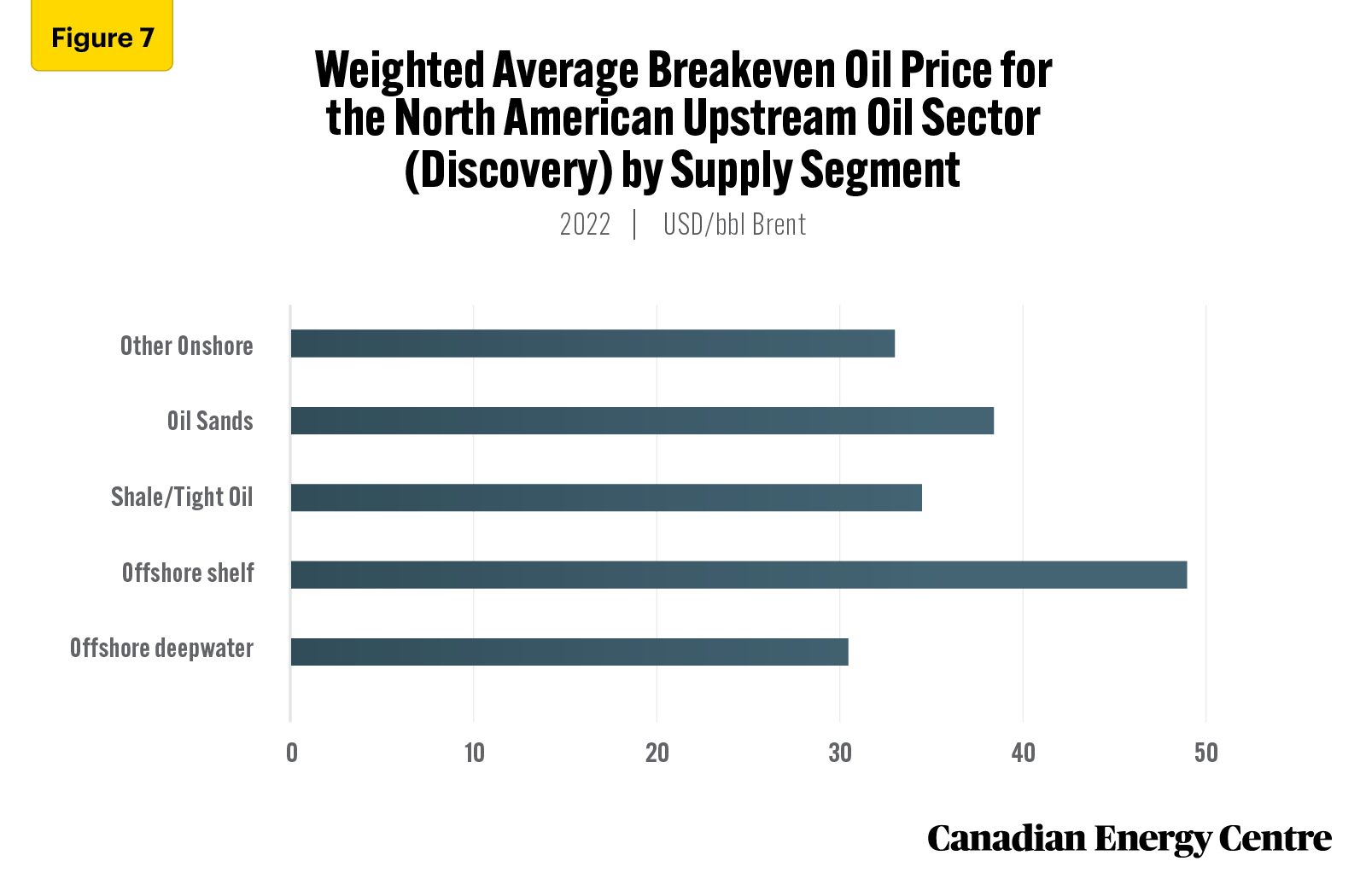

Finally, benchmarking costs of discovery Canadian upstream oil sands assets shows an average breakeven oil price of $38.61 US Brent, based on a flat Brent oil price of USD $70 per barrel. This compares favourably to North American offshore deepwater, offshore shelf, and other onshore. The weighted average breakeven cost of discovery oil sands assets ($38.61 US Brent) also moves closer to the weighted average breakeven oil price for discovery shale/tight oil ($34.62 US Brent) (see Figure 7).

Source: Derived from Rystad Energy, 2023

Percentage decline in costs for Canada’s upstream oil sector compares very favourably with other major oil producing countries

Figure 8 looks at the rate of decline in supply costs for the Canadian upstream oil sector compared with nine other major oil producing countries, between 2015 and 2022.

As noted earlier, the Canadian upstream oil sector experienced a percentage decline of over 35 per cent during the period, falling from a weighted average breakeven oil price of $76 US Brent per barrel to average breakeven oil price of $49 US Brent per barrel.

This 35 per cent decline rate in upstream oil field breakeven costs was the was the third largest decline among the 10 major oil producing countries analyzed between 2015 and 2022, behind only Iran and Brazil, but ahead of the United States, the UAE, Saudi Arabia, Iraq, China, Russia, Iraq, and Kuwait (see Figure 8). This number incorporates producing, under development and discovery phases of oil production.

Source: Derived from Rystad Energy, 2023

Conclusion

Despite talk from some that the Canadian upstream oil sector is high cost and will be uncompetitive in the future, the results from our time series analysis suggest otherwise.

The point forward breakeven oil price costs of production for Canada’s upstream oil sector have come down dramatically over the last seven years. Between 2015 and 2022, the breakeven declined by 35 per cent, to $49 US Brent per barrel. Over the same period, the breakeven for the oil sands sector fell by 41 per cent, to $46 US Brent per barrel.

As Kent Fellows says,” …one thing seems clear: market forces will not eliminate legacy oil sands production before other sources. There is a reasonable argument that, if there is a last barrel of oil produced in North America, it will come from an oil sands operator unless government policy decides to actively forgo that economic opportunity” (Fellows, 2022).

The 35 per cent decline in Canadian upstream oil sector supply costs was also the third largest decline among the 10 major oil producing countries, between 2015 and 2022.

With Brent oil prices currently in the range of $70 to $80 US per barrel, the Canadian upstream oil sector and the oil sands sector remain competitive on a supply cost basis given the track record of cost reductions over the past seven years. This bodes well for the Canadian upstream oil sector well into the future.

Notes

This CEC Fact Sheet was compiled by Lennie Kaplan at the Canadian Energy Centre (www.canadianenergycentre.ca). The author and the Canadian Energy Centre would like to thank and acknowledge the assistance of three anonymous reviewers in reviewing the data and research for this Fact Sheet. Image credits: Cenovus’ Foster Creek oil sands project.

The written content in this report was prepared by the Canadian Energy Centre (CEC) and does not represent the views of Rystad Energy.

References (links live as of January 31, 2023)

Fellows, Kent. (2022). Last Barrel Standing? Confronting the Myth of “High-Cost” Canadian Oil Sands Production <http://bit.ly/3wnX7P4>; IHS (2019). Four years of change: Oil sands cost and competitiveness in 2018. <http://bit.ly/3IQ8qac>; Rystad Energy (2021). Average breakeven price for new upstream projects now below $50 per barrel. <https://bit.ly/3CBEtXp>; Rystad Energy (2023). Regional sustainability: finding the best path as energy markets change. <http://bit.ly/3TkiAl4>; Rystad Energy UCube. (2023). <https://bit.ly/3veaMIV>.

Creative Commons Copyright

Research and data from the Canadian Energy Centre (CEC) is available for public usage under creative commons copyright terms wit attribution to the CEC. Attribution and specific restrictions on usage including non-commercial use only and no changes to material should follow guidelines enunciated by Creative Commons here: Attribution-NonCommercial-NoDerivs CC BY-NC-ND.